Photo: Hollywood Reporter

Next year, Disney (DIS 0.89%) will be the first American company to open a major media-themed resort in Mainland China. Disney's Shanghai resort is sure to please Chinese families who are looking to find the most magical place on earth without leaving mainland China. Disneyland Hong Kong has performed well for the company, and Disney hopes this new resort inside of the mainland will be even more successful. However, others are looking to add their own media-themed parks as well, including Dreamworks (DWA +0.00%), which plans an indoor park near Shanghai.

Now, Comcast (CMCSA +1.98%) is joining the group with its plan to add a Universal Studios (a subsidiary of Comcast) theme park near Beijing. Is it too late for the cable company to compete with Disney and Dreamworks, which will already have theme parks operating in China as well as substantial investments in China? Thanks in part to a booming urban population and middle class in China and good Universal Studios brand equity in Asia, Comcast should still do just fine.

Mickey gets ready to welcome Chinese families to the happiest place on Earth... at least on the Mainland. Photo:Disney

Disney and Dreamworks, bringing the magic to the Mainland

Disneyland Hong Kong was a highlight of Disney's 2013 fourth-quarter earnings report, as its revenue improved 9% year-over-year while Disney posted 7% year-over-year revenue growth company-wide. When the company broke ground on its Disney Resort Shanghai back in 2011, CEO Bob Iger said that "Our Shanghai resort will be a world-class family vacation destination that combines classic Disney characters and storytelling with the uniqueness and beauty of China. Working with our Chinese partners, the Shanghai Disney Resort will be both authentically Disney and distinctly Chinese."

DreamWorks partnered with Shanghai Media Group and three other local entertainment companies to create Oriental Dreamworks, a joint venture that includes production studios and attractions in Shanghai. Observers have called this a "Chinese content company" in which Dreamworks Animation holds a 45% stake, with the remaining 55% of the venture split between the three influential Chinese partners. Oriental DreamWorks already has four feature projects in development including Kung Fu Panda 3. Oriental Dreamworks is also sinking its feet into the Asian theme-park pool with a $3.1 billion indoor park in Shanghai that is set to open in 2018.

Comcast wants in too -- Is it too late to compete with Disney and Dreamworks?

Comcast-owned Universal Studios is now breaking ground with its forthcoming film-themed amusement park in China, which it expects to open in 2018. However, Universal Studios is not new to Asia -- this new park near Beijing will be the company's fourth in Asia outside of the well-established ones in Japan and Singapore and the coming Universal Studios park in South Korea.

Theme park operations have been a lucrative segment for Comcast, both because of the American theme parks and the company's Asian growth. The company made $2.2 billion in total theme park income during 2013 and reported $1 billion in operating cash flow. At an investor conference in January, Comcast CEO Brian Roberts said that the company is "doubling down on theme parks," and that "We think there is a lot there in the theme park business for many years to come, and that we have the low market share and only one way to go."

Millions of reasons for excitement about Universal Studios Beijing

The growth of Chinese middle class means that Chinese families have more opportunities to visit places like Universal Studios. Additionally, as income-earning opportunities grow in China's cities, more and more citizens are moving to the big cities, such as Beijing and Shanghai, for work. Beijing currently has a population of over 20 million people, more than five times that of Los Angeles. The growing population and increasing income of families moving into the middle class are good signs for leisure companies such as Universal Studios. While Disney and Dreamworks are competing for these families down in Shanghai, Comcast may be reaping the profits from being the main attraction near Beijing up north.

Source: McKinsey Research Group

The Chinese market is a good place to "double down"

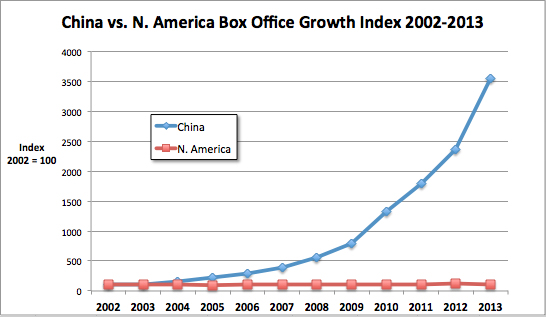

The Chinese film and media industry is booming. PricewaterhouseCoopers projects a value for the industry of $6.49 billion in 2017, more than double its $3.26 billion value in 2012. This just includes the movie production value generated by the film and media industry, without adding in the theme parks and other revenue-generating operations that Disney and Comcast will develop in the country to gain from the brand equity that the growth in film viewership will bring. Analysts bullishly expect China to become the largest film and media market in the world in the next few years.

Source: ChinaFilmBiz.com

Source: ChinaFilmBiz.com

Can Comcast compete in China, even though it's starting late?

Disney and Dreamworks will already have operations in China by the time Universal Studios opens near Beijing. However, there is room for multiple companies to benefit from growth in China and Asia in general. Hundreds of millions of Chinese consumers will be moving into the cities and into the middle class in the coming years.

All three of the companies mentioned seem to be making smart moves to gain in this growing Chinese market. Even though Comcast is coming into the market later than the others, there should be plenty of profits to be had from the Beijing market. With the other two theme parks down south in Shanghai, Universal Studios should still do well up north near Beijing. Following the success the company has shown in Singapore and Japan already, investors should feel that this move, no matter what happens with Disney and Dreamworks down in Shanghai, is a good move for Comcast.