Warren Buffett and Berkshire Hathaway (NYSE: BRK-A) (NYSE: BRK-B) own shares of Wells Fargo (WFC +0.14%) for multiple reasons. Profitable and prudent management are definitely two of those reasons, but a third may be more interesting: Its brand.

Most valuable bank

Wells Fargo is the smallest of the Big Four banks (Bank of America (BAC +0.84%), Citigroup, and JPMorgan Chase) based on its asset size, and it would have to grow by nearly 40% (or a staggering $600 billion) to equal Bank of America:

|

Bank |

Size ($ trillions) |

Size Relative to Wells Fargo |

|---|---|---|

|

JPMorgan Chase |

$2.477 |

160% |

|

Bank of America |

$2.150 |

139% |

|

Citigroup |

$1.895 |

123% |

|

Wells Fargo |

$1.547 |

100% |

Source: Company Investor Relations.

Yet what is often lost is that when it comes to the market capitalization -- the total value of its shares -- the chart flips, as Wells Fargo is much bigger than its four peers:

|

Bank |

Market Capitalization ($ billions) |

Size Relative to Wells Fargo |

|---|---|---|

|

Wells Fargo |

$264.2 |

100% |

|

JPMorgan Chase |

$206.4 |

78% |

|

Bank of America |

$154.8 |

59% |

|

Citigroup |

$143.7 |

54% |

Source: Google Finance.

And while Wells Fargo would have to grow its balance sheet by 40% to match Bank of America, it turns out Bank of America would need to watch its stock price rise by 70% to overtake Wells Fargo in terms of total value.

Of course, Wells Fargo topping the Big Four should come as no surprise, as it's well known it has a premium valuation thanks to its impressive ability to effectively and profitably generate returns. But it turns out there's one more way it beats the Big Four.

Most valuable brand

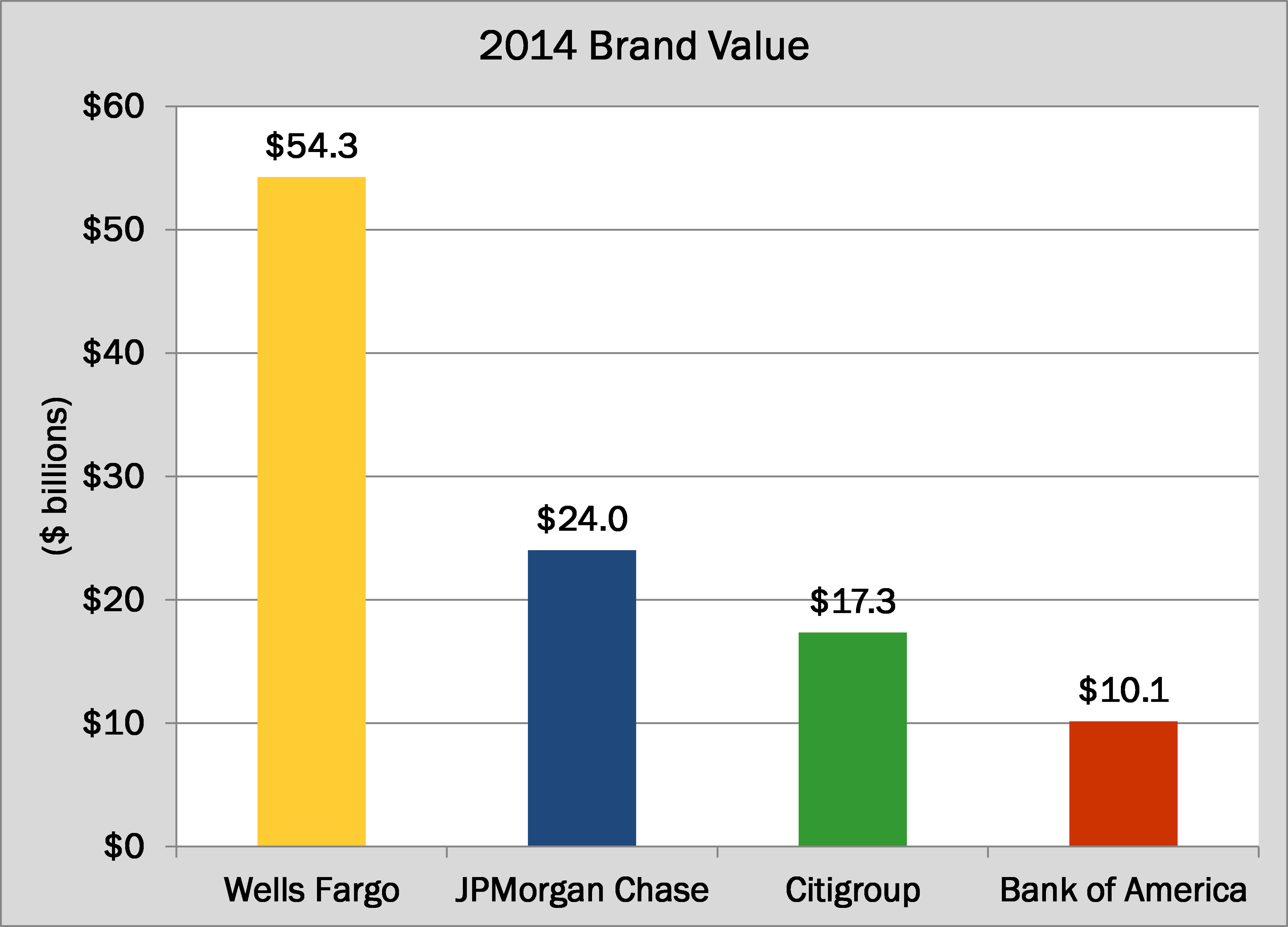

Consultancy Millward Brown recently released its BrandZ Top 100 brand ranking, which calculates the value of brands through research involving two million customers across 30 counties and over 10,000 brands.

It determines the value of brands by quantifying how much of a company's profits can be tied to the brands customers see and interact with, and as a result, it puts a dollar value on the worth of the brand itself. As a result, JPMorgan Chase is separated into two brands, JPMorgan (its corporate arm) and Chase (its consumer arm).

And here we see Wells Fargo once again commands an incredible lead over its peers:

Source: Millward Brown.

As shown in the chart above, the lead held by Wells Fargo is even more impressive as the value of its brand is nearly five and a half times more valuable than Bank of America. And it's actually worth more than the combined values of JPMorgan Chase, Citigroup, and Bank of America.

Why this matters to investors

Warren Buffett -- who owns more than $23 billion (or 9%) of Wells Fargo -- once said, "understanding the value of brand helped drive the decision to buy Coca-Cola in 1988." From that Coke investment, he's turned $1.3 billion into $16.5 billion.

When it comes to investing, all too often we only consider the information and data revealed in earnings releases and annual reports when making a decision. This is absolutely critical, but at times, this forces us to miss insights like this revealed by Millward Brown, and Buffett himself.

In these, we can learn while it is by no means the only thing, the value of a company's brand can be critical when considering any company as an investment.