Not a fan of the too big to fail banks? It turns out they're only getting bigger. And the reason why will surprise you.

The remarkable growth

Over the last year, the four biggest banks in the United States, Bank of America (BAC 0.47%), Wells Fargo (WFC +0.43%), Citigroup (C +0.12%), and JPMorgan Chase (JPM 0.18%) have seen their total asset size grow by roughly 2.5%. And while that doesn't sound like a lot, consider they've grown by nearly $200 billion. They now have total assets worth more than $8.1 trillion.

Said differently, the growth in size at those four in one year's time would've made the fifteenth largest bank in the U.S.

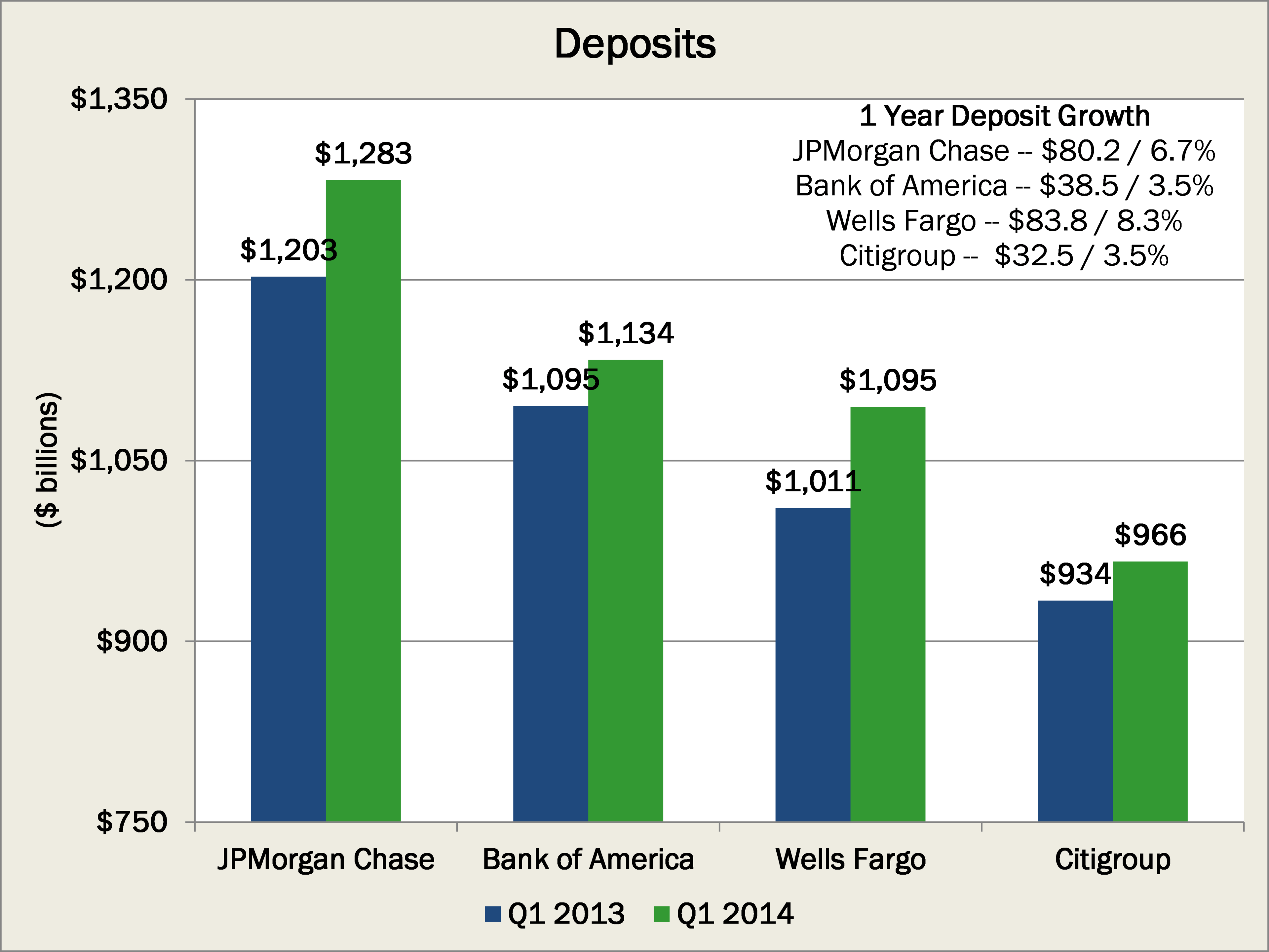

The deposits at the big four have grown by an even more staggering rate, up $235 billion, or 5.5%. JPMorgan Chase and Wells Fargo each added more than $80 billion:

Source: Company Investor Relations.

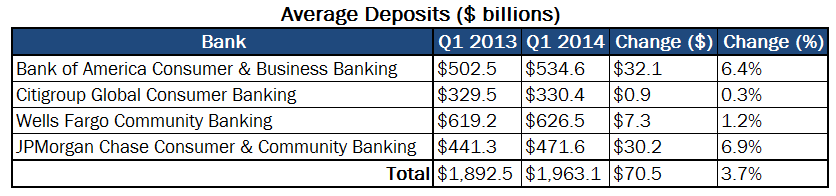

While it's easy to think the increased deposits are from their relationships with the biggest companies, it turns out more than $70 billion of that growth was from their relationships with individuals and small businesses:

Source: Company Investor Relations.

The reason for growth

There are many reasons for this growth at the biggest banks. Yet one fascinating one to consider is the rise of technology, especially on mobile phones.

New things are coming to Wall Street.

The Pew Research Center found in July of last year that 35% of cell phone owners used mobile banking, almost double the 18% in 2011. Bain, a consultancy, suggested one of the five critical things banks must do to build loyalty from consumers was to "accelerate the digital transformation," as mobile banking continued to expand "its mainstream appeal."

In addition, Bain found customers who regularly used mobile banking were likely to rank 14 points higher on a 100 point scale that measures customer loyalty known as "net promoter score" than those who didn't.

So, what does this all have to do with the biggest banks? J.D. Power and Associates noted its retail banking satisfaction study found the six biggest banks improved customer satisfaction by 23 points to 782. While they fell behind the midsized banks (with less than $33 billion in assets), which stood at 796 on the 1,000 point scale, the growth at the midsized banks was just 11 points.

The reason behind the smaller banks falling behind the biggest ones?

"Midsize banks are falling behind in meeting the needs of the fastest growing demographic groups, millennials and minorities, especially in online, mobile and problem resolution," noted the director of banking services at J.D. Power, Jim Miller. "If midsize banks don't change their focus to adjust to demographic shifts, they are extremely vulnerable and risk losing market share to competitors and becoming irrelevant."

When he was asked about the investment the bank made in mobile banking in 2013, Bank of America's CEO Brian Moynihan noted:

We have got a great product and we just -- I think we are at a steady state. We spend just overall, we decide which business, about $3-billion-and-change in annual technology development, just development, and we expect that number to stay constant over time.

Bank of America has seen its mobile accounts grow by nearly 20% over the last year to 15 million. Although smaller in size, Wells Fargo noted its growth in mobile customers was even more impressive at 23% to 12.5 million. And in fact, JPMorgan Chase has led the way with growth to 16.4 million, a gain of 24%, or a staggering 3.1 million individuals.

If Bank of America spent $3 billion, one can only imagine what Wells Fargo and JPMorgan Chase put out.

The future

Much has been made of the shifting dynamics of the American consumer to rely on technology. And it turns out, this change not only benefits big-name technology companies, but in fact the biggest banks as well.