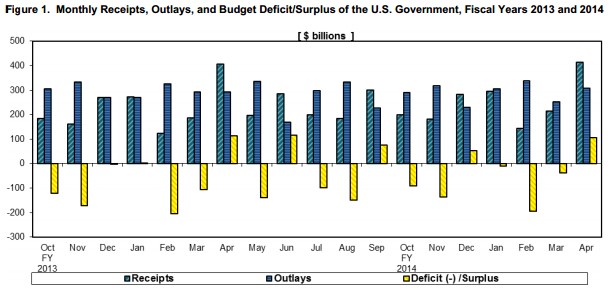

Less spending and more taxes are paying off for the U.S. government. The Treasury Department announced a surplus of $106.9 billion for April, according to a report released today, down slightly from last April's $112.9 billion surplus. The government typically runs a surplus during April, when individual tax returns are due and corporations make quarterly tax payments.

After March had clocked in at a $36.9 billion deficit, tax time helped this latest report soar into surplus territory. Analysts had expected as much, and their $114 billion surplus estimate proved to be slightly higher than actual numbers.

Overall April receipts (inflow) totaled $414 billion, while total outlays clocked in at $307 billion. The country is still running an overall deficit for the fiscal year.

The year-to-date numbers show some upside. For fiscal 2014, which began Oct. 1, 2013, the Treasury's deficit comes in at just $306 billion, a 37% improvement over the same period for the 2013 financial year.

On the receipts side, individual income taxes are up around $28 billion from the prior-year period to $823 billion fiscal-year-to-date, while corporate income taxes have increased just over $20 billion from the prior-year period to hit $157 billion fiscal-year-to-date.

On the expenditure end, a tapered defense spending budget (down $20 billion to $341 billion fiscal-year-to-date), as well as lower interest expenses, helped keep more money in the government's piggy bank.

The CBO released a report last month stating that if current laws stay the course, the budget deficit in fiscal year 2014 would be $492 billion. At an estimated 2.8% of gross domestic product (GDP) that would be nearly a third less than the $680 billion shortfall in fiscal year 2013, which was equal to 4.1% of GDP, said the CBO

-- Material from The Associated Press was used in this report.