In his most recent letter to the shareholders of Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B) Warren Buffett said one single business was critically important to the entire U.S. economy. And the good news is: he owns it outright.

His remarkable remarks

Berkshire Hathaway encompasses a variety of businesses, from energy, finance, insurance, and manufacturing firms to retail stores as well. Yet one of its biggest businesses is railroad Burlington Northern Santa Fe (BNSF), and you won't believe the praise Buffett piled on it.

In the most recent letter to shareholders Buffett said (emphasis added):

BNSF carries about 15% (measured by ton-miles) of all inter-city freight, whether it is transported by truck, rail, water, air, or pipeline. Indeed, we move more ton-miles of goods than anyone else, a fact establishing BNSF as the most important artery in our economy's circulatory system. Its hold on the number-one position strengthened in 2013.

While Buffett is known for his love of businesses Berkshire Hathaway owns, his remarks display how much he values the railroad. And as it turns out, shareholders and all Americans should too.

Image Source: Coca-Cola

The benefit to Buffett and Berkshire Hathaway shareholders

BSNF was purchased by Buffett in November 2009, valuing the railroad at approximately $44 billion. At the time Buffet remarked this was "a huge bet," on not only the company, its leadership, and the industry, but most importantly, "it's an all-in wager on the economic future of the United States."

Buffett has been known to make enormous acquisitions, but the one of BNSF was remarkable because it was made in the midst of the Great Recession when many questioned the future of the American economy. Yet Buffett understood the troubles would be temporary, and made the acquisition to provide another business to Berkshire Hathaway with incredible size -- it operates across 51,000 miles encompassing 28 states and two Canadian provinces -- and competitive advantages. As a result, its shareholders have seen the rewards.

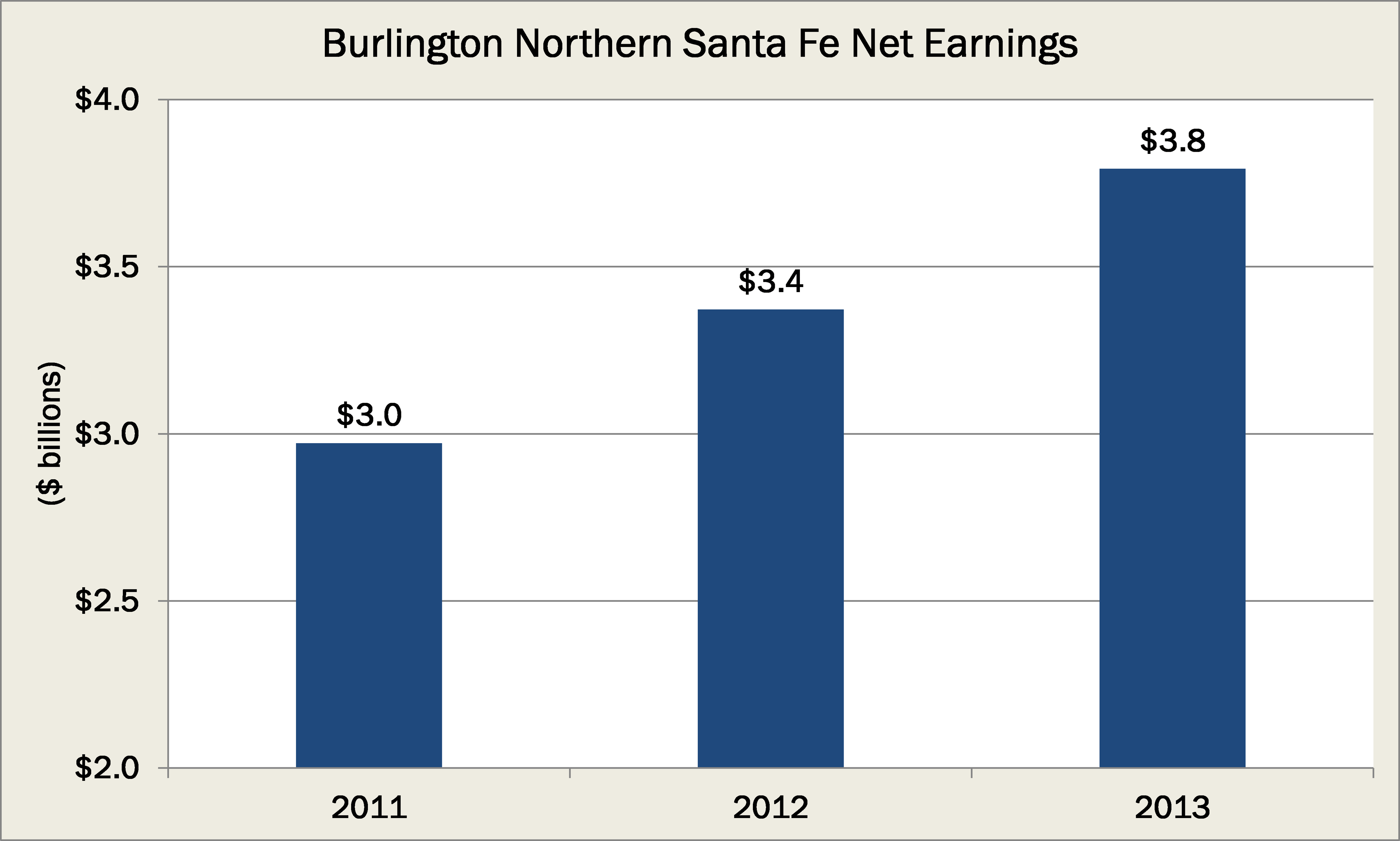

As shown in the chart below, since 2011 -- the first full year of after the acquisition was complete -- BSNF has seen its annual earnings jump by nearly 30%:

Source: Company Investor Relations

One of the reasons for this gain in earnings is strong revenue growth -- up 13% since 2011-- but the railroad has also done a tremendous job at adding to its profitability. A simple calculation of the profit margin -- earnings divided by revenue -- reveals it has improved from 15.2% in 2011 to 17.2% in 2013.

While two percentage points don't sound like much, on the $22 billion in revenue in 2013, that improvement meant an additional $450 million in earnings.

With all that in mind it's no wonder Buffett says BNSF is a member of the "sainted group," of Berkshire Hathaway companies known as The "Powerhouse Five."

Yet the reality is BNSF benefits not only Buffett and shareholders, but all Americans.

Image Source: www.insidermonkey.com

The benefit to Americans

Buffett notes, "BNSF, like all railroads, also moves its cargo in an extraordinarily fuel-efficient and environmentally friendly way, carrying a ton of freight about 500 miles on a single gallon of diesel fuel," which is four times more efficient than trucks.

Knowing half of its revenue was from the transportation of consumer and agricultural products, the lower costs offered by BNSF for manufacturers to transport goods should lead to lower costs for consumers. Many have suggested the infrastructure of America is in dire need of change but Buffett suggests such a thought "in no way applies to BNSF or railroads generally."

The Foolish bottom line

Many believe Buffett is simply good at picking which stocks to trade. But the reality is, he's an expert investor in businesses, not stocks. And whether he owns them outright or makes investments in their publicly traded shares, he always understands he is buying into the company itself.

And while it's clear BNSF has benefited both Buffett and Berkshire investors, the truth is, it benefits all Americans as well.