Stocks fell sharply on Tuesday, as poor performance on the earnings front from the retail industry weighed on investor confidence. Given the role that consumers have played in the overall economic recovery, any signs of fatigue on their part could suggest a coming turning point in the five-year-old bull market. Despite losses for major-market benchmarks of around three-quarters of a percent, Dendreon (NASDAQ: DNDN), E-House (China) Holdings (NYSE: EJ), and Red Robin Gourmet Burgers (RRGB +0.75%) managed to climb substantially today.

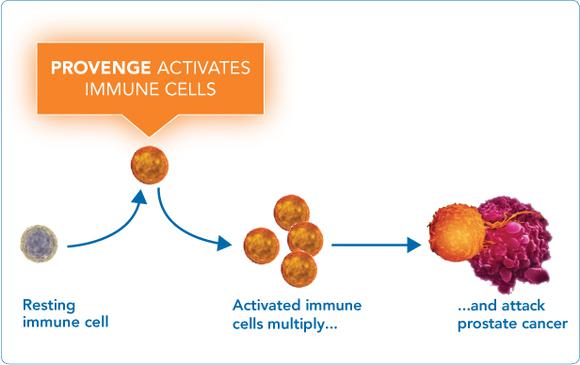

Source: Dendreon.

Well-known biotech Dendreon climbed nearly 8% after issuing new data on its top drug, prostate-cancer treatment Provenge. The data supported further gains in survival from using Provenge, but more importantly from an investor's standpoint, it once again put Dendreon on the radar screen for speculative traders bidding up share prices. From a long-range perspective, though, today's news does little to solve Dendreon's biggest problem: convincing doctors that the expensive treatment is markedly superior to other forms of treatment. Until Dendreon finds a solution to that issue and thereby boosts sales of the key drug, it'll be hard for the stock to hold onto any share-price advance for very long.

E-House (China) Holdings gained 13% after reporting first-quarter earnings. The Chinese real-estate company gave investors exactly what they wanted to see this morning, with earnings per share that doubled what shareholders had expected to see on a 40% jump in total revenue. In particular, E-House's online services experienced amazing growth, with sales nearly doubling from year-ago levels, and better than 50% growth in real-estate information and consulting services also bolstered the company's bottom line. E-House remains optimistic for the current year as well. Even though economists remain concerned about potential bubble conditions in the Chinese real-estate market, the services that E-House provides could actually hold up reasonably well even in an orderly decline in that market, as long as panic doesn't dry up the appetite for real estate entirely.

Source: Red Robin Gourmet Burgers.

Casual restaurant chain Red Robin jumped 12% after topping earnings-per-share estimates by a dime in the first quarter. Same-store sales jumped 5.4%, with net income rising 26% on an 11% gain in overall revenue. Higher average prices provided the biggest part of Red Robin's gains, with only a slight increase in traffic helping the restaurant's numbers as well. Red Robin says that comps could fall toward low single-digit percentages for the full year, but it expects to open new restaurants and remodel existing locations. With initiatives like its Finest premium burger line paying off, Red Robin is aiming higher for the future.