Spending money is one thing that we excel at in the United States, which is why Visa (V +0.19%) is such a valuable business. It long ago carved out an enduring place in consumers' wallets. In emerging markets, it's starting to look like companies such as Western Union (WU 2.52%) and Vodafone (VOD +0.15%) are in the command seat.

Changing technology

In essence, Visa acts as the middleman between buyers and sellers. Its technology allowed 58 billion transactions to take place last year. These pipes are so integral to business today that retail giants are accusing Visa of using its market position to inflate fees. But that's exactly the kind of power that Visa has in developed markets. In fact, the largest retailer in the world just hit Visa with a lawsuit that could have far-reaching implications not just for Visa, but for the entire retail industry.

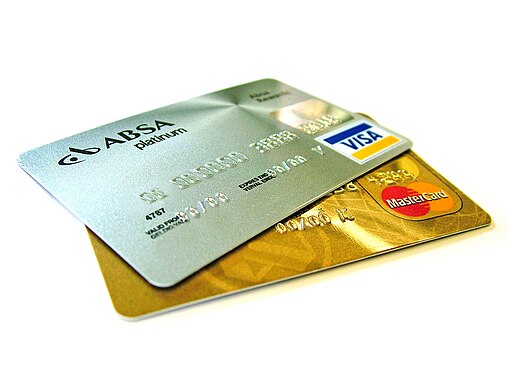

Source: Lotus Head

While mature markets are the past, the future is in emerging markets. That's where companies like Western Union are trying to build their businesses. For example, of the 500,000 or so Western Union locations around the world, about 90% are outside of the United States. The company has been gearing up its business in areas with large underbanked populations so that customers can use the modern technology they have, like cell phones, to do all of the buying and selling they want without ever having to use a bank.

That's effectively what Visa did to paying by check, which put the bank at the heart of a transaction. The fact that so many consumers in emerging markets have technology, but not a lot of money, actually puts companies like Western Union ahead of Visa in these markets.

Where the growth is

While new services from a Western Union would have to unseat Visa and MasterCard in mature markets, that isn't the case in emerging markets. These nations will simply leapfrog the old ways and jump right into more modern methods -- like mobile payment systems. It's why Western Union is focusing on that space. It's also why Vodafone, the telecom company, happens to be doing so well in the finance arena.

(Source: Raidarmax

Vodafone already has a large base of customers in emerging markets like India, and select countries in Africa. That makes adopting the company M-PESA money transfer service very easy for customers. The offering was started in Kenya in 2007 under the Safaricom banner (Vodafone runs that business), and has since expanded it to nine countries.

To get a sense of the scale of the company's success, there are 23 million mobile money users in Kenya and 17 million (nearly 75%) are M-PESA customers. Visa would kill for that kind of penetration. If Vodafone can reach even half that level in M-PESA served countries like India, South Africa, and Egypt it will be building a fortress that not even a giant like Visa can defeat. And it's set to bring the service to Europe, too, recently launching it in Romania.

Don't underestimate the underbanked

It's easy to look at the United States and question the value of serving what is a pretty small population of people with limited access to banks. Those with bank access are so much richer and easier to reach. However, the underbanked are a global phenomena, and there are much larger opportunities in emerging markets where bank access is much less common. Visa can't really serve these customers, but Western Union and Vodafone can. The emerging strength of Vodafone's M-PESA service is both an example of the opportunity, and a call to action for investors.