NICE Systems (NICE 1.40%) delivered a set of first-quarter results that were anything but nice, and the stock fell nearly 10% on the day of the results. The company specializes in offering hardware and software that captures and analyzes customer interactions across a number of platforms. For these reasons, it's often seen as a big-data play. Fools may be asking what the disappointing results mean for NICE, for rivals like Verint Systems (VRNT +0.00%), and for companies looking to expand its data analytics offerings, like IBM (IBM 0.02%)?

NICE Systems soft first quarter

A quick roundup of the results reveals that revenue and EPS came in below the bottom end of its guidance. In addition, its full-year guidance was reduced.

- First-quarter revenue of $228.6 million vs. guidance of $230 million-$240 million

- First-quarter non-GAAP EPS of $0.57 vs. guidance of $0.58-$0.63

- Full-year revenue guidance reduced to $995 million-$1.025 billion from $1.01 billion-$1.035 billion

- Full-year non-GAAP EPS guidance reduced to $2.68-$2.80 from $2.73-$2.85

- Second-quarter guidance of $230 million-$240 million in revenue, and non-GAAP EP of $0.55-$0.62

It was anything but a nice quarter, and the report doesn't auger well for Verint or IBM. It matters to IBM because the company is a partner of NICE in offering big-data analytics solutions, and, as Fools already know, IBM is depending on growth in areas like business analytics to counter slow growth elsewhere in its product portfolio. In fact, earlier this year, IBM announced a $1 billion investment in creating a business unit for Watson, its supercomputer system that delivers data analytics via the cloud.

More of a NICE Systems issue than an industry problem

While it's never good news to see a leading company in an industry reducing full-year guidance, there are three key reasons that suggest this is more of a company-specific issue.

First, the quarter marked the CEO transition, and its new leader, Barak Eilam, outlined his view that "what we saw in Q1 is mainly the result of the transition of a CEO which is a natural." He then announced he was taking "a more cautious approach" on guidance.

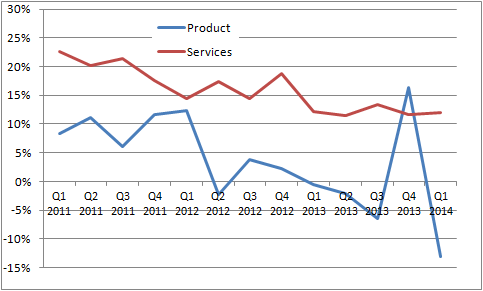

Unfortunately, it's not entirely clear what he meant by a "natural" transition, but NICE wouldn't be the first company to see a new CEO take a more cautionary approach to guidance – it certainly helps a new guy to be able to beat expectations. Furthermore, it's reasonable to speculate that there may have been a pull-forward effect in the fourth quarter. The difficulty in the quarter seems to be related to product revenue -- 34.6% of total revenue -- which declined 13%. Service revenue, which makes up 65.4% of total revenue, came in 12% ahead. Indeed, the possible pull-forward effect can be seen in this chart of product revenue growth.

Source: NICE Systems Presentations

In fact, if you add the total revenue figures for the fourth quarter of 2013 and the first quarter of 2014, it reveals growth of 7.5% compared to the same period last year -- a figure notably higher than the analyst forecast of 5.9% revenue growth for 2013.

Second, NICE's management is arguing that its business is becoming more seasonal, with a stronger weighting toward the second half, and its fourth quarter being seen as being particularly strong. To a certain extent, this helps explain the chart above. However, it's also worth pointing out that full-year guidance was reduced nonetheless.

Third, the main weakness in the quarter came from its security solutions, down 11% to $47million, while customer interactions grew 1% to $139 million. Financial crime and compliance revenue increased 24% to $43 million. Security solutions are notoriously lumpy in the industry, and a security-focused company like Verint Systems tends to have earnings that are hard to predict.

The bottom line

Fools invested in Verint Systems and IBM can probably sleep soundly. It's disappointing that NICE Systems reduced estimates, but its issues seem to be company-specific and don't speak to wider weakness in the industry. Furthermore, don't be surprised if it beats its lowered expectations going forward. The big-data analytics industry isn't showing many signs of slowing down.