Wynn seems to be a great bet on Macau growth, but not so when compared to the industry as a whole. Photo: NY Times

Shares of Wynn Resorts (WYNN 0.88%) surged over 6% following the company's earnings release, as the company beat estimates on earnings per share thanks to growth from its Macau operations. However, its total revenue growth of 9.7% is not quite so good in comparison with the results from Las Vegas Sands (LVS 0.97%) and MGM Resorts (MGM 1.87%), Wynn's main competitors. Investors should look at how well the industry as a whole did this quarter before they decide to be so happy about these results.

The key facts laid out in the Wynn Resorts earnings report include:

Total revenues up 9.7%

Macau revenues up 14.2%

Las Vegas revenues down 1.5%

Occupancy rates up to over 98% from 93% in the first quarter of 2013

Wynn Resorts' investors should be happy that the company is posting revenue growth of nearly 10% year-over-year. Additionally, the company posted solid revenue from its VIP gaming operations, as concerns about this had sent its stock price down a few weeks ago. Simultaneously, the company was able to increase its mass-market revenue in Macau by over 23% year-over-year, which seems to have helped drive up the company's hotel occupancy rates.

The stock is climbing today as more investors buy Wynn on these good results, but should new Wynn investors feel so excited about this earnings release? Wynn was left behind this quarter by Las Vegas Sands and, to a lesser extent, by MGM Resorts. If you are a new investor looking to get into the gaming industry, this company probably shouldn't be your first buy-in. This table shows what Wynn's "solid earnings" look like in comparison with the industry.

Wynn Resorts vs. Las Vegas Sands and MGM Resorts

|

Wynn Resorts |

MGM Resorts |

Las Vegas Sands | |

|---|---|---|---|

|

Net Revenue |

9.7% Growth YoY |

12% Growth YoY |

21.4% Growth YoY |

|

China Revenue |

14.2% Growth YoY |

33% Growth YoY |

49% Growth YoY |

|

Share Price |

$219 |

$24.33 |

$76 |

|

P/E (TM) |

31 |

63 |

24.4 |

Las Vegas Sands led the field with net first-quarter 2014 revenue of a record $4.01 billion, up over 21% year-over-year. This was led by the company's huge bet on Macau, which paid off with nearly 50% EBITDA growth. MGM Resorts came in at a not-so-close second as it also posted solid results from its China operations, though it posted revenue growth of barely more than half of that of Las Vegas Sands.

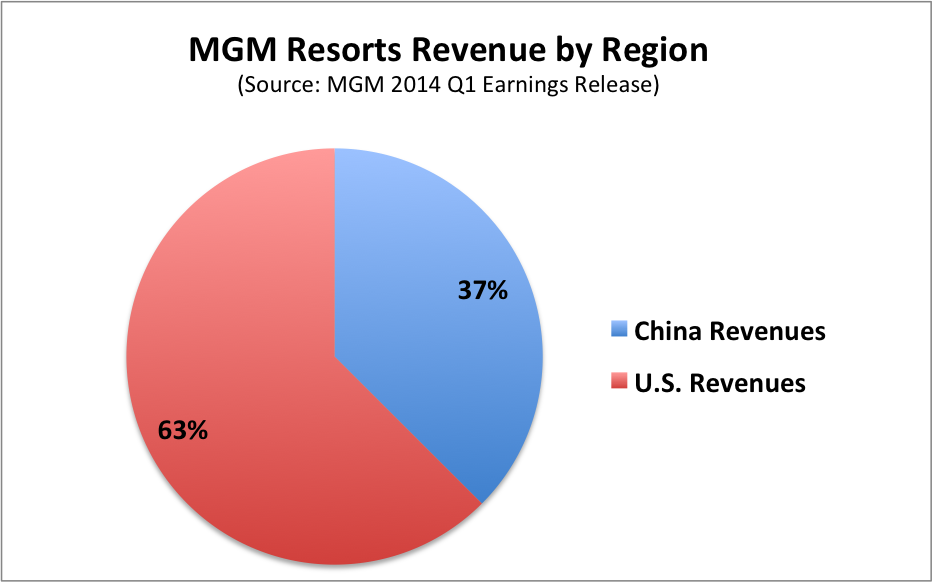

A key reason why Las Vegas Sands has been able to crush this quarter is through revenue growth in Asia. This not only includes Macau, it also includes revenue from the company's operations in Singapore. Because Sands is a front-runner in the bidding to win a casino in Japan, this trend seems like it will only grow. Wynn, by contrast, gets 75% of its revenue from Macau. MGM only gets 37% of its revenue from there, with most of the company's global revenue still coming from Las Vegas and the U.S. Northeast region.

Las Vegas Sands not only beat Wynn Resorts and MGM Resorts on total net revenue and net revenue growth, it remains better at driving mass-market consumer growth as well. Wynn investors are excited about the company's 26.7% growth in VIP table games wins, which surpassed the company's 23.7% growth in mass-market revenue during the first quarter. Yet compare this to Las Vegas Sands' increase of 54% year-over-year in mass table wins and MGM Resorts' mass-market increase of 45% for the quarter. In fact, Wynn is actually driving down the industry-average figure of a 40% mass-market increase, according to analysts at Barrons.

The middle class of China, which makes up most of the mass-market consumer base of gaming companies, continues to boom. According to research by the McKinsey group, by 2022 more than 75% of China's urban consumers will earn between $9,000 and $34,000 a year while 4% of the total Chinese population fell within that range back in 2000. Thus, the mass market has become the focus of the gaming industry. For this reason investors should focus less on Wynn's gains in VIP gaming and worry more about Wynn's potential shortcomings in regard to gaining mass-market growth.

One more reason to believe in Las Vegas Sands over Wynn: The coming casinos on the Cotai strip

Wynn investors are excited about the coming $4 billion Wynn Palace on Cotai with an expected opening date in 2016. The brand new resort will include a 1,700-room hotel-casino, a performance lake which will put the one in Las Vegas to shame, and much more. One major operating highlight of Wynn's first-quarter earnings was that the company raised its hotel room occupancy rate to 98.1% from 93% in the year-ago period. Therefore, the new resort and the added rooms should help provide more space for the company to continue growing.

CEO Steve Wynn introduces the vision for the new resort on the Cotai strip back in 2012. Photo: Reuters

However, once again Las Vegas Sands is making a bigger bet on visit growth. The company's new Cotai resort, the Parasian, is set to open in mid-2015 and it will include over 3000 new rooms. Because Las Vegas Sands has done a better job of recruiting mass-market players to come to its casino, it will need places for those gamers to sleep. This is one more sign that Las Vegas Sands is making bigger bets on the trends that are driving growth in Macau.

Foolish takeaway: Bravo to Wynn on a good quarter, but in comparison with the industry its numbers aren't impressive

With an industry growth rate of 19% in 2013, it would be hard for any casino company to be in Macau without reporting at least some revenue growth. That overall Macau gaming growth has helped Wynn to post nearly 10% total revenue growth despite a decline at its Las Vegas operations. However, in comparison with figures from the industry, especially those of Las Vegas Sands, these earnings are not very inspiring. Investors should look at Wynn's first-quarter earnings with a perspective that considers the results from the industry and Wynn's competitors before making a pick.