Back in 2008, a friend at work schooled me on a new way to get instant news and stay in contact with people around the world at the drop of a hat. It was simple and an ideal mobile experience. It was Twitter (TWTR +0.00%), and he loved it.

Now I'll be honest — back then, I was a bit skeptical of social networking in general, so I more or less dismissed it and moved on. Fast-forward to today, though, and I have certainly changed my tune. Not only do I use Twitter, but I own shares in the company as well. And I think the stock is set up to deliver market-stomping returns over the coming decade — making today a great time to add it to your Explorer investments.

1. Twitter Is a Big Deal Today

What started out as an idea between friends eight years ago has today turned into a major mobile communication platform with more than 240 million monthly average users. Twitter has grown its sales from a meager $28 million in 2010 to $665 million in 2013, and it's projected to bring in more than $1 billion in 2014. And judging from the latest quarter, it sure looks like Twitter is doing all the right things.

President Obama took to Twitter to celebrate his reelection in 2012:

Four more years. pic.twitter.com/bAJE6Vom

— Barack Obama (@BarackObama) November 7, 2012

Supernova member Hodges Bradberry (RedandBlack) recently noted the value he sees in Twitter's real-time open platform:

Twitter is great. In Fulton Co Court for jury duty and know within minutes about an earthquake in LA.

— Hodges Bradberry (@HodgesBradberry) March 17, 2014

From the president of the United States to Fools just like you, Twitter is part of the daily lives of people share their ideas and stay informed. If you're not on Twitter, you're kind of missing out.

2. It's Going to Be an Even Bigger Deal in the Future

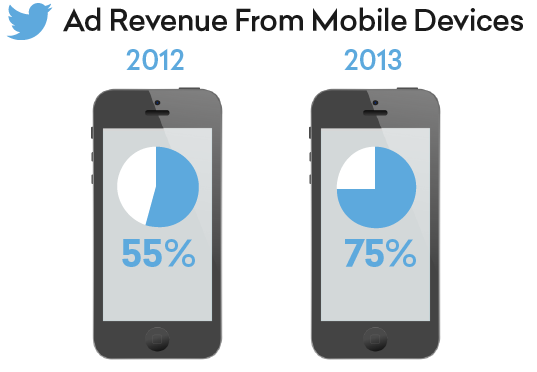

The latest estimate from eMarketer has the worldwide mobile ad spending market pegged at $78 billion by 2017 which means plenty of opportunity for Twitter to get in on the action. Analysts now see Twitter's sales hitting $6.1 billion in 2018, and I think that could be conservative given the upward trends in social media and mobile communication.

3. First Place on the Second Screen

Twitter is becoming one of the go-to virtual hang-outs for big events and a leader in the second-screen movement. The Super Bowl, the Olympics, the Oscars — heck, even the PGA Championship (now that's what I'm talking about) — whatever the event may be, Twitter is proving itself to be an ideal and complementary second-screen experience. It's estimated that more than 90% of the live-TV conversation today happens on Twitter.

That would explain the creation of the Nielsen Twitter TV Ratings, which shine a bright light on the real-time conversations happening on Twitter about live TV. This serves as valuable information Twitter can use to show its TV-advertising clients where they're going to get the most bang for their advertising buck.

This short video shows how Twitter's TV ad targeting works — and why clients are jumping on board:

The Nielