There is a lot to like about Bank of America (BAC +0.97%), and a recent comment from its CEO -- which, as most of his remarks do, lacks excitement -- but provides all the more reason for optimism.

The insightful quote

When asked about the expense reduction at Bank of America -- excluding litigation, its expenses fell from $17.3 billion in the first quarter of 2013 to $16.2 billion in the most recent quarter -- addressing its consumer business, CEO, Brian Moynihan, said:

[T]his is a long-term strategy, so whether it is New BAC or not, we will continue to optimize the platform. ... So at the end of the day, if you look at it across the last five or six years we have more customers, a lot more deposits and a lot less cost structure as we reposition to meet the customers' changing uses of first computers then phones and the enhanced effect of the ATMs.

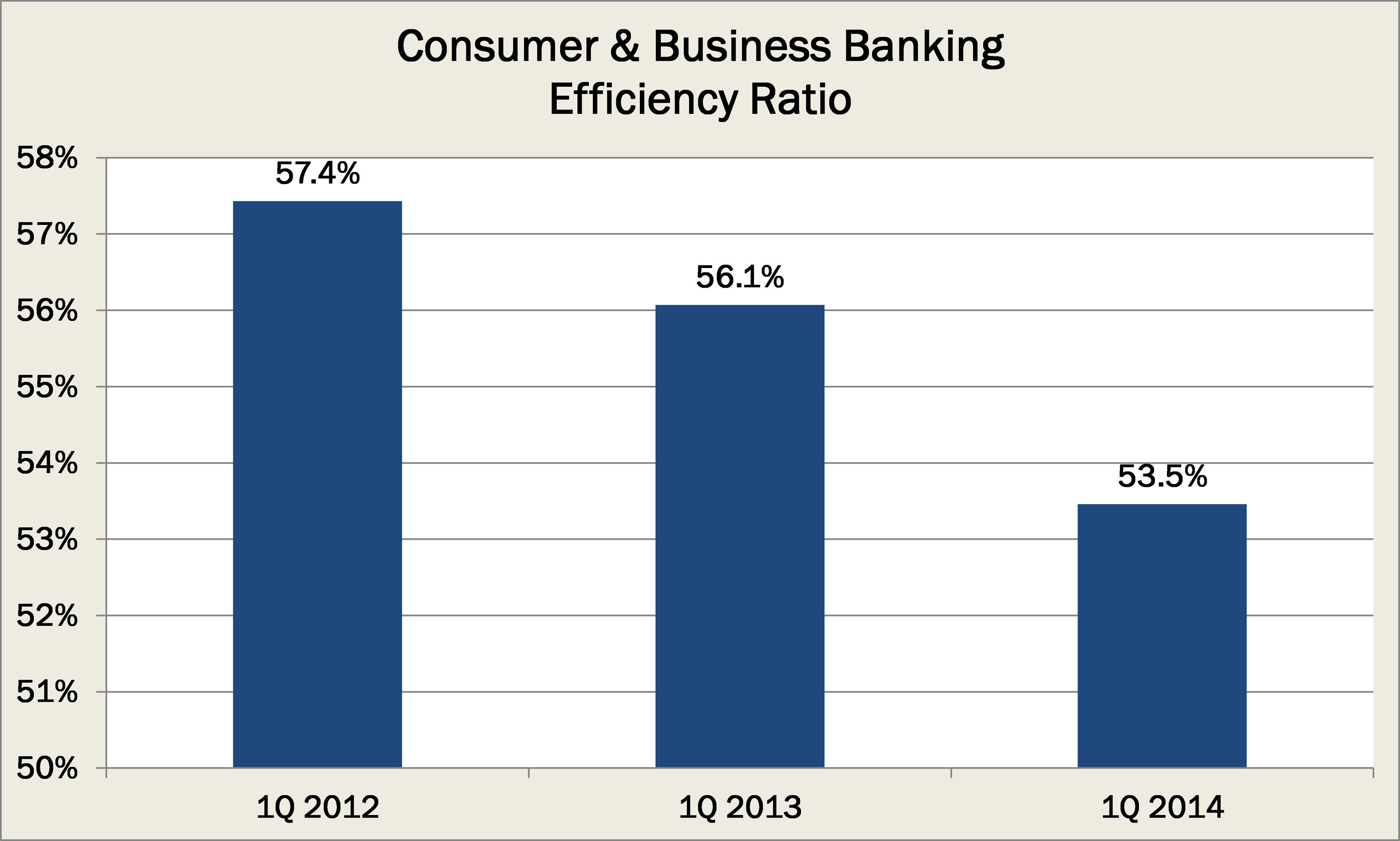

One of the fascinating ways to measure these efforts is the efficiency ratio -- which looks at the cost of each dollar of revenue -- which has had a remarkable trend over the past few years:

Source: Company Investor Relations.

In fact, the business itself has seen its expenses fall by $300 million over that same time, from $4.3 billion in the first quarter of 2012 to $4.0 billion in the most recent quarter. All of this is to say its Consumer and Business Banking arm has been a clear example of the success Bank of America has had in becoming a more efficient -- and therefore profitable -- operation.

The second key benefit

Back in September 2011, Bank of America issued an official statement on its "Project New BAC," which began in January 2010 in an effort to allow it "to become a more focused, leaner, and more efficient company."

But it would be a mistake to only talk about the expenses in this undertaking. Moynihan himself notes, part of the reason behind the shifting dynamics of its consumer business -- whether it be reducing branches or pushing for customers to use its mobile technology -- is to "reposition to meet the customers' changing uses."

You see, Bank of America didn't stop at suggesting the only aim of Project New BAC was to make it "a more focused, leaner, and more efficient company," but continued noting that it would be "providing all of its customers and clients with the best financial services, generating strong revenues, carefully managing expenses and risks, and delivering long-term value for shareholders."

And it's here where we see the benefit.

Part of the reason behind this shift is to provide its customers with the means to access their banking services in the ways they prefer. This is why Bank of America has pushed its mobile deposit technology -- 10% of deposits were made using it in the first quarter -- not simply because it's cost effective for the bank, but it's exactly what its customers want.

Altogether, we can see Bank of America is doing critical two things. It is reducing its expenses in an effort to boost its profits, and it's enhancing its technology to create better -- and often more cost effective -- relationships. It understands that by meeting the needs of its customers it will ultimately be able to meet the needs of its shareholders.