What a difference a few days can make. Earlier this week, the U.S. Bureau of Economic Analysis released one of the weakest gross domestic product reports in years. Today, the U.S. Bureau of Labor Statistics rolled out its latest employment report, and its tally of 288,000 new jobs added in April is the largest monthly increase since January 2012. In fact, it's the fourth-largest monthly increase in American jobs since the end of the recession, and it now puts the American economy a mere 114,000 jobs away from setting a new all-time employment high more than six years after employment last peaked.

Source: U.S. Bureau of Labor Statistics.

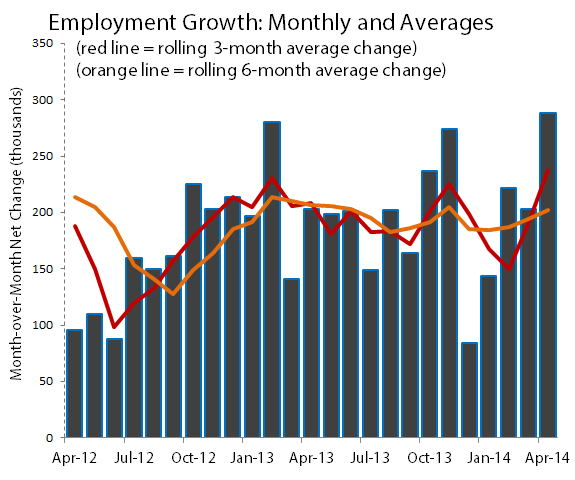

Not only was this one of the strongest single-month reports in years, it also helped push longer-term rolling job-growth averages to better levels than we've seen for much of the past year. The three-month average jobs gain -- thanks to three consecutive months of greater than 200,000 new jobs added -- now stands at 238,000, the highest such three-month average improvement since March of 2012. The six-month average job gains aren't quite so impressive, but this is nonetheless the first time that the past six months of job growth have averaged out to over 200,000 jobs since last November:

Source: U.S. Bureau of Labor Statistics.

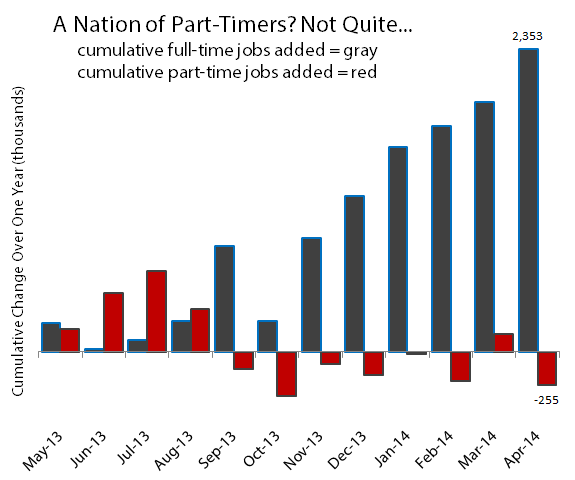

Another positive sign in this report was the ongoing growth in full-time jobs and a general decline in part-time work. Over the past year, Americans have found 2.4 million new full-time jobs, but have left nearly 300,000 part-time jobs:

Source: U.S. Bureau of Labor Statistics.

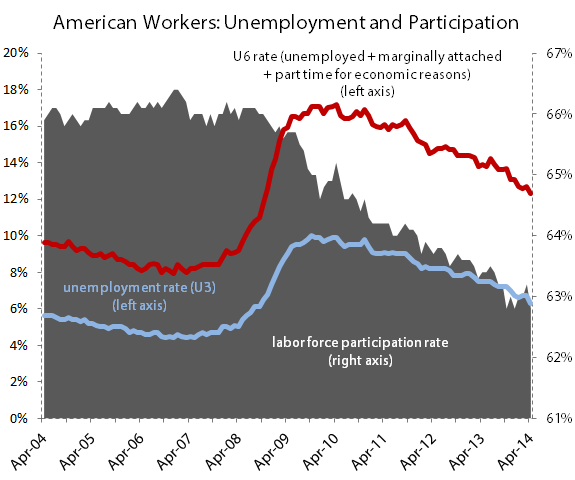

The jobs report also showed one of the largest declines in unemployment in years, as 733,000 fewer people were unemployed last month -- which is the largest single one-month decline in the number of unemployed Americans since the end of World War II. This huge drop in the unemployed tally pushed the unemployment rate down to 6.3%, which is lower than it's been since late 2008. Even the U-6 unemployment rate, commonly cited by pessimistic economy-watchers, dropped to 12.3%, a level that also hasn't been seen since late 2008.

