For Apple (AAPL +0.29%) the Dr. may soon be in the house.

Multiple news outlets have reported that Apple is in talks to acquire headphone maker and music-streaming service Beats Electronics for $3.2 billion. The acquisition would be the biggest ever for the company that makes the iPhone, iPads, and Mac computers. If the deal goes through Apple would not only be purchasing Beats' popular line of high-end (and high-priced) headphones, it would also be buying the Beats Music service that started earlier this year. Unlike Apple's ad-supported iTunes Radio service (which many see as the company's answer to Pandora (P +0.00%)), Beats Music uses a subscription model charging users $10 a month for unlimited access to songs in the service's catalog through a smartphone, tablet, or Web browser.

Beats was founded by music-industry executive Jimmy Iovine and legendary hip-hop artist/producer Dr. Dre. Beats has sort of gone down this road once before as HTC once held a 50% share of the company, but has since been bought out of its investment, according to GeekWire.

The Beats line of headphones, which appeals to both audiophiles and the style-conscious, would give Apple another high-end line to market through its online and physical retail channels. The subscription-based music service would give the company a hedge against falling sales in its iTunes music store and a way to prepare for a possible future where people stop owning music.

The day of the download may be past

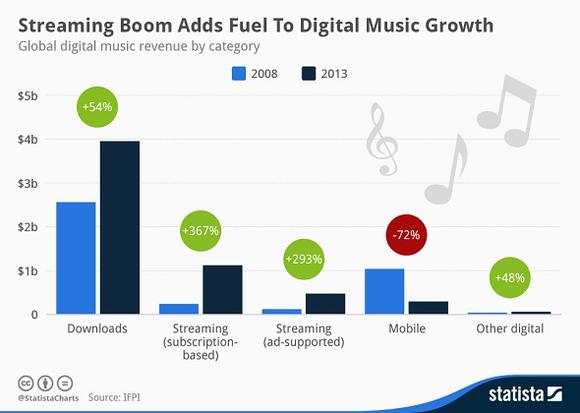

Downloads have been a tremendous source of revenue and continued growth for digital music sales, but signs point to the possibility that sales for downloads have peaked while streaming and subscription-based services have tremendous room for growth.

Global digital music revenues reached an all-time high of $5.9 billion in 2013 as revenues from streaming services, both ad-supported (+17.6%) and subscription-based (+51.3%), saw strong growth that outweighed a slight decline in download sales (-2.1%), according to IFPI, a music business trade association. The chart below shows that over the past five years downloads are up by more than 50% but the 2013 dip suggests the rise of streaming services will eventually supplant the need for most people to actually own music.

The iTunes Store generated $9.3 billion in net sales during 2013, a 24% increase from 2012. Growth in the iTunes Store, "reflects continued growth in the installed base of iOS devices, expanded offerings of iOS apps and related in-App purchases, and expanded offerings of iTunes digital content," according to the company's annual report. Apple does not break out how much of that revenue comes from music sales, but the number is likely huge and the company may see the writing on the wall for downloads.

"They are buying into the future and the future is going to be streaming and subscription," Jon Irwin, the former president of rival music service Rhapsody, told Bloomberg. "Revenue from streaming and subscription is growing. Files and downloads are shrinking. Everyone has to engage in streaming and subscription."

Subscription services were something former Apple CEO Steve Jobs was long resistant to pursue, but current CEO Tim Cook seems more than open to the idea. Buying Beats gives Apple a ready-made platform that should let it compete with Spotify, the current subscription leader.

The devices are good too

Apple makes high-end products that it charges a premium for. It also makes stylish computers and devices that are almost as much fashion accessory as they are tech items. The Beats headphones -- which retail for between $170 and $450 -- were designed with exactly the same logic. In many ways the Beats line feels like an Apple product already and Apple already sells the line in its online and retail stores.

Adding Beats to the Apple family of products should be a natural fit and it opens up opportunities for the company. Imagine Beats-branded headphones paired with a special edition iPhone or Beats-designed earbuds. This is new territory for Apple, which usually buys smaller companies, shuts down their products, and integrates some technology into existing (or new) Apple devices. With Beats, Apple will be buying a successful product that it should be able to market alongside its own offerings while expanding sales through its stores.

This deal just makes sense

But the purchase isn't just about headphones and a music service. Apple is also buying some street cred. Apple has a reputation as a pretty hip company but adding the cache that comes with being in business with Iovine and Dr. Dre makes Apple cooler. Apple is geek hip now (and geeks are in at the moment), but Iovine brings music exec hip, and Dre is on the hip hop Mount Rushmore and he has crossed over to a mainstream audience while retaining his rap credibility.

Apple (or any company) faces an uphill battle competing for paying subscribers with a music service, but it needs to be in that space. Apple should be able to exponentially increase sales of Beats products by optimizing and integrating the line for its devices. It should also be able to increase sales of the already-successful headphones by featuring them more prominently in its stores. Overall, this acquisition -- should it occur -- makes sense for Apple and it's hard to see a downside.