Heating, ventilation, and air conditioning, or HVAC, company Lennox International (LII +1.77%) is always an interesting one to follow because its results give a good perspective on a market that is very important for so many other companies. For example, companies like Ingersoll-Rand (IR +8.09%) and Johnson Controls (JCI +3.03%) have significant HVAC operations. The sector as a whole is also a useful barometer for the condition of the North American construction markets.

Lennox International gives mixed results

The market took a dim view of Lennox's recent results and immediately marked its stock down a few percentage points. It's a slightly harsh verdict on the earnings report since revenue came in slightly better than analyst forecasts. Moreover, the company maintained its full-year forecast of 3%-7% revenue growth at constant currency, and adjusted EPS of $4.20-$4.40; the mid-point of this range implies nearly 19% growth from 2013.

That kind of growth rate is not bad for a company facing foreign exchange headwinds which are expected to reduce revenue by 1% in 2014. Furthermore, Lennox's profitability is being held back, at least in the short term, by start-up costs associated with its entry into the variable refrigerant flow, or VRF, market where it will compete with Johnson Controls, Ingersoll-Rand, and others. VRF is a technology which allows users to heat and cool simultaneously across different zones of a building. Management intends to start shipping VRF systems in the second half of the year, and is aiming for $100 million in sales within five years. To put this into context, it represents nearly 3% of analysts forecast of $3.38 billion in revenue for 2014.

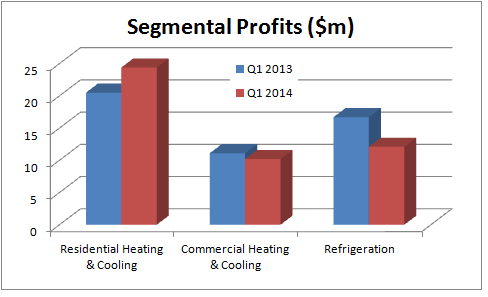

The impact of the VRF investment can, at least partly, be seen in the segmental profit figures (commercial HVAC) for the first quarter:

Source: Lennox International presentations

Lennox International gives color on its end markets

While, the commercial segment's profitability was hit by the increased investment, its underlying conditions are improving. In fact, commercial revenue was up 6% at constant currency, with North America equipment revenue up "low double-digits with replacement revenue up nearly 20%." In addition, extreme bad weather held back new commercial construction revenue to "low single-digits" in the quarter. That's not bad, under the circumstances. Management also claimed to be winning market share from Ingersoll-Rand in commercial HVAC.

Turning to the company's overall rview, when asked which markets he felt the most optimistic on in 2014, Lennox CEO Todd Bluedorn replied that "in terms of confidence it's Residential, Commercial, and Refrigeration, probably in that order, and it's tied to what the end-markets are going to do."

Indeed, this viewpoint is reflected in the company's guidance for mid-single-digit growth in North American residential HVAC shipments. North American commercial shipments were forecast to be up in low single-digits, but global refrigeration shipments are predicted to be flat in 2014.

It was slightly disappointing that guidance for the commercial segment wasn't upgraded, and the ongoing tough conditions in the refrigeration segment reflect the weakness in the U.S. supermarket and convenience store sector. However, the residential segment recorded an impressive 10% revenue growth with segment profits increasing 19%. Clearly, this is a manifestation of an improving housing market, and history suggests that the commercial construction sector lags the residential sector in terms of investment.

The bottom line

All told, this was a pretty positive report for the HVAC industry. Investors in Johnson Controls and Ingersoll-Rand should anticipate favorable results in future. Lennox International's profitability was held back by currency and its investment program, but these issues don't relate to underlying weakness in its HVAC markets.

The refrigeration segments prospects are rather more uncertain, with management predicting soft conditions for 2014. Lennox's results weren't bad, but on a P/E ratio of nearly 19 times forward earnings, the company's stock probably needed a bit more than it delivered in the first quarter.