Source: Wikimedia Commons

One of the best performing stocks on May 1,2014 was Weight Watchers International (WTW +0.00%). After the weight-loss giant reported revenue and earnings that handily outpaced analyst expectations, shares rose almost 20%. Although this news may make investors think that now is a prime time to sell their stake in the company and consider NutriSystem (NTRI +0.00%) as a prospect, are the long-term prospects of Weight Watchers good enough to propel the stock even higher?

Weight Watchers' amazing quarter

For the quarter, Weight Watchers reported revenue of $409.4 million. Although this is a nice clip above the $399.2 million analysts anticipated, revenue still came in almost 17% lower than the $490.8 million the company reported in the same quarter last year.

In its earnings release, management attributed the declining sales to fewer active subscribers in its North American and United Kingdom segments. For the quarter, the company recorded 3.6 million active subscribers, down 14% from the 4.2 million a year earlier. About 93% of these came from its North American operations, as consumers opted to use free apps instead of the company's online platform.

In terms of profitability, the company did even better. For the quarter, Weight Watchers saw its earnings per share come in at $0.38. This represents a 56% drop compared to the $0.87 the company reported the same quarter a year earlier, but was 322% above the $0.09 analysts expected. The decline in profits came from the company's cost structure, which rose in relation to sales but not to the extent analysts forecast. During the quarter, the company's cost of goods sold rose from 42.2% of sales to 45.6%, while its marketing plus selling, general, and administrative expenses rose from 36.8% of sales to 42%.

Is Weight Watchers outmatched by NutriSystem?

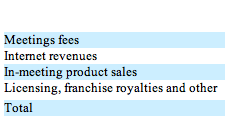

Over the past five years, Weight Watchers has been something of a mixed bag. Between 2009 and 2012, the company's revenue soared more than 31% from $1.4 billion to $1.8 billion. This increase was due largely to an increase in Internet revenue the company generated, which rose 157% from $196 million to $504.3 million. This did, however, change for the worse when Weight Watchers saw its revenue fall 6% to $1.7 billion as meeting fees, in-meeting product sales, and licensing revenue fell 9%, 16%, and 6%, respectively.

Source: Weight Watchers

While this turn of events may look scary, it pales in comparison to how rival NutriSystem has done. Every year since at least 2009, the company was hit by a drop in sales. Between 2009 and 2013, NutriSystem's revenue fell a whopping 32% from $524.6 million to $358.1 million. According to the company's most recent annual report, its declining sales trend has been due to fewer new customer starts combined with decreased on-program revenue and price declines designed to retain customers.

From a profitability perspective, NutriSystem's performance has been even worse. During this five-year time frame, the company's net income declined 74% from $28.8 million to $7.4 million. This rapid decline was due to the drop in revenue the business experienced combined with an increase in its cost of goods sold, which rose from 46% of sales to 51.4%. In contrast, Weight Watchers' bottom line grew almost 16% from $177.3 million to $204.7 million, largely due to the company's higher revenue.

Foolish takeaway

Based on the data provided, it's pretty clear that Weight Watchers had a strong quarter. But the fact that revenue and earnings are coming in far lower than last year's numbers is a concern. Currently, the company is being hindered by a shrinking customer base as free alternatives are being made available, but this news from the company that the picture isn't as bad as investors think could be a sign of better times to come.

Moving forward, the company could continue delivering strong performance, but only investors who understand the risk associated with it should delve in. If Weight Watchers doesn't seem like a good prospect for you, an interesting possibility is NutriSystem; but with revenue and earnings that are in free fall, the business likely carries with it more risk than its larger peer.