Does your portfolio jump or fall violently with every little news item? If it does, you might need to adjust your holdings to make sure you can comfortably ride out anything the market throws at you, especially with all of the "correction" talk in the news lately. Over the long term, you're better off with low-volatility companies that offer consistent growth and income. A couple of great examples in the financial sector are Toronto-Dominion Bank (TD +0.32%) and Wells Fargo (WFC +1.67%), so let's see why they belong in your portfolio.

What is volatility anyway?

Volatility is a measure of how much a stock tends to move over a given time period, and is a pretty good way of quantifying the risks involved in a stock. In other words, riskier companies have the potential for big price swings, hence higher volatility. The less volatile a stock is, the less it reacts to market news and other economic conditions because they are less likely to have a detrimental effect to the company's business.

This matters to us, especially with a possible correction approaching, because during big market drops, high-volatility stocks tend to get crushed, while stocks with low volatility tend to ride out the storm much better. Take a look at Wells Fargo and Toronto-Dominion (TD) Bank and how they perform during tough times.

The best bank in the United States

Wells Fargo is an exceptional bank for a few reasons. First, the quality of its assets is excellent, and this is evidenced by the bank's performance during the financial crisis. This quality allowed it to make savvy moves like its acquisition of Wachovia at a steep discount, doubling its size. In fact, Wells Fargo was the only U.S. bank still holding an AAA rating from S&P in 2007.

The company is also one of the most ambitious banks in the world in terms of growth, both of its current businesses and through expanding its reach through acquisitions. For instance, Wells Fargo's investment banking division was virtually nonexistent before it acquired Wachovia, but since the acquisition Wells has grown its investment banking market share from 4.1% to 5.7%, making it the 8th largest investment bank in the U.S.

As a result of its asset quality and ambitious strategies, the bank is one of the few in the market to continue to grow its dividend in spite of the crisis. In fact, Wells now pays out a higher dividend than they ever did before the crisis. How many other banks can make this claim?

Rock-solid banking from north of the border

Toronto-Dominion Bank, or TD Bank, is based in Canada, but does have a very significant U.S. presence. Like Wells Fargo, it has grown tremendously as a result of acquisitions and excellent management, and the bank's assets have nearly quadrupled in the past 10 years.

TD is known as the "most convenient bank", with some of the longest operating hours in the industry. It is not unusual for TD Bank branches to be open on Saturdays and Sundays, and drive-thru services are offered until midnight in many locations.

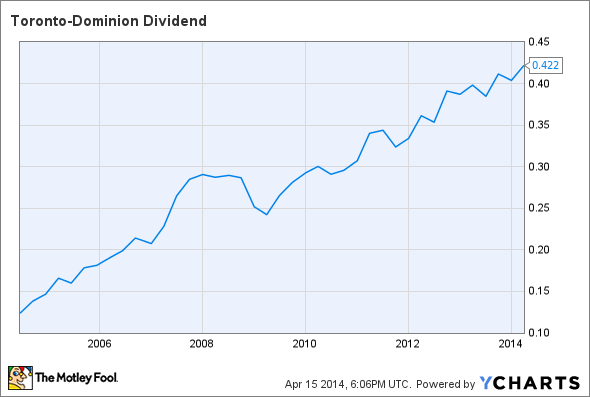

As far as performance during tough times goes, consider how unlike virtually every U.S. financial institution, TD Bank never cut its dividend as a result of the crisis, but raised it every single year. In fact, TD's dividend has more than doubled since 2006, from $0.80 per year to $1.88.

Watch the news!

Pay attention to these and other banks over the next few weeks, especially if the market stays strong. Stocks overreact to news stories, and this is especially true during earnings season! If your patient and keep an eye out, you might be able to scoop up shares of two of the most solid banks in the world at a discount.