Bank of America (BAC +0.98%) customer service trailed the average across the U.S. But a deeper dive shows there's good news to be had.

The big loser

The latest capture of customer satisfaction from J.D. Power was released this week and, despite all the turmoil surrounding banks, satisfaction is actually at an all-time high.

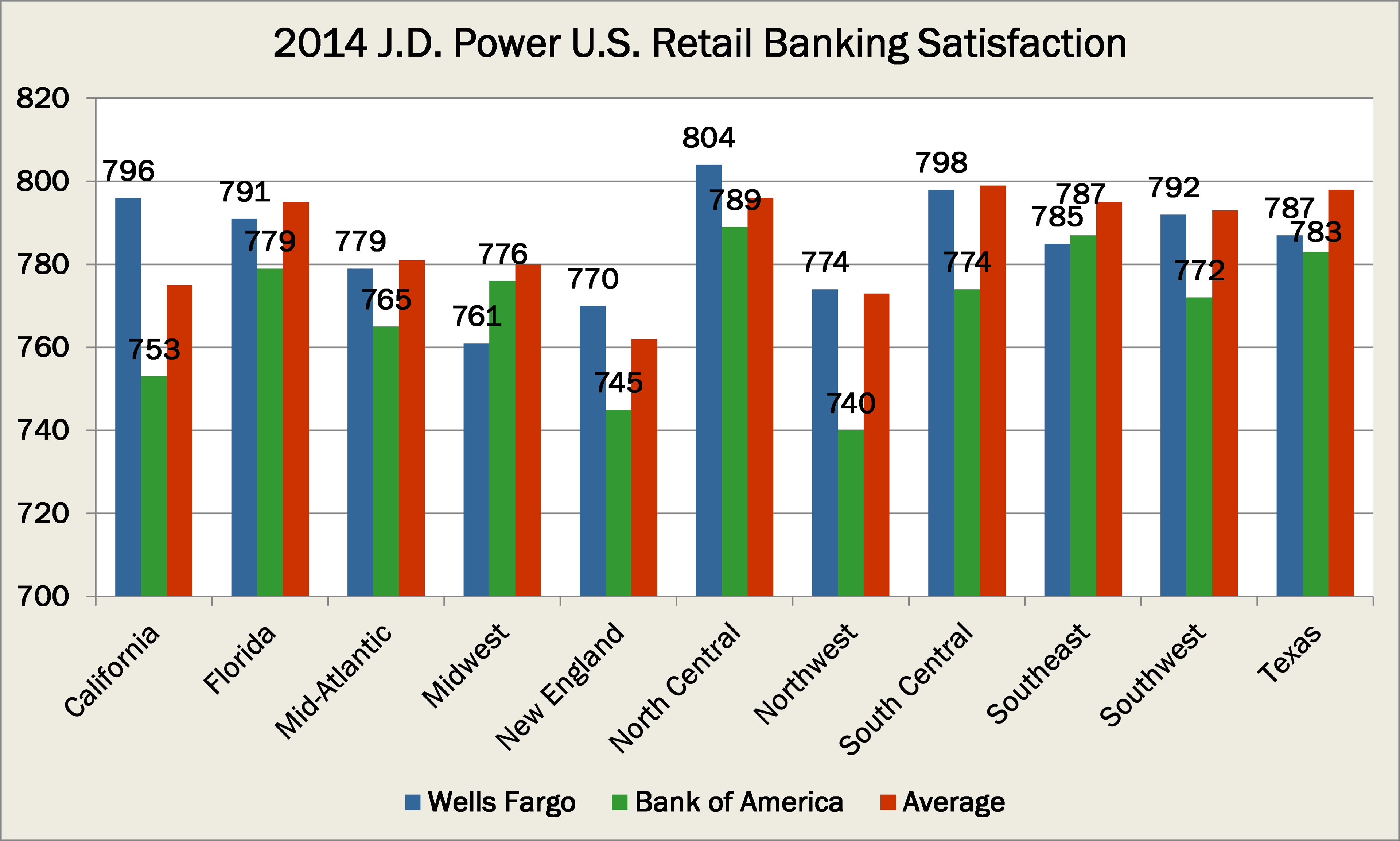

Only Bank of America and Wells Fargo (WFC +2.02%) are categorized in all 11 regions in which J.D. Power collects information. Bank of America trails the average in all areas, but Wells Fargo isn't far behind, trailing in seven regions:

Source: J.D. Power and Assocates

But it must be noted the average gap between Bank of America and all the other banks stands at 17 points, versus just 1 for Wells Fargo.

With all of this in mind, it's easy to think this is just one more piece of bad news piled on to Bank of America. But there is one thing both investors and individuals need to know.

Things are looking up for Bank of America.

Pace of improvement

The average customer service rating of all banks improved in each of the 11 areas. But since we knew overall satisfaction reached a record high, this should come as no surprise.

What may come as a surprise is that Bank of America saw its customer satisfaction, also rise in all eleven areas.

And not only that, but the improvement recognized by Bank of America actually outpaced the banking average. It's total scores in the 11 areas rose by 287 points, which was 15% more than the total growth recognized by the average bank.

What this means to individuals and investors

This can be taken two ways. Bank of America started at a lower point, so they had more room to move up. Or, it's evidence that the bank is not only committed to improving itself, but is succeeding as well.

I've chosen to take the latter.

Bank of America itself is a turnaround story. Whether it was the disastrous acquisition of Countrywide or the consumer rage over the $5 fee fiasco, Bank of America has seen some of the lowest lows of any bank in the country.

While progress to recover from these troubles has been neither fast nor easy -- five years after the market collapse it's suspected to shell out more than $20 billion in legal settlements this year alone -- it's still making measurable progress.

Source: Company Investor Relations.

In 2013, the company earned nearly as much as it did in the five years from 2008 to 2012 combined. While income will take a hit in 2014 as a result of the settlements, my colleague John Maxfield noted, "Bank of America is indeed nearing the finish line when it comes to legal liability dating back to the financial crisis."

Bank of America has a long way to go until all the marks of the financial crisis are truly behind it. But improvements in customer satisfaction and the bottom line show that it's certainly making progress.

Warren Buffett recently said his $5 billion investment in Bank of America was already worth nearly $11 billion. But he was content holding until 2021 -- and perhaps beyond.

Buffett's investment in Bank of America is "one we value highly," and you should too.