Juniper Networks (JNPR +0.00%) is a network and communication devices company that is involved in the provision of network infrastructure products, software, and related services. It sells its products to wireless and wireline communication service providers like Verizon (VZ +1.67%) and AT&T (T +1.11%). Routers are Juniper's primary product, accounting for around 48% of the total revenue in 2013.The market leader, Cisco (CSCO 1.88%), is the primary competitor of Juniper and has an approximately 65% market share in routing.

Routers, SDN (Software Defined Networking), and NFV (Network Function Virtualization) are expected to grow in the coming years. Juniper is well positioned to capitalize on this growth because of its competitive product offerings, consistent positive financial performance, cost management, and capital structure management strategies. The recently concluded quarter is a testament to these facts and paints a bright picture for the quarters ahead.

Recent financial performance

Juniper posted a strong performance in Q1 2014. It beat consensus revenue estimates for the quarter and matched analyst expectations in terms of EPS. This strong performance reflected the company's competitive products and improved operational management.

Revenue

Juniper posted a revenue of $1.17billion in the first quarter of 2014, which translates to a 10% year-over-year (Y/Y) revenue growth; Wall Street revenue estimate was $1.15 billion. This revenue growth was the result of the company's penetration in data centers through its family of switches. Routing also grew by 7% on a Y/Y basis. The point to note is that Cisco is a major player in this market and Juniper's ability to capture the share from Cisco indicates that it has a competitive line of products.

Net income

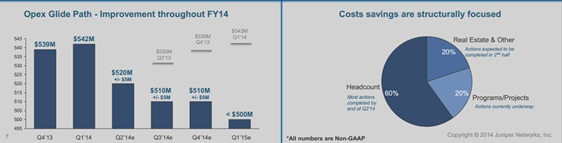

Juniper reported a net income of $142.6 million as compared to $123.8 million posted in the same quarter last year. Net income grew by 15%, which is higher than the growth in revenue. This was because the company managed to reduce its R&D costs by 3% on a Y/Y basis. Note that Juniper is aiming to reduce its OPEX below $500 million by the end of Q1 2015, which will result in improved operating margins, and the higher EPS will be reflected in valuations going forward.

Cash and balance sheet

The company has approximately $2.9 billion in cash and cash equivalents. The current ratio is around 2.6 as compared to the industry average of 2.16. Juniper generated around $977 million operating cash flow in the trailing 12 months. Despite these solid cash flows, lack of a proper dividend plan or share buybacks had raised criticism from activist investors. The company has now announced plans to return around $3 billion to shareholders in the next three years. Around $2 billion will be returned with share buybacks by the end of the first quarter of 2015. Juniper also plans to increase the percentage of debt financing to increase the attractiveness of its stock.

Juniper is also initiating an annualized dividend of $0.40 starting from Q3 2014. Analyzing these dividend payments reveals that the company can sustain, and in fact even grow, its dividends in the years to come.

Overall, the company's financial performance and position is healthy. Competitive products, cost saving strategies, and restructuring appear to be the drivers of this strong performance.

Investment thesis

Following are some of the more significant reasons why Juniper is a good investment option going forward:

- Due to the growth of smartphones and tablets, data consumption is on the rise. The increasing need for data requires networks of increased capacity and efficiency. Juniper is well positioned to grow because the growth of routers, switching, software-defined networking, and network function virtualization is attached to the growth of data, data centers, and network service providers. The carrier router and switch market is expected to grow by 8.8% until 2017. SDN system sales are expected to reach $15.6 billion by 2018 (these sales were just $626 million last year). NFV revenue could rise to $1.9 billion in 2019 as compared to just $203 million at present.

- Cost and capital restructuring efforts will help the stock to rally in 2015. The company is trying to reduce its OPEX to less than $500 million by the first quarter of 2015 and is targeting a 25% operating margin by the same period. Juniper's planned restructuring includes a 6% personnel reduction, consolidation of the Sunnyvale campus and reducing R&D costs.

- The company recently formed a collaboration with GainSpeed to deliver a next generation virtualized converged-cable-access platform (CCAP). Juniper aims to combine its routing and switching capabilities with GainSpeed's technology. This will deliver a virtual CCAP, which will result in a 10x increase in scale and data capacity while reducing the cost of capacity by 67%. These claims indicate that Juniper is making headway in technology and innovation, and this will spur the company's growth in the coming years.

Bottom line

The biggest investor concern with Juniper has always been its lack of a dividend payoff. With a 12% stock growth in the last 5 years this concern was not misplaced. But the recent announcement of a buyback program, and a possibility of dividends, significantly increases the viability of Juniper as a long-term investment. The growth in data consumption and rallies spurred by share buybacks would also help the investor's cause.