Source: McDonald's.

McDonald's (MCD +0.04%) is delivering lackluster financial performance lately, and competition from successful fast-casual players like Chipotle Mexican Grill (CMG +0.42%) as well as traditional fast-food competitors like Burger King (BKW +0.00%) represents a considerable challenge for the company. On the other hand, McDonald's is attractively valued, and the risks seem to already be incorporated into current valuation.

Is McDonald's an undervalued investment or a declining business?

Not "lovin' it"

Total consolidated revenues increased by an uninspiring 1%, to $1.6 billion, during the first quarter of 2014. Constant currency sales did marginally better with a 3% increase during the period, but global comparable-sales performance was quite weak with an increase of only 0.5% versus the first quarter of 2013.

Operating income declined by 1% year over year, and earnings per share came in at $1.21, a decline of 4% versus the same quarter in the prior year, and lower than the $1.23 per share forecast on average by Wall Street analysts.

Performance in the U.S. was particularly weak with a 1.7% decline in comparable sales during the quarter, and a fall of 3% in operating income in the country. According to management, these results reflected "negative comparable guest traffic amid challenging industry dynamics and severe winter weather."

Europe was relatively better: McDonald's reported an increase of 1.4% in comparable sales and a growth rate of 6% in operating income in the Continent. On the other hand, the APMEA region delivered a worrisome decline of 0.8% in comparable sales, and a dip of 10% in operating income.

Competitive pressure

McDonald's is facing a series of considerable challenges. The trend toward healthier food and lackluster consumer spending represent a problem for many companies in the fast-food industry; besides, the competitive landscape is becoming increasingly challenging lately.

Fast-casual restaurants are gaining ground versus traditional fast-food chains. These restaurants offer higher-quality ingredients for a marginally more expensive price, while maintaining the overall speed and customer experience of fast-food chains, and the concept is resonating remarkably well with customers.

Chipotle Mexican Grill is the undisputed growth leader among fast-casual restaurants, and the company is delivering extraordinary performance while clearly outgrowing McDonald's by a wide margin.

Chipotle Mexican Grill announced last week an explosive increase of 24.4% in sales during the first quarter of 2014, to $904.2 million. Comparable-store sales jumped by 13.4% during the quarter, and management mentioned increased traffic as the main reason for this extraordinary performance.

Traditional fast-food chains are also gaining ground versus McDonald's via successful product innovation in the last several quarters. Burger King is scheduled to report earnings for the first quarter of 2014 on April 25, but the company is performing better than McDonald's on the back of successful new products such as its Big King sandwich and low-calorie french fries Satisfries.

For the fourth quarter of 2013, Burger King delivered an increase of 5.7% in systemwide sales, and a growth rate of 1.7% in systemwide comparable sales. Burger King also delivered a big increase of 14.3% in adjusted EBITDA during the quarter, so the company is outgrowing McDonald's when it comes to both sales and earnings performance.

Tempting valuation

The challenges and difficulties affecting McDonald's are certainly considerable, but the company is trading at compelling valuation levels, so many of the problems affecting McDonald's seem to be already reflected in the stock price.

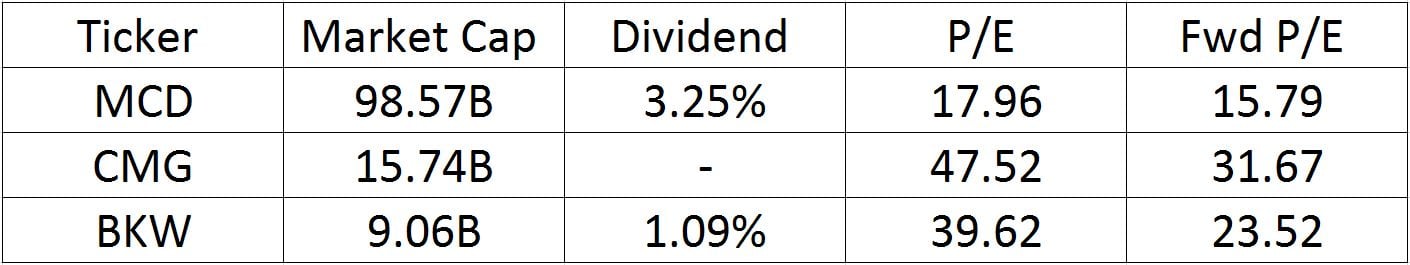

Looking at ratios like P/E, forward P/E, and dividend yield, McDonald's trades at a big discount versus competitors such as Chipotle Mexican Grill and Burger King.

Data source: FinViz.

The dividend yield should provide some downside protection at current levels considering that McDonald's has proven its ability to increase dividends through good and bad times. In an unquestionable sign of financial strength, the house of Ronald McDonald has raised its dividend each and every year since 1976.

Bottom line

McDonald's valuation and rock-solid dividend provide a convenient entry point for investors who are willing to patiently wait for the company to accelerate revenue growth via successful product innovation. Until -- or unless -- that happens, however, returns will most likely remain subdued, because current performance does not merit a much higher valuation for the company.