Intel (INTC 5.63%) recently posted a media alert on its website to say that it's planning to host a series of keynotes and events at this year's Computex trade show. Last year at Computex, Intel launched its Haswell processor, which brought some pretty stunning performance-per-watt gains to notebook and Ultrabook computers. This year, Intel needs to make an even bigger splash and show some progress where it counts -- in tablets and smartphones, where incumbents Qualcomm (QCOM 0.83%) and MediaTek rule.

Give us an update on the future

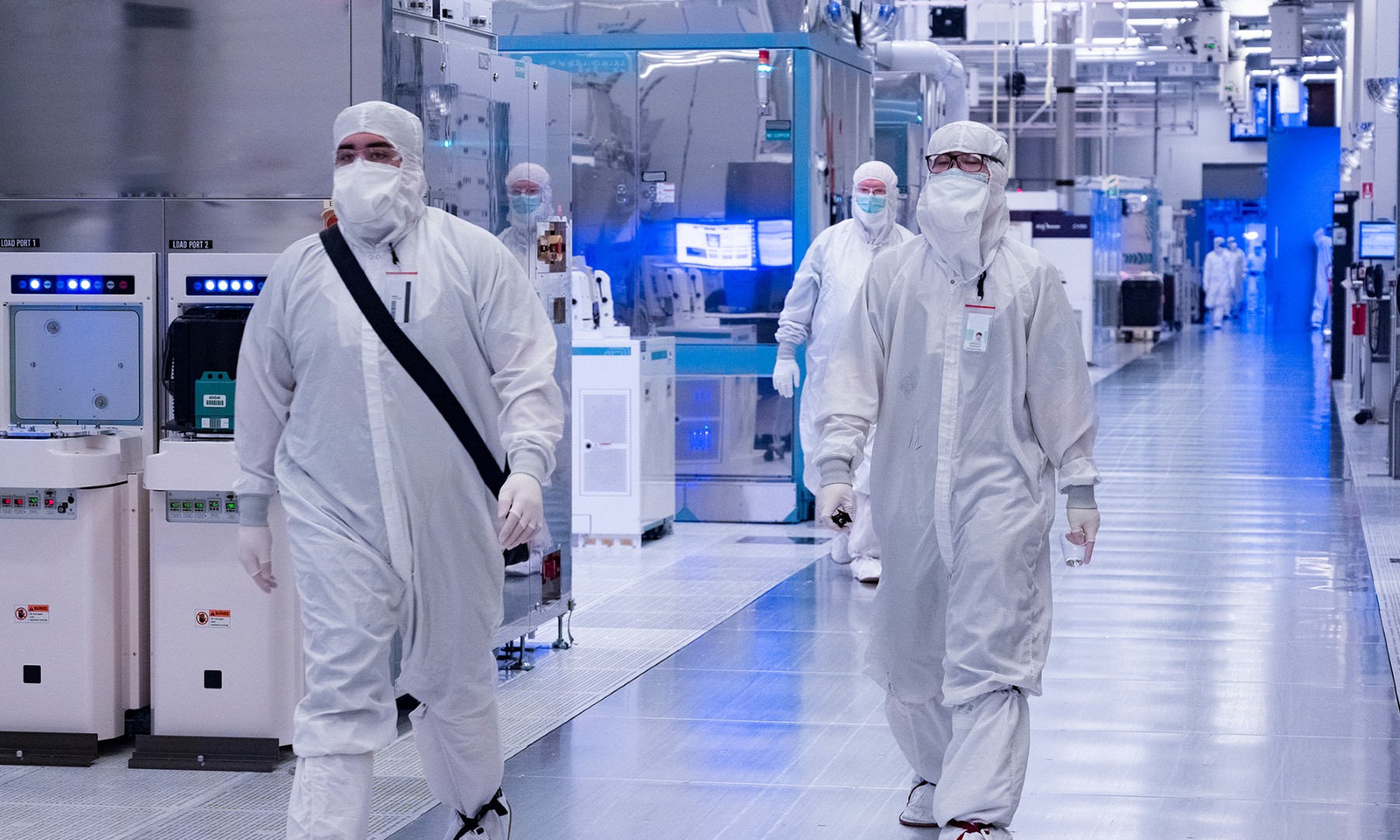

In the PC space, Intel is the undisputed, unequivocal leader in terms of performance, power, and -- the ultimate metric -- sales. It can afford to keep whatever neat innovations it has for next year's products tightly under wraps until the time comes to launch those new products. After all, with products that generate a whopping $33 billion a year in the PC space, there's no need for Intel to tell us why the products it's trying to sell today are going to be rendered obsolete tomorrow.

However, when it comes to the mobile side of things, Intel has within a rounding error of 0% smartphone applications processor share and still pretty negligible tablet market share (although this grows over the year). This means that investors seeing their company lose about $1 billion a quarter on its investments in mobile have a right to know what's coming down the pipe and why they should be confident that these investments will actually pay off in the long run.

Intel needs to address smartphones

Intel has spent a lot of time talking about tablets, but understand that Intel is at an operating expense run rate of about $3.7 billion in mobile. The entire tablet chip market was under $4 billion last year, according to Strategy Analytics, so even at 50% gross margin, Intel needs about $7.4 billion a year worth of business. Even if Intel had 100% of all tablet silicon share, it wouldn't get Intel's mobile group to breakeven. The only way Intel will become profitable is through real share gains in smartphones.

Right now, Intel's smartphone story is a bit of a mess. The company recently announced its Merrifield smartphone platform, but in the three months since it's been "shipping," not a single OEM partner has announced a design with it. The higher-end sister product to Merrifield, known as Moorefield, looks much more potent, but that product, too, doesn't have any announced smartphone design wins. This is a red flag that Intel will hopefully address at Computex with designs from numerous partners.

Tell us about Broxton

Intel has promised that its 2015 product, known as Broxton, will be a "lights-out great product" (per Intel CFO Stacy Smith) and that it's working to "nail it exactly to what the market wants" (per Intel Mobile GM Hermann Eul). If this is a mid-2015 product, the specifications are set in stone and Intel should now be in the final, post-silicon debug stage of the development of this product.

At this point, Intel is probably trying to shop this platform for 2015 smartphones -- coming later to market than Qualcomm's Snapdragon 808/810, but it should be in the running for H2 2015 or H1 2016 smartphones. What Intel really should do if it wants to bolster investor confidence is to give investors a look at this chip's specifications so that the investment community can properly analyze its competitive position relative to what Qualcomm (which continues to grow its presence across the entire smartphone market) and MediaTek have signaled will be coming down the pipe during that timeframe.

If Broxton is a truly leadership product, then we can be reasonably confident that Intel will win some nice designs and narrow that mobile operating loss. If it turns out to be another "too little, too late" effort (and from the specifications, we will know), then investors will be able to properly temper expectations for smartphone traction during 2015.

Foolish bottom line

After Computex, the next big "event" that Intel can use to really inform investors' long-term decisions will be the Intel Developer Forum in September, so it's really important that the company gives investors plenty to chew on here. It won't be the end of the world if Intel doesn't update us on these products, but it'd go a long way toward restoring investor confidence in the company's long-term prospects.