Europe has traditionally been a stronghold of alternative energy, but macroeconomics is starting to catch up with the solar industry. In the first quarter of 2014, Germany's solar installations fell 41% from Q1 2013 thanks to lower subsidies.

Germany is not the only European country to look at. The Spanish government has slapped large levies on solar panels that have forced some people to remove their existing rooftop systems altogether. It would be nice to hope that this is a temporary issue, but the macroeconomics show that the problems are not transient.

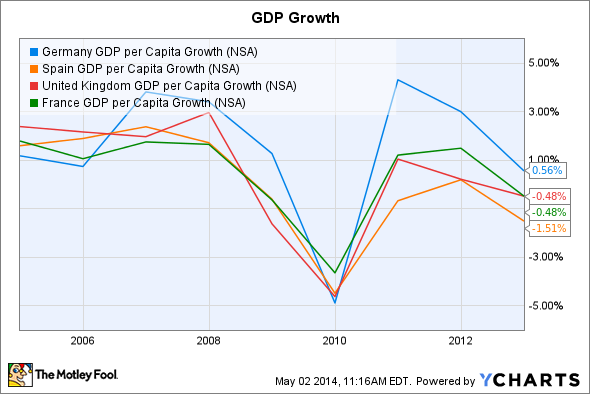

Germany GDP per Capita Growth data by YCharts

The numbers

The chart clearly shows that while Germany is doing better than its southern cousins, all of these European nations are suffering from low economic growth. These issues will not disappear, as there are inherent problems in the Maastricht regime. Low economic growth depresses tax revenue, making it difficult to justify clean energy subsidies.

The U.K. is better off, as it uses the pound instead of the euro, but the U.K.'s integrated trade relationship with the continent makes it is almost impossible to avoid catching a cold from Europe's influenza.

Which solar manufacturers will suffer?

In general Chinese solar manufacturers have more exposure to Europe. This does not paint a pretty picture, as falling European sales will only hurt their already depressed margins.

In 2013 a full 30.1% of Yingli Green Energy's (NYSE: YGE) total revenue came from Europe. This is a big percentage of sales, and the company expects that between fiscal year (FY) 2013 and FY 2014, Europe's percentage of total shipments will fall from 30% to 15%. Seeing as Germany accounted for 18.2% of Yingli's 2013 total revenue, the recent news about falling German installations is especially pertinent.

Trina Solar (NYSE: TSL) is in a very similar situation. In 2013 Europe accounted for 30.8% of its revenue. With Germany providing 10.4% of its sales, the recent German subsidy cuts are a big issue for Trina Solar. Note that Trina's EBIT margin of -2.1% and Yingli's EBIT margin of -7.8% are already depressed, so Europe's falling subsides and depressed growth only add fuel to their fires.

SunPower (SPWR +0.00%) is in a far better position than Trina Solar or Yingli; but Europe, the Middle East, and Africa (EMEA) did contribute 17.3% of SunPower's 2013 non-GAAP revenue. In Q1 2014 EMEA actually grew to comprise 18.5% of its non-GAAP revenue. Even management expects that EMEA may be a drag on future growth. The low-growth case puts EMEA contributing 15% of SunPower's recognized 2014 megawatts.

The exception

First Solar (FSLR +0.34%) only has marginal exposure to Europe's issues. In 2013 Europe only comprised 5% of its net sales. Beyond the shadow of a doubt First Solar's main focus is the Americas. In 2013 the United States provided 86% of its net sales and Canada contributed 8%, together making 94% of First Solar's net sales. Not only is First Solar not exposed to Europe's issues, it also has a healthy EBIT margin of 11.5%.

To grow First Solar needs to expand into new regions, and it is already hard at work in promising areas like Latin America. In 2013 it purchased Solar Chile and its 1.5 GW pipeline.

The bottom line

The situation is not too complex. Europe is suffering from low growth that will impact Trina Solar, Yingli, and SunPower. This is not a huge issue for SunPower, as the company is profitable and Europe comprised a comparatively small portion of its 2013 sales; but nevertheless this is an issue to be aware of. First Solar is in the best position out of the four; Europe comprises a minimal portion of its sales, and First Solar has many growth opportunities outside of Europe.