Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Russian payment processor Qiwi PLC (QIWI +0.00%) climbed 15% today after its quarterly results and outlook impressed Wall Street.

So what: The stock had pulled back sharply in 2014 on concerns about slowing growth, but today's Q1 results -- adjusted net income spiked 72% on a top-line jump of 46% -- coupled with upbeat guidance are quickly easing those worries. In fact, total payment volume increased 20% during the quarter, while operating margin expanded 930 basis points, to 56.9%, suggesting that Qiwi's competitive position and efficiency are rapidly improving.

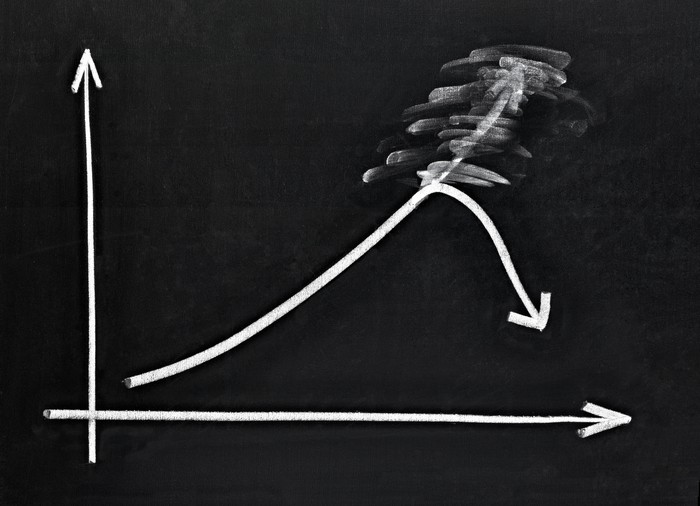

Now what: Management now expects full-year adjusted profit growth of 27%-29% on a revenue increase of 25%-27%, up from its prior view of 25%-27% and 20%-22%, respectively. "Our strong financial performance demonstrates that we continue to execute and gain share in the fast-growing payments markets we serve," said CEO Sergey Solonin. "Looking forward, we will continue to focus on our core strategies of expanding the number of participants in our network, increasing the utilization of our services, and driving the adoption of Visa QIWI Wallet." Of course, with Qiwi shares now up about 180% over their 52-week lows, and trading at a forward P/E above 20, much of that growth potential might already be baked into the valuation.