Going into Facebook's (FB 0.34%) first-quarter earnings report today, the stakes were undoubtedly high. Not only has the company been growing its top and bottom line faster than anyone expected, but the market has also priced into the stock some wildly bullish expectations. Facebook stock trades at about 100 times earnings. But despite the Street's euphoric outlook for the company, Zuckerberg and Co. delivered yet again in Q1. Here's the story in three charts.

Increasingly mobile

In the third quarter of 2012, 0% of Facebook's revenue came from mobile. Back then, the Street was dubious: Could Facebook meaningfully monetize the limited real estate on a small smartphone display?

Today, investors have their answer: When it comes to monetizing mobile, Facebook is the master. In the company's first quarter of 2014, Facebook confirmed that it is still succeeding on mobile -- better than ever, actually. Just a year and a half after it introduced mobile ads, mobile ad revenue now accounts for 59% of Facebook's total ad revenue.

Data for chart retrieved from SEC filings for quarters shown.

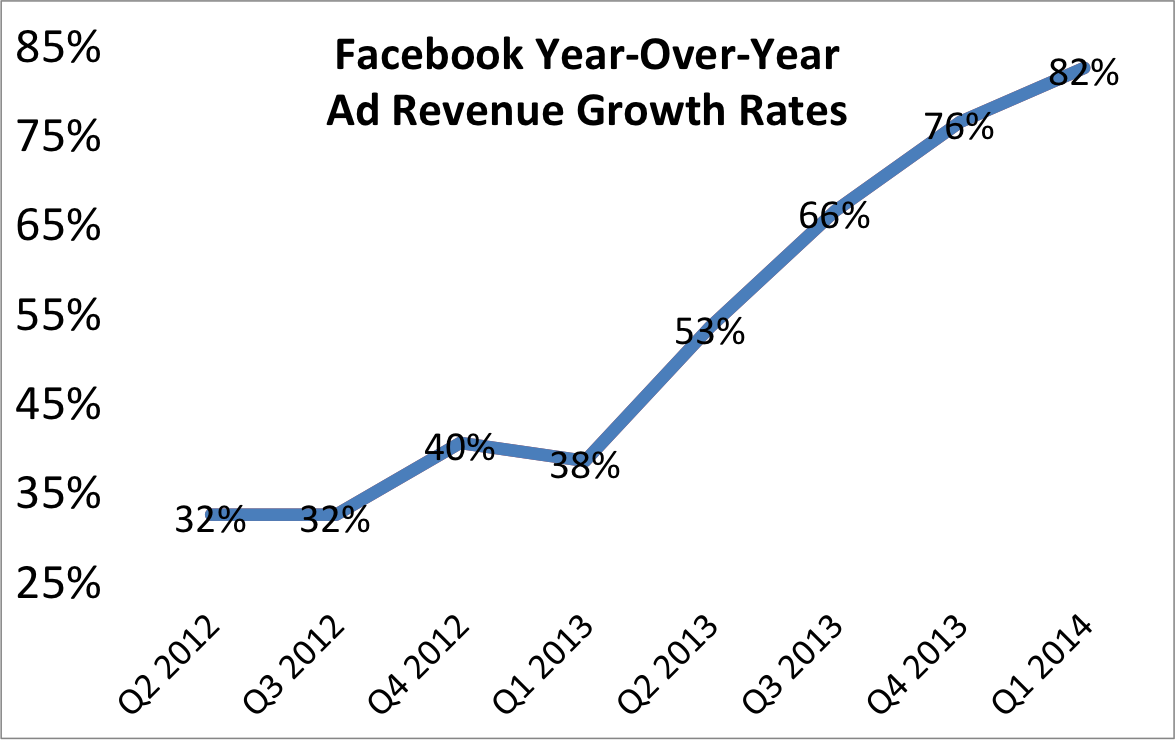

Accelerating growth

Facebook isn't just growing -- it's growing faster every quarter. In Q1, Facebook continued this trend. With the help of a growing base of monthly and daily active users, improving user engagement, higher quality ad products, new ad products, and larger spending from marketers, Facebook was able to post a record year-over-year ad revenue growth rate as a public company in Q1.

Data for chart retrieved from SEC filings for quarters shown.

Benefiting from monstrous operating leverage

Facebook showed off the power of its enviable operating leverage in its first-quarter results. Operating income soared 188% on a 72% boost in year-over-year revenue. Facebook can thank its robust operating margin of 43% (up nicely from 26% in the year-ago quarter) for that. On a non-GAAP basis, Facebook's operating margins reached 55%, up from 39% last year. Facebook's Q1 figures even trump Google's Q1 non-GAAP operating margin of 32%.

The growing leverage has resulted in some wild growth in operating income.

Data for chart retrieved from SEC filings for quarters shown. Non-GAAP rates were used due to large and volatile charges as a percentage of total revenue in Facebook's earlier quarters as a public company.

Facebook's overall results crushed expectations. The consensus analyst estimate was for Facebook to report non-GAAP earnings per share of $0.24 and year-over-year revenue growth of 60%. Instead, Facebook posted non-GAAP EPS of $0.34 and revenue growth of 72%.

While Facebook's first-quarter results are impressive, they don't necessarily make the stock a buy. Trading at such a considerable premium to earnings, it would be very difficult to argue that Facebook trades at a discount to fair value these days. Does this mean current Facebook shareholders should take their profits if the stock trends higher on this news? Not at all, the social network's excellent performance is just more evidence that Zuckerberg and his team of programmers have what it takes to continue to disrupt advertising and woo big marketing budgets.