With increased competition, some investors are worried that the "cut-throat grocery business" has finally caught up to Whole Foods Market (WFM +0.00%). Meanwhile, the businesses that stock Whole Food's shelves, WhiteWave Foods (WWAV +0.00%) and Hain Celestial (HAIN +6.69%), just reported stellar earnings. This all has some investors wondering if a paradigm shift in "healthy" stock picking is under way.

Is the organic grocery sector becoming too tight?

Image of the first Whole Foods Market courtesy of Whole Foods Market

Earnings recap

All of this "healthy" discussion about Whole Foods business has been sparked by earnings developments; both at Whole Foods, and other leaders in the health food movement. WhiteWave, the Silk soy milk maker, grew revenue 36% over the same quarter last year, and earnings soared 40%. Meanwhile Hain saw healthy growth as well, with third quarter sales and earnings rising by 22% over the same quarter in 13'. Both of these food manufacturers exceeded the markets expectations, and provided strong guidance, and the market rewarded them.

Meanwhile, Whole Foods sales looked decent on the surface, revenues grew 9.7% and same-store sales grew 4.5%, but profits were flat. Then Whole Foods delivered a terrible trio to investors: it missed analysts expectations for the quarter, it noted increased competition on its earnings call, and it tempered its full year guidance. With major national retailers making "splashy" news by jumping into the organic game, the lowered guidance and competition worries are the last thing the market wanted to hear.

Examining the bear case for Whole Foods

This earnings report was not the reason Whole Foods sank. It sank because investors viewed the earnings report (and lowered guidance) as confirmation of fears they already had. The stock fell 20% after poor earnings, but the stock has been halved from its 52 week high.

The stock market looks forward, and sometimes lowered guidance can hit panicky investors at the worst time. Clearly Whole Foods is facing some new competition, but nothing about its earnings report should leave us so worried that it won't continue to lead.

The organic market makes up a small percentage of grocery sales, and revenues are expected to grow in excess of 13% annually for the next decade, which is a wonderful recipe for growth, so why are Whole Foods investors surprised that other companies are jumping on this trend? Further, competition worries are not new for Whole Foods, and the bear thesis for this stock has been the same since it went public. I came across this article posted in a Stock Advisor (proud member here) discussion board, by Daniel Joshua Rubin, that explains my point perfectly. If you read the article it highlights all of the bear worries for Whole Foods (margin pressures, increased competition, etc.); yet the article was written way back in 2006.

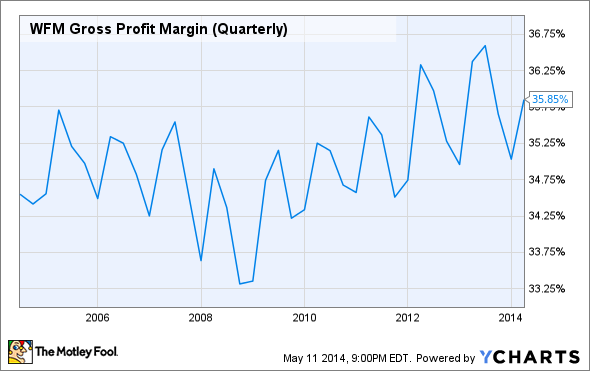

When you step away from the noise, the hype, and the headlines, it's clear that Whole Foods' profit margin is actually pretty stable. It may not go up in a straight line, but they've weathered some epic storms.

WFM Gross Profit Margin (Quarterly) data by YCharts

Buying Whole Foods requires a leap of faith

Even today, Whole Foods is priced as a growth stock. It trades at a similar forward P/E (25-30) as both WhiteWave, and Hain; they're all priced for growth. You may wonder why anyone would pick a grocery store over a packaged food company. After all, don't WhiteWave and Hain benefit from the boom in healthy eating, regardless of where customer's shop? The answer is complicated.

WFM P/E Ratio (Forward) data by YCharts

While it may sound like any grocery store is a bad investment, the primary reason (fierce competition) is the same for most food companies. That's why brand identity and quality matter so much in all food businesses, restaurants, packaged food companies, and even grocery stores. All three companies face tremendous competition; when you go to a grocery store there are literally hundreds of packaged food options vying for your dollar. WhiteWave and Hain are winning because their products are the first names you think of in their space; they have wonderful brand identity. For example, the name Silk, to me, is nearly synonymous with almond or soy milk. Isn't that the same for Whole Foods and organic grocery?

It takes a leap of faith to invest in Whole Foods, because the future is unclear right now. For me, it's a leap worth taking, because I believe that, in a competitive business, brand identity wins. I feel organic shoppers, on average, seek out their food choices. I don't feel like this crowd wants to shop at a discount retailer; I also don't feel the discount retail crowd wants to buy pricier organic food. I believe every company serves a purpose, and Whole Foods fits with the organic crowd. As long as Whole Foods can stay at the forefront of our minds when its comes to organics, and same-store sales suggests they can, I'm willing to bet they'll ride out this margin pressure storm.