Paying a premium price for anything is always tough to stomach. Yet one picture reveals why investors should be willing to pony up for one big bank. Just like Warren Buffett did.

The eye-opening reality

Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B), run by Warren Buffett, is often known for its biggest investments. After all, at last count its four biggest stock holdings made up more than 55% of its nearly $120 billion portfolio of investments.

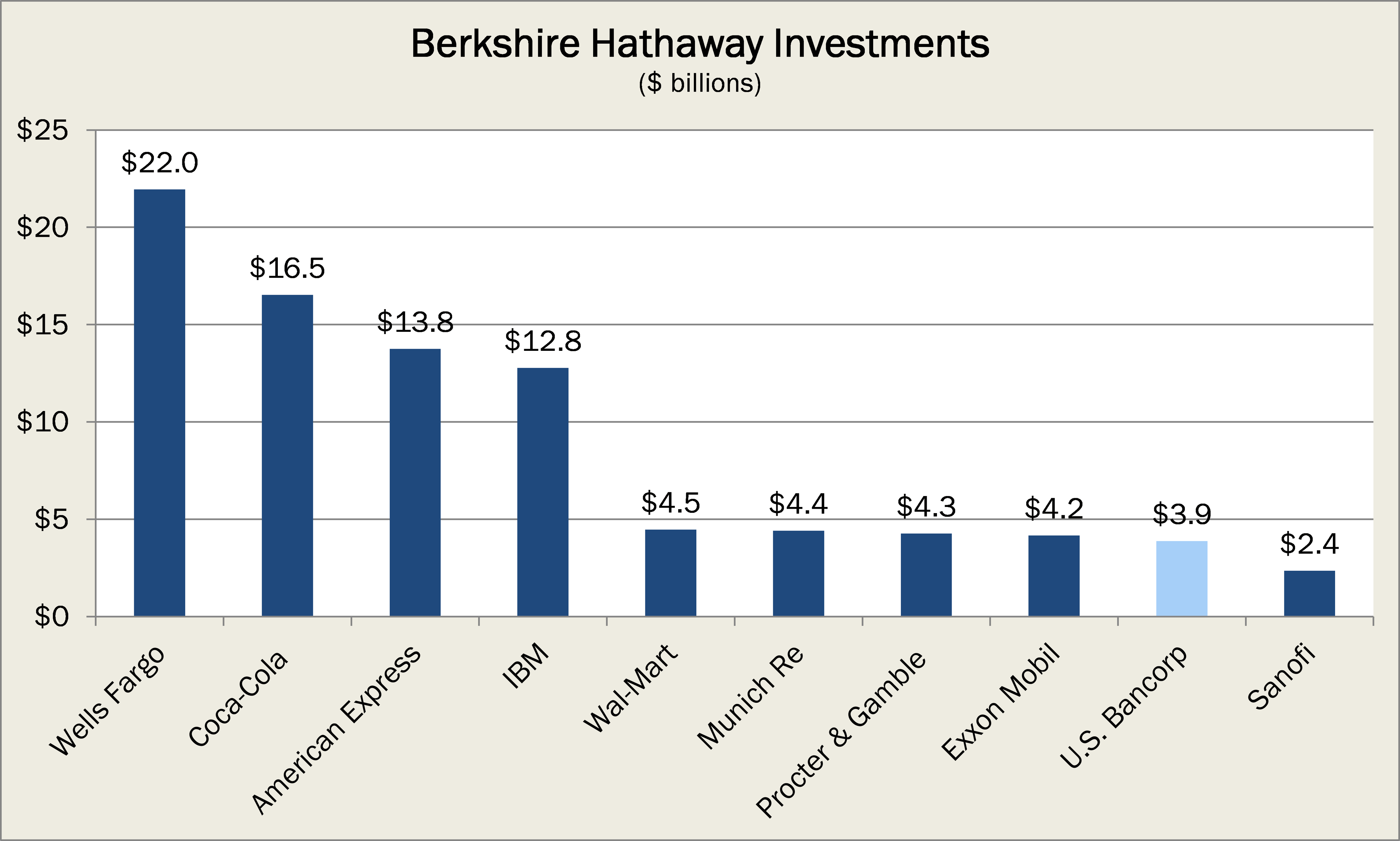

Yet often lost in that is the reality Berkshire also owns more than 5% of US Bancorp (USB +2.45%), worth almost $3.9 billion, making it the 9th largest holding. Yet the investments of Berkshire Hathaway are really divided into tiers, and as shown in the chart below, it is much close to being the fifth than eleventh:

Source: Company Investor Relations

Far from a value investment

What people assume about Buffett and Berkshire Hathaway is many of the stock purchases are made because they're value investments. After all, Buffett himself once said:

Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down.

However no one would suggest US Bancorp is a "value" investment. Its price to tangible-book value sits at 3.0, well above the 2.2 value of the other well-known (and enormous) Buffett bank investment, Wells Fargo. In fact it more than doubles the 1.4 P/TBV that JPMorgan Chase trades at.

Buffett actually began adding to his position nearly 10 years ago, when US Bancorp traded at an even more expensive valuation than where it sits today.

All of this is to say it's tough to believe anyone would call US Bancorp "marked down," either then or now.

One critical reality

Yet the truth is, investors should be willing to pay a premium for the bank itself. A recent slide from its annual meeting reveals exactly why it commands such a lofty value:

Source: Company Investor Relations

As you can see, of the three critical profitability measures of banks, US Bancorp delivers resounding victory not over just the last year, but in fact the last six. All of this is to say, the premium price is certainly justifiable seeing the ability of the bank to deliver returns to its shareholders.

The Foolish bottom line

The sentence before the Buffett quote mentioned earlier said this:

Long ago, Ben Graham taught me that "Price is what you pay; value is what you get."

And the thing to see about US Bancorp is, while it may trade at an expensive price, it truly delivers value.