Yesterday Warren Buffett revealed a stake in Verizon (VZ +0.39%) that is pushing the stock higher today as the Dow Jones Industrial Average (^DJI +0.47%) treads water. As of 1:30 p.m. EDT the Dow was down 16 points to 16,431. The S&P 500 (^GSPC +0.64%) was at breakeven.

On a slow day for the Dow Jones, the big news is that Warren Buffett's Berkshire Hathaway (NYSE: BRK-A) took a stake in Dow component Verizon. Berkshire revealed in its 13-F that it had bought 11 million shares of Verizon, worth just over $500 million. Additionally, Berkshire added 17% to its stake in fellow Dow stock Wal-Mart, buying 8.6 million shares to bring Berkshire's total holding to 58 million, or 1.8% of Wal-Mart.

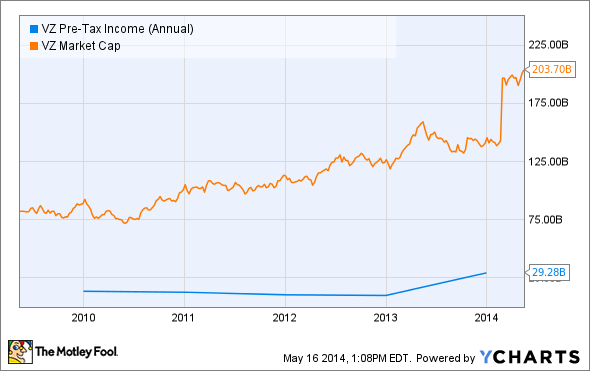

Verizon is up 2.3% on the day. Over the years Buffett has had a strategy of buying companies with large moats at fair prices and holding them forever. This strategy was encompassed in one of his most famous quotes: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." Studies have shown that Buffett's definition of a "fair price" is generally 10 times pretax earnings. The purchase of Verizon fits that bill perfectly.

Verizon's moat comes from three main places. First, Verizon has large holdings of spectrum, without which no competitor can arise. Second, there are large switching costs for consumers in the mobile space, particularly because of Verizon's history of requiring two-year contracts. Third, Verizon is part of an oligopoly that controls the U.S. mobile market -- AT&T, T-Mobile, and Sprint are the only companies that can be considered competitors. The biggest risk to the oligopoly is increased regulation or a price war among telecoms, which could well be sparked by T-Mobile or Sprint. Sprint in particular is now backed by Softbank, and its billionaire president Masayoshi Son has promised to start a "massive price war" if allowed to merge with T-Mobile. Price wars are detrimental to the entire industry, so the odds are small but present.

Fair price

Verizon also meets Buffett's definition of fair price now that it controls all of Verizon Wireless, having bought out Vodafone's stake in the former joint venture.

VZ Pre-Tax Income (Annual) data by YCharts.

With a market cap of $203 billion, Verizon's stock currently trades at seven times pretax earnings, so if history is any guide, we can expect to see Buffett purchasing shares again in the future.