At Broadcom's (NASDAQ: BRCM) most recent analyst day, the company talked at length about the new challenge the semiconductor industry is set to face on the economics of future manufacturing technologies. Mirroring what industry experts like Handel Jones have argued, Broadcom management said it expects that the cost per transistor (that's the building block of a modern chip) will rise in coming generations.

That, in a nutshell, means that as chips get smaller and power and performance improve, it becomes more expensive to add additional features such as bigger CPUs, beefier graphics, and dedicated accelerators. If your customer is willing to pay the added premium for products built on these new FinFET manufacturing technologies, then it's a win, but for cost-sensitive applications it may make more sense to stick to older technologies.

Don't take my word for it -- ask Broadcom's Rajiv Ramaswami

At the recent Cowen Technology, Media & Telecom Conference, Rajiv Ramaswami, executive vice president and general manager of Broadcom's infrastructure and networking group, noted that the semiconductor company would need to be very judicious about what designs it moves to the 16 FinFET manufacturing technology node, and what products it continues to iterate on 28 nanometer. When Ramaswami was questioned about whether the entire networking product lineup would eventually transition to 16 FinFET, his response was, "It's not clear yet."

The idea here is that the products that really benefit from more performance at lower power and the ones that offer the largest return on investment will move to the next-generation node. Broadcom expects that it can raise the average selling prices of these products since they will pack more features and performance. This makes sense -- the "better" product costs more. In a world where Broadcom's principal competitors all build their silicon at the same place, this isn't a problem.

This spells trouble for mobile processors

Broadcom sells big, bad networking chips for, in some cases, hundreds if not thousands of dollars. For the juiciest, highest-margin components, the move to FinFETs won't be a problem. The issue -- which affects the entire fabless semiconductor industry -- is when we start to talk about cheap chips. You know, like mobile applications processors.

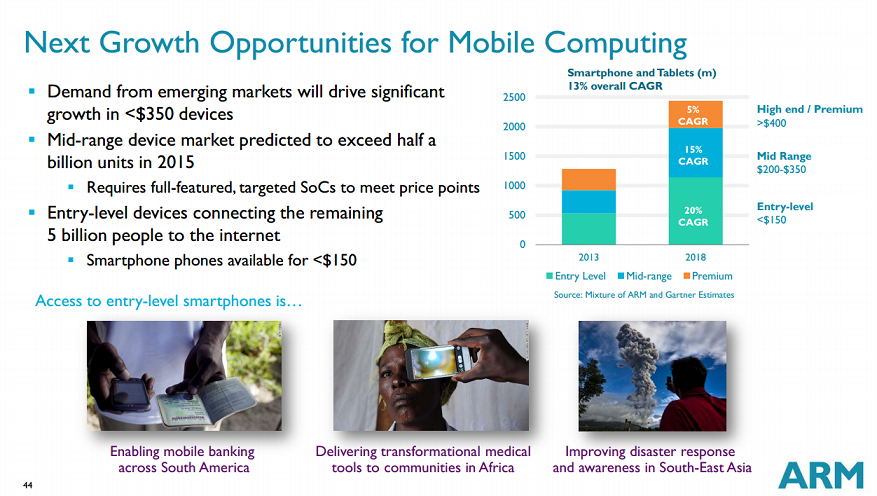

If you look at this recent slide from ARM Holdings (ARMH +0.00%), you can see a very clear trend: the low-end and midrange device markets -- both of which are cost sensitive -- are on the rise, while the growth in the high end is rather muted (and given Samsung's (NASDAQOTH: SSNLF) recent price cut on the Galaxy S5 relative to the Galaxy S4 at launch, this segment is not immune to average selling price erosion).

Source: ARM Holdings.

So you've got an industry that is increasingly focused on cost-sensitive products, and it seems that the "obvious" path to improved performance leads to meaningfully higher chip prices. There is most certainly a problem here, and it means that either one of two things will occur:

- Margins for the fabless chip vendors will erode as the foundries capture most or all of the value of these chips.

- Mobile chips will become more expensive over time as they get better.

In the first scenario, the foundries win and the fabless chip designers lose. In the second scenario, the foundries and the fabless chip vendors win, but the device vendors lose. A company such as Samsung, which builds its own mobile devices and is increasingly building its own chips, could avoid many of the pitfalls that a fabless player may encounter (also note that Samsung is trying to be a foundry, so it "wins" that way, too).

Foolish takeaway

As the industry advances to next-generation manufacturing technology, a lot of hard choices will have to be made about what manufacturing technology is used. It's no longer in the best economic interests of many players to blindly move everything to the latest and greatest manufacturing technology. This will have dramatic and sweeping implications to the industry, and -- particularly for price-sensitive markets like mobile applications processors -- the advancements through process nodes may slow significantly.