Global courier giant FedEx Corp.'s (FDX 0.15%) operating margin has been trailing as it finds itself in the middle of slow economic growth and a difficult business environment. With a presence in more than 220 countries, FedEx's business relies heavily on the health of the global economy. Slowing GDP growth in major markets is hurting profitability in the once lucrative core air delivery business as more customers prefer cheaper services over speed.

FedEx came up with a restructuring plan three years ago, and investors have become more optimistic about it over time. With the company now cutting its earning guidance for fiscal 2014 (ending in May) after a harsh winter, however, it's a good time to separate one-time issues from fundamental ones and see where things stand.

Source: Wikimedia Commons

Margin woes

FedEx cut its earnings forecast for fiscal 2014 to $6.55-$6.80, down from $6.73-$7.10 per share. The company cited the bitter winter as the main culprit for its disappointing earnings performance in the third quarter and the lowered guidance. It had reported earnings of $1.23 per share in the quarter and pegged the weather impact at a loss of $125 million.

In the conference call, however, management talked about other factors that are weighing on margins, including the sloppy practices of e-commerce retailers. CEO Fred Smith highlighted issues such as packages that weren't "packed well," labels that weren't "affixed to the packages very well," and shipment advices that weren't "tendered to the carrier." He said that these issues don't attract media attention but certainly has a bearing on the bottom line.

There's also the fundamental issue with FedEx's profitability, which of course has to do with the company's business model. Air delivery has always been pivotal for FedEx's operations and for the Express segment specifically, which is the biggest revenue earner for the courier giant. In the past, the company made big profits with premium services like Priority Overnight. As of late, however, customers are increasingly bending toward more economic services, which is hurting margins.

The story gets grimmer if you consider the skyrocketing fuel prices that have added to the company's spiraling operating cost. These factors pulled down FedEx's operating margin from 7.5% in fiscal 2012 to a meager 5.8% in fiscal year 2013.

It's tough, but doable

FedEx has set a target of achieving a 10% operating margin in each of its segments in the long run. Currently perched at 6.7% in the third quarter of the fiscal year 2014, it definitely looks like a tall order. It's not unattainable, though.

Out of the three issues troubling FedEx, we can discount the weather as it's far-fetched to expect that every winter will be this extreme. As far as the faulty practices of the e-commerce retailers are concerned, it's more of an industry issue rather than something specific to FedEx. This must be equally vexing for United Parcel Service (UPS +0.44%), but it doesn't deter that company from maintaining operating margin north of 10%.

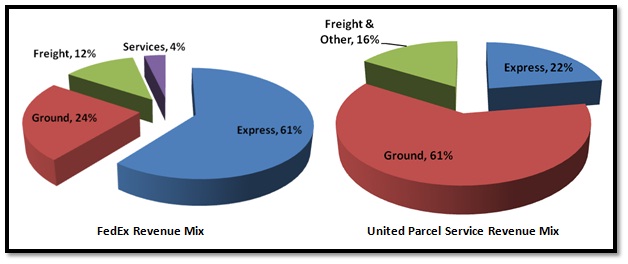

So, if FedEx can alter its business model and focus more on ground business like UPS (as seen in the chart below), it's quite possible that the company can also get its operating margin to the 10% level. Fortunately, the company understands this, and is slowly increasing the proportion of the higher-margin ground business.

Fiscal year 2013. Chart made by author. Source: FedEx, United Parcel Service

Given the size of the Express segment, however, it's going to remain the mainstay of FedEx's operations in the foreseeable future. This is where the big restructuring plan comes in, aiming at operating cost savings of $1.6 billion in the Express segment and $10 million elsewhere by the end of fiscal year 2016.

Firm plans

During the third quarter conference call, CFO Alan Graf sounded upbeat about the progress of the restructuring plan. He said, "We're seeing a lot of traction. I'm pretty excited about what we're going to deliver in 2015 and, to a greater extent, in 2016." The layout of the plan from a recent company presentation is given below:

Source: FedEx Roadshow Presentation, April 2014 – Slide 6

Maximum savings are expected from modernization of the fleet, and implementation of an employee voluntary retirement scheme.

FedEx is replacing its fleet comprised of Boeing MD 10s, MD 11s and 727s with more fuel-efficient Boeing 757s and 767s. The 757s promise a 20% cost improvement while the 767s are expected to save a good 30% compared to the earlier aircraft. As the replacement program gathers steam, the company is expected to garner more profits.

FedEx implemented its employee voluntary retirement program in 2013, and nearly 75% of the 3,600 staff members who had accepted the offer left by March of this year. The effect is starting to show in the operating margin of the Express segment, which improved to 2% from 1.8% in the year-ago quarter.

The crux

FedEx is turning around operations through multiple restructuring initiatives and cost-cutting measures. Margins could get better once these initiatives yield results. The winter effect is over and FedEx is back to basics. Good times could be round the corner.