Having Apple (AAPL 0.16%) as a competitor is scary.

Recent rumors suggest Apple is likely to move into the world of payments. This potential move should scare some companies, but Bank of America (BAC 0.37%) shouldn't bat an eye.

Source: FLickr / Jun Seita.

The move into mobile

CEO Tim Cook recently noted Apple has now 800 million registered iTunes users, almost all of whom have stored credit cards.

Cook went on to say, "the mobile payments area in general is one that we've been intrigued with, and that was one of the thoughts behind Touch ID... I don't have anything specific to announce today, but...it's a big opportunity on the platform."

Despite Apple's enormous user base, if you think Apple is prepping to take down Bank of America and the other major banks, you're wrong.

The reality

Apple has been rumored to dive into the payments industry, not the banking industry. While it's easy to think those two are synonymous with one another -- after all we make payments with the cards issued by banks -- it's vital to understand the differences.

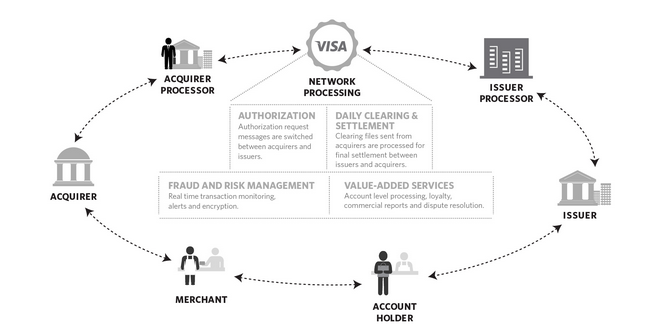

Although the swipe of a card is simple and easy, the payments industry encompasses a variety of moving parts, pieces, firms and industries. A quick glance at a chart from Visa in its latest annual report shows just how complex it is:

Source: Company Investor Relations.

Bank of America has a joint venture with First Data called Bank of America Merchant Services, which is an acquirer -- a unit that has relationships with merchants and stores to ensure the payments they receive are processed -- but this is a remarkably small part of its business.

Why Bank of America isn't worried

The merchant services business at Bank of America processed $625 billion worth of transactions last year. However "merchant services," can only be found four times in its annual report.

This is still a bank, and the majority of its revenue is still generated from loans and securities. Last year, net interest income stood at $43 billion.

It also earns money from its investment banking operations and other operations which charge fees, known as noninterest income, and it had $47 billion worth of that last year.

All of this is to say, while Bank of America is involved in payments, it is by no means a principal source of its income.

Who should be scared

While it may not be a threat to Bank of America, Apple's possible entrance into the payment landscape should terrify PayPal, a unit of eBay.

PayPal has had impressive growth. It has 148 million registered users -- a 35% increase since 2012 -- and its total payment volume recently sat at $52 billion.

148 million users is nothing to sneeze at, but it pales in comparison to Apple's 800 million users. Apple could build its own PayPal-like platform and easily plug its users into it via its numerous platforms and hardware devices.

If Apple was able to create a better user experience (something it is has continuously done in the past) customer loyalty to PayPal could fade. Apple also has the financial strength with its nearly $160 billion in cash to invest in its platform and not be pressured to turn a quick profit from any new business segments.

How it all ties together

While Apple is poised to expand into the payments industry, and could be a threat to PayPal, it isn't moving into the banking industry and challenging the big banks.

Bank of America and the other major banks are surely keeping an eye on what Apple is doing, but for the time being, it isn't something that threatens their business, even though many likely wish it would.