However, it's important to understand why unemployment dropped so steeply. The labor force participation rate, which simply measures the ratio of Americans who want to work against the total population of working age, plunged below 63% again. This is the third time since October that labor force participation has fallen below 63%, so this could be either a period of stabilization or a futile wobble before further declines, but the result doesn't paint a good picture of the health of the workforce:

Source: U.S. Bureau of Labor Statistics.

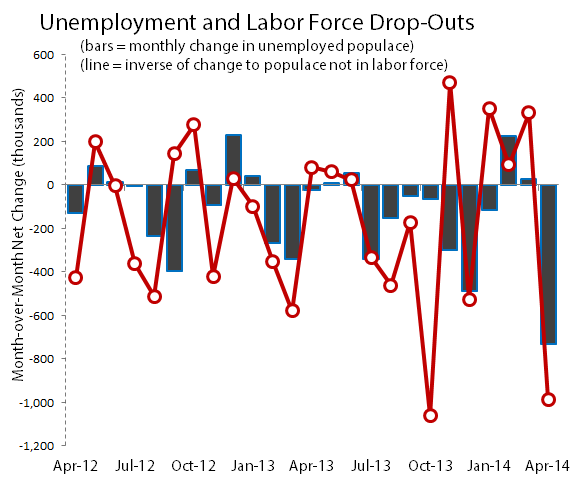

A decline in unemployment that corresponds primarily to a drop in people counted as part of the labor force is nothing to celebrate, but over the past year, these two statistics have generally moved rather closely together. In the chart below, monthly changes in the labor force, represented by the inverse of growth in the BLS' "not in the labor force" metric, is paired up with monthly changes in unemployment. You should be able to see the similarity rather easily:

Source: U.S. Bureau of Labor Statistics.

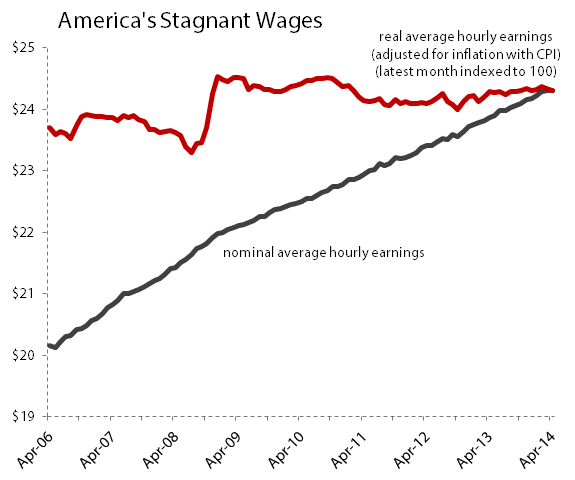

Another cause for concern in what was a pretty good report on the surface is the stagnation of hourly wages, which did not change at all from March to April, and which have now grown less than 2% on a nominal basis over the past year. And there's another problem -- measuring hourly wages nominally, as the BLS does, hides the fact that real wages have barely gone anywhere in recent years. When we adjust the BLS' hourly wages for inflation, we find less than 3% growth since 2006, which was the first year for which the BLS began reporting average hourly earnings for the entire workforce:

Source: U.S. Bureau of Labor Statistics.

The vast amount of data that the BLS provides every month can easily be twisted to argue nearly any point you like, and this month is no different. Job growth appears strong, but the labor force is weakening. Unemployment has fallen and full-time jobs are the source of all this employment growth, but the average American worker isn't actually making more money in real terms than he or she would have been five years ago.

American investors have reacted with indifference, and with so many contradictions, there's no reason why they should cheer or flee -- the Dow Jones Industrial Average (^DJI 0.34%) is actually lower in the afternoon after enjoying a slight opening-bell surge on the early interpretations of today's jobs data. It's still likely that the American workforce will set a new record for total employment in May, as I first predicted last month, but with so many more potential workers not working, investors will probably meet that record with indifference similar to what they've shown today. Things are still getting better, but that's not good enough.