Early this morning Goodyear Tire & Rubber Company (GT +1.54%) announced its first-quarter results, which sent some investors heading toward the door. As investors bailed, Goodyear's stock price fell more than 8% in premarket trading before recovering a couple of percentage points by late morning. Let's take a look at the financial numbers, the cause of the weaker-than-expected earnings, and whether or not this is a mere speed bump for the tire maker or something worse.

By the numbers

Let's get the dry numbers out of the way. Starting from the top, revenue fell 8% to $4.47 billion, which fell short of analyst expectations of $4.8 billion. Goodyear Tire & Rubber reported a $58 million loss in the first quarter, or $0.23 per share. But when adjusted to exclude one-time items, Goodyear posted earnings of $156 million, or $0.56 per share, which still checked in $0.04 per share below expectations. Let's look at the main culprits for the weaker than expected top- and bottom-line results.

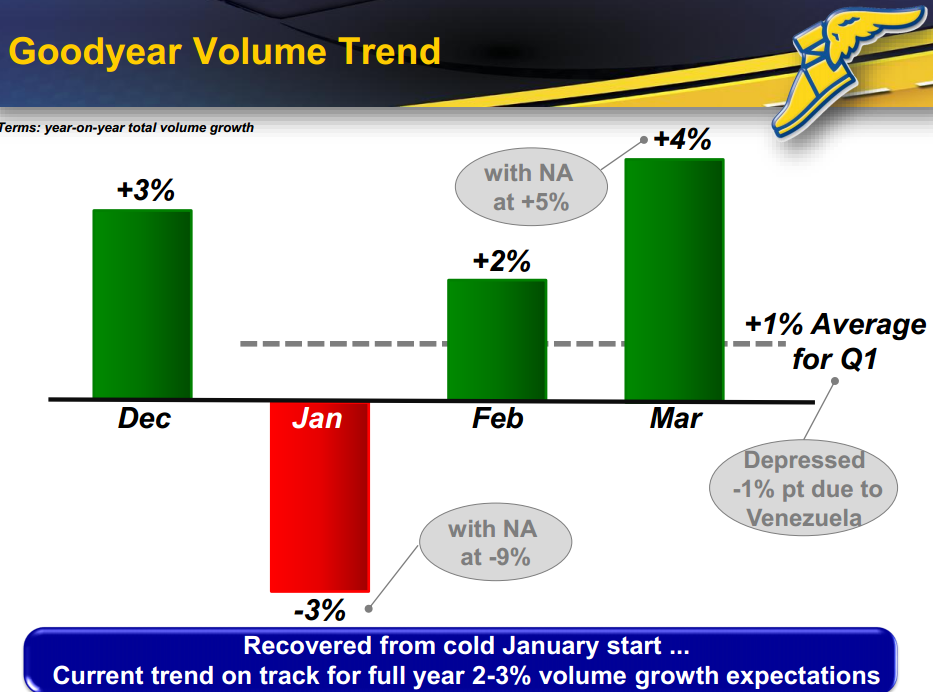

Goodyear's top-line revenues were clearly affected by the harsh winter weather that slowed sales throughout the industry. Goodyear supplies tires to original equipment manufacturers, or OEMs, on a just-in-time basis, which means as sales of vehicles slow, there's little to no inventory buffer and Goodyear's revenues are directly and immediately affected. In addition to the slowdown in vehicle sales that dampened Goodyear's revenue from OEMs, its business with large replacement tire customers slowed as retailers suffered from slower consumer traffic. In the graph below, you can see how drastically January's weather affected Goodyear's results.

Source: Slide 5 of Goodyear's first-quarter presentation.

Now, to explain Goodyear's net loss in the first-quarter.

Venezuela

Investors knew Venezuela would be a drag on profits; it just wasn't clear how much it would be. There were two factors behind Goodyear's struggles in Venezuela. First, the tire maker recorded a $132 million charge related to the drop in the value of the Venezuelan bolivar -- that knocked off $0.47 per share from the bottom line. Second, the company also took a $30 million hit due to labor issues, which have since been resolved with a new labor contract this month.

Despite the difficult first quarter, management remains confident it's a mere speed bump in 2014.

"We remain confident in our full-year expectation of 2 percent to 3 percent year-over-year volume growth, despite the negative impact of severe January winter weather in North America and labor and economic disruptions in Venezuela during the quarter," said Richard J. Kramer, chairman and chief executive officer, in a press release.

Silver lining

While the overall financial results were a bit weak, there were some positive takeaways as well. Goodyear posted a 210-basis-point increase in its segment operating margin, year over year, to 8.3%. If you're keeping track, that marks its fourth consecutive quarter above 8%. Also, the company's raw material cost declined 6% in the first quarter and management expects that to be a trend for the remainder of 2014. Truck tires also boost margins for Goodyear, and that looks to be a tailwind for the company as truck sales in the U.S. continue to be robust while outpacing overall industry vehicle sales growth.

Foolish takeaway

After digesting Goodyear's first-quarter results, most investors were likely pondering two questions: Is the sell-off warranted? And is this a speed bump or the beginning of a worse-than-expected 2014?

In my opinion, the sell-off from a short-term perspective is warranted to take profits; however, I believe it's only a speed bump for long-term investors. While Goodyear doesn't trade at an outlandish forward P/E ratio, investors have to consider that the stock price has more than doubled over the last year, including this 6% sell-off. Like it or not, a minor speed bump in quarterly earnings is enough for some investors to take profits and send the stock price down.

To the second question, this does appear to merely be a speed bump for Goodyear. While January weather negatively affected OEM production and sales, as well as retailer traffic, Goodyear's business rebounded sharply in the following two months. Furthermore, there's absolutely no reason to expect significant charges from Venezuela to recur.

Combine those two factors with management's confidence that its summer lineup of new tire products has positioned it better than previous years for a strong selling season, and long-term investors should take today's pullback with a grain of salt.