Source: Wikimedia Commons

Heading into earnings, investors holding shares of J.C. Penney (JCP +0.00%) are probably feeling pretty nervous. Over the past few years, the retailer has been struggling with declining sales and consecutive annual losses, each year worse than the last.

Now, with the company teetering between recovery and financial distress, it's very possible that this upcoming earnings release will give investors some insight into what the future holds for the business. Will this quarter signal a definitive turnaround, or should investors consider looking to Macy's (M 1.61%) or Kohl's (KSS 1.92%) for a brighter future?

Mr. Market seems cautiously optimistic on the retailer

For the quarter, analysts expect J.C. Penney's management team to report revenue of $2.71 billion. If these forecasts are correct, this will signal a modest 3% gain compared to the $2.64 billion the company reported in the same quarter a year earlier and would most likely be due to a rise in comparable-store sales as customers return to the once high-flying retailer.

From a profitability perspective, Mr. Market also hopes to see some improvements compared to what the company reported last year. If the turnaround is going as well as what analysts perceive, J.C. Penney will report a loss of $1.25 per share for the quarter. Admittedly, this is far from ideal, as investors would much rather see a net gain. But even a loss of this magnitude, which would equate to an aggregate loss of $381 million, would be better than the $1.58 per share loss seen during the same quarter last year.

A nice earnings release could be a sign of a definitive turnaround

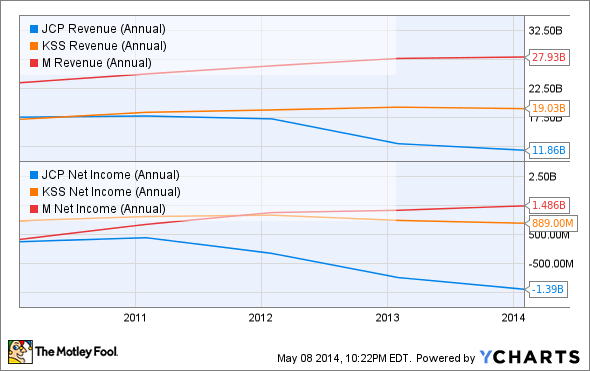

The past five years have not been particularly kind to investors owning a piece of J.C. Penney. Between 2009 and 2013, the company's revenue fell a jaw-dropping 32% from $17.6 billion to $11.9 billion. After a management shakeup, Ron Johnson, the CEO a that time, instituted a series of plans to turn the company from a stagnating business to a thriving enterprise.

Unfortunately, these plans, which included cutting off the company's coupon program and switching up its store format, resulted in a significant customer exodus. This, in turn, caused the company's fall in revenue and turned its net gain of $251 million in 2009 into a net loss of $1.4 billion by the end of its 2013 fiscal year.

Source: J.C. Penney

It was during this time that the board of directors threw Johnson out of the company and reinstated Mike Ullman as the top executive. Under Ullman's leadership, J.C. Penney continued posting losses but began, last October, seeing comparable-store sales rise. Due to Ullman's decision to begin providing coupons and his more interesting choice to continue growing the company's store-within-a-store concept championed by Johnson, the business earned $0.11 in the fourth quarter of its 2013 fiscal year, far better than the $0.82 loss analysts expected.

Are there better long-term picks than J.C. Penney?

If management can turn the company around and begin posting annual net gains and improving revenue metrics, J.C. Penney could end up being an attractive play for the Foolish investor. However, as a turnaround, the business does provide a lot of downside risk, especially when placed next to rivals like Macy's and Kohl's.

Over the past five years, Kohl's has done alright for itself. Between 2009 and 2013, the company saw its sales rise 11% from $17.2 billion to $19 billion. This sales increase was partially due to a 4% aggregate rise in comparable-store sales but was mostly due to a 9% increase in store count from 1,058 in 2009 to 1,158 by year-end 2013.

J.C. Penney revenue (annual) data by YCharts

Even though this is significantly better than J.C. Penney's performance, the company's profitability did suffer as a result. During this five-year period, Kohl's reported a 9% decline in net income from $973 million to $889 million, as higher costs stifled its ability to create value.

Over the past five years, the best performer has been, without a doubt, Macy's. During this time frame, the retailer saw sales climb 19% from $23.5 billion to $27.9 billion. Despite being negatively affected by a 1% drop in store count, Macy's benefited greatly from a 23% rise in comparable-store sales.

In addition to higher sales, Macy's reported a phenomenal growth rate in net income over this period. Between 2009 and 2013, the business saw net income soar 352% from $329 million to $1.5 billion. This was due, in part, to the company's rising sales. But it can also be chalked up to lower costs, primarily in the business' interest expense, which fell from 2.4% of sales to 1.4%, and its selling, general, and administrative expenses, which dropped from 34.3% of sales to 30.2%.

Foolish takeaway

Going into earnings, Mr. Market has higher hopes for J.C. Penney, but its expectations are also cautious given the company's recent performance. If management can meet or surpass sales and earnings estimates, it could be a sign that the company is well on its way back up to the former glory it once had. But any shortfall could harm the already fragile trust of the retailer's shareholders.

For investors who don't believe in the company's ability to achieve a full-fledged turnaround, both Kohl's and Macy's might make for more appealing opportunities. Both have sported revenue growth over the past few years, and Macy's in particular has seen some tremendous bottom-line expansion. This could make either enterprise a more stable and successful long-term prospect than J.C. Penney but would have the downside of smaller returns if their struggling peer does end up making a comeback.