Great operational performance doesn't necessarily mean a stock is a great investment. Sometimes, all it takes is a cheaply rated company to deliver slightly better-than-expected results in order to deliver good returns to shareholders. Such considerations spring to mind when considering Cisco Systems' (CSCO 0.08%) latest third-quarter results. They weren't great, especially when compared with a rival like Juniper Networks (JNPR +0.00%) in its core switching and routing businesses, but they were enough. So, what are the chances that Cisco can do it again?

Cisco beats its own guidance

At the time of its second-quarter results, there was a sense that the stock could go higher just beating its weak guidance. In fact, Cisco's management had forecast a 6%-8% revenue decline for the third quarter, only to deliver a 5.5% decline. While a mid-single-digit revenue decline is nothing to write home about, there were some positive signs indicating that Cisco can get back to growth.

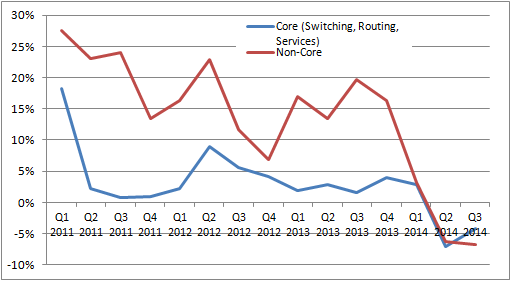

Total orders grew by 1%, and the book-to-bill ratio was "comfortably above one." Both metrics are an indication of future growth, but they are also a reflection of how bad Cisco's operational performance has been. The following revenue growth chart helps to demonstrate some of the underlying themes.

Source: Cisco Presentations, author's analysis

Cisco's core and non-core growth

Core growth comprises its switching, routing, and services revenue. Together, they made up 70% of Cisco's revenue in the third quarter. Essentially, Cisco is going through product transitions in its switching and routing product lines, and they suffered revenue declines of 6% and 9.6% respectively in the quarter.

The weakness in routing lies in stark contrast with the last earnings report from Juniper Networks, which saw Cisco's rival increase its routing product revenue by 7%. Juniper Networks' management also declared itself "very pleased" with its switching performance (up 46% in terms of product revenue) in the quarter. In other words. Cisco's weakness really does appear to be a company specific issue, because Juniper is doing well.

Unfortunately, based on comments by CEO John Chambers on the conference call, Fools shouldn't expect things to turn around soon for Cisco.

On switching, he said, "As a result of these transitions, it will be several more quarters before we see growth in overall switching." A similarly upbeat, but cautious, tone was taken on routing: "While we saw momentum, actually good momentum in high-end routing orders ... it is still early in the transition, as revenue lags orders by a quarter or so."

Moreover, service revenue growth, which is largely dictated by previous product sales, has now slowed to just 2.6%.

Much depends on a successful product transition in switching and routing, but there is also a significant amount of uncertainty with its non-core products.

Cisco's non-core assets are a combination of its service provider video, collaboration, data center, wireless, and security product lines. The negative growth in its two largest non-core segments is a cause for concern.

| Non-Core Category | Growth | Share of Total Revenue |

| Service Provider Video | (26%) | 8% |

| Collaboration | (12%) | 8% |

| Data Center | 29% | 6% |

| Wireless | 3% | 5% |

| Security | 10% | 3% |

Source: Cisco Presentations

There are some positive signs in collaboration. Orders were up 4%, indicating future growth. But service provider video "will take multiple quarters to return to growth," according to Chambers. Service provider video is struggling as, yet again, Cisco is undergoing a product transition in shifting sales of its set-top boxes toward cloud-enabled ones.

Emerging-market weakness, service provider bottoming?

In addition, its emerging-market difficulties appear to be getting worse, with emerging-market orders down 7%, and orders from the BRICs and Mexico down 13%. In fact, only the Americas region -- orders up 3% -- contributed positively to the 1% total order growth, and Cisco is becoming increasingly reliant on U.S. commercial and enterprise orders -- up 7% and 10%, respectively -- in order to generate growth.

Its overall service provider revenue remains weak, with a 5% order decline in the quarter. However, this follows the previous two quarters, where service provider orders declined 13% and 12%, respectively. Perhaps orders from these traditional Cisco customers are set to improve? In addition, service provider revenue has been hit by the production transition in service provider video revenue discussed above.

In fact, a quick look at Juniper Network's service provider revenue reveals 10% year-on-year growth--anther sign that Cisco's problems are largely its own.

Where next for Cisco Systems?

All told, this wasn't a great report from Cisco. Weakness remains in emerging markets and service providers, and there is still an amount of uncertainty over its product transition in switching and routing. Companies like Juniper Networks are reporting strength in areas where Cisco is weak. Also, it can't rely on service revenue growth, because it's largely dependent on product growth. In addition, its acquisition history is questionable, as evidenced by the decline in its non-core revenues. Cisco has made a significant number of acquisitions in these businesses.

In short, there isn't a lot to love about the company, but it may not matter. Cisco currently trades on a forward P/E ratio of 11.3 times estimated July 2015 earnings. If it hits the 2015 estimate of $2.15 in EPS, then its product transitions will have taken place successfully and the stock will start to look extremely cheap. It's worth a look for value investors, but cautious investors might want to wait for signs of success with its core switching and routing revenues.