MGM Resorts International (MGM +2.02%) reported Q1 2014 earnings Tuesday morning. With consolidated net revenue increases of 12% YoY, as well as an EBITDA Growth of 19% over the same time, MGM seems to have been an out performer this quarter. While these figures are good, and MGM investors should be happy as the share price gets a small bump, the figures are still lower than others in the industry, such as Las Vegas Sands (LVS +2.34%) which reported a few days earlier.

The key facts laid out in the MGM Resorts earnings report include:

- Net revenue of $2.6 billion, up 12% YoY

- Operating income of $413 million, compared to $302 million YoY

- EBITDA for domestic properties up 12% YoY

- EBITDA for MGM China properties up to record levels, with 33% increase YoY

Increasing revenues on Mass Market gamers

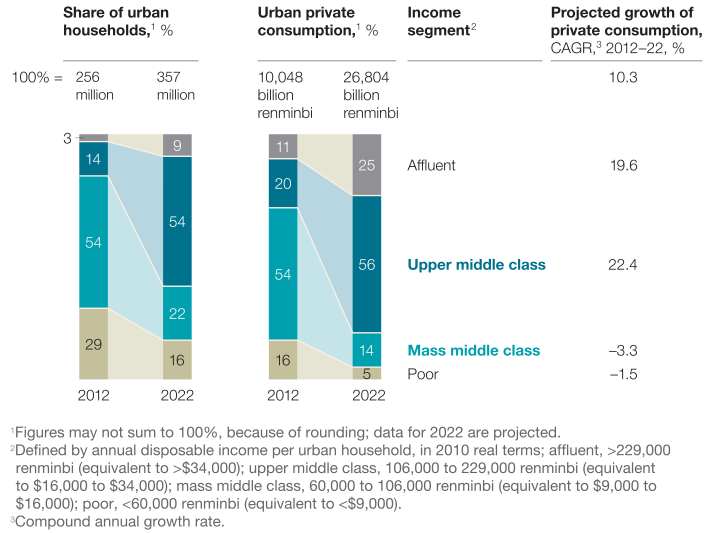

These numbers should make MGM Resorts investors happy. The company is making strides to continue growing in Macau. One interesting point in the earnings is the 45% revenue increase MGM had in mass market gaming in China, as opposed to the VIP high-rolling players that Macau resorts used to focus on. The middle class of China, those that make up most of the mass market consumer base for gaming companies, is a good bet on continued growth. According to research and analysis by Mckinsey group, by 2022, more than 75% of China's urban consumers will earn between $9,000 and $34,000 a year. Compare that to the 4% of the total Chinese population who fell within that range in the year 2000.

The magnitude of China's middle-class growth is transforming the nation. Graphic: Mckinsey

While the growth in Mass Market consumers is helping to drive growth in Macau for MGM Resorts, and over all the company has reported a strong quarter for its overall casino operations, is the company doing well relative to others in the industry?

Comparing MGM to Las Vegas Sands Q1 Earnings

While MGM Resorts did well in Q1, especially with strong growth in Macau, it is not the highest performer in the industry. Las Vegas Sands, which reported on April 24th, showed much stronger growth in Macau, which led the company with higher overall revenue and revenue growth over Q1 2013. Additionally, Las Vegas Sands is still cheaper than MGM on a price to earnings basis.

| MGM Resorts | Las Vegas Sands | |

|

Net Revenue | 12% Growth YoY | 21.4% Growth YoY |

| China EBITDA | 33% Growth YoY | 49% Growth YoY |

| Share Price | $24.33 | $76 |

| P/E (TM) | 63 | 24.4 |

Las Vegas Sands reported net revenue during Q1 2014 of a record $4.01 billion, up over 21% YoY. Additionally, continued strong growth in Macau with nearly 50% EBITDA growth makes it the industry leader so far. While MGM Resorts posted solid results from China operations, it is still earning most of its revenue from U.S. operations, including a struggling Las Vegas and U.S. Northeast region.

Las Vegas Sands, by contrast, has made a much bigger bet on this region, and has clearly won on its Asian bet. This not only includes Macau, but Las Vegas Sands also gains revenue from operations in Singapore, and is a front runner to win a bid for a casino in Japan.

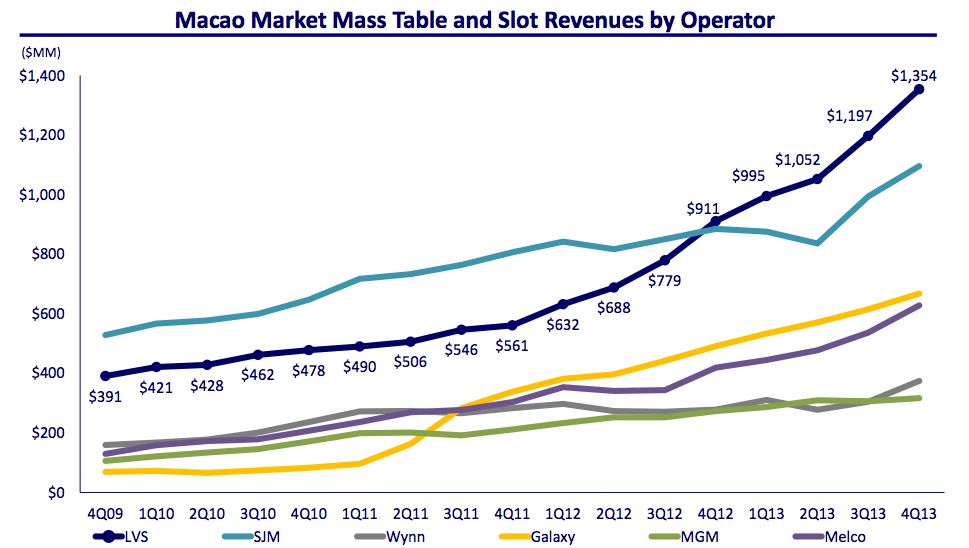

Las Vegas Sands not only beat MGM Resorts on total net revenue and net revenue growth, but continues to beat MGM oen mass market consumer growth as well. While MGM Resorts had a mass-market increase of 45% for the quarter, Las Vegas Sands's mass table win increased 54% YoY, compared to the industry growth rate of an estimated 40%. This is consistent with Las Vegas Sands being the industry leader in mass-market growth over the last few years.

Photo: Las Vegas Sands 2013 10Q presentation

Foolish takeaway

Macau's gaming industry is still growing at incredible rates, and that growth has helped to spur on MGM Resorts during Q1. With strong revenue and mass market increases for the company, MGM investors should not be disappointed. However, in light of the industry standards for growth in gaming, as well as competitors such as Las Vegas Sands posting even more incredible numbers, investors looking to get into one of these companies now need to continue to ask themselves, of the companies gaining on this industry, which is gaining the most. For new investors looking to get in on this market, that does not appear to be MGM.