Source: MGM

After the company posted revenue and earnings results for the first quarter of its 2014 fiscal year on April 29, shares of MGM Resorts (MGM +1.44%) soared 8.5% to close at $24.98. Because of these results and the fact that the business's shares are still trading at a 13% discount to their 52-week high, some investors might be thinking that now is a prime time to jump into the fray. However, is everything as clear-cut as it appears or should the Foolish investor look to Las Vegas Sands (LVS 0.01%) or Melco Crown Entertainment (MPEL +1.20%) for out-sized returns moving forward?

MGM Resorts' stunning quarter

For the quarter, MGM reported revenue of $2.63 billion. Although this represents a slight beat in comparison with the $2.58 billion that analysts had anticipated, it exceeded the $2.35 billion the company reported for the year-ago quarter by 12%.

The company chalked up its strong results to explosive growth in its MGM China segment. Revenue in the segment grew an impressive 26% to $941.4 million from $747.6 million in the first quarter of 2013. This jump in sales at the company's Macau operations mostly stemmed from a significant increase in gambling in the region, which has seen a 20% improvement in gross revenue from January through March.

Domestically, MGM saw a modest 5% increase in revenue from $1.49 billion last year to $1.57 billion this year. This increase stemmed from better performances from key casinos like Mandalay Bay and the Bellagio, but it was negatively affected by the company's MGM Grand Detroit, which saw revenue fall more than 5% from $140.9 million to $133.1 million.

Source: MGM

From a profitability perspective, MGM did even better. For the quarter, the casino operator reported earnings per share of $0.21. In addition to surpassing the year-ago figure by $0.01, this surpassed analysts' expectations by 133%. This partially stemmed from the revenue increase, but a reduction in costs also drove this performance.

In comparison with the year-ago quarter, MGM reported that the costs associated with its rooms fell from 5.4% of sales to 5.1% while its food and beverage expenses declined from 8.7% of sales to 8.4%. Additionally, the company's interest expense decreased by 7% as its debt load fell. This was all complemented by a $3.5 million income tax benefit for the quarter versus the $30.4 million income tax provision the business booked last year.

How does MGM stack up to its peers?

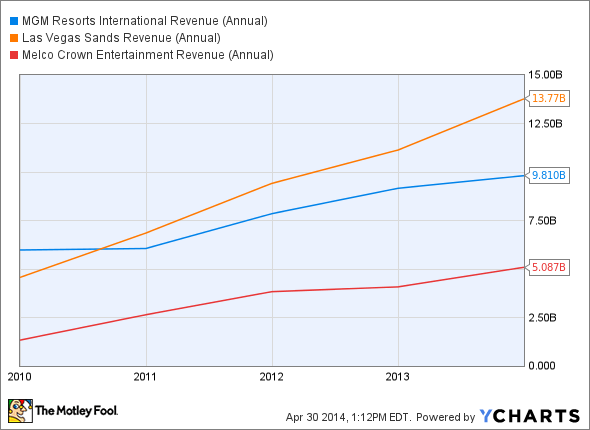

Over the past five years, MGM has been a strong growth story, as evidenced by its rise in revenue. Between 2009 and 2013, the company saw its revenue soar 64% from $5.98 billion to $9.81 billion. The main driver behind the company's larger top line was the acquisition of a larger stake in its MGM China segment and the growth achieved in that region, but its domestic revenue has also risen at a reasonable rate.

While this performance is impressive, it pales in comparison to those of rivals like Las Vegas Sands and Melco Crown. Over the same five-year time-frame, Las Vegas Sands saw its revenue increase 202% from $4.56 billion to $13.77 billion, while Melco Crown's sales leaped 282% from $1.33 billion to $5.09 billion. Both companies have one thing that MGM does not, significant stakes of revenue derived from Macau.

MGM Revenue (Annual) data by YCharts

In 2013, Las Vegas Sands received 65.3% of its sales from casinos operated in Macau, up from 59.1% a year earlier. Melco Crown received a whopping 100% of revenue from the region in both years, but the company is opening its City of Dreams Manila resort in the Philippines this year so its contribution from the region should fall. With Macau seeing tremendous growth, both companies have been able to capitalize on their exposures to the market far better than MGM has, as MGM only saw its contribution from the region rise from 30.7% of sales to 33.8%.

Foolish takeaway

From the revenue and profitability perspectives, MGM reported tremendous improvements in comparison with both last year's numbers and analysts' estimates. Moving forward, the business will likely continue on this trend if its exposure to Macau keeps rising while the region itself improves. This could make for an interesting prospect for the Foolish investor interested in a business that is diversifying its operations. However, investors who are looking for more of a pure play in Southeast Asia might find Melco Crown or Las Vegas Sands to be better prospects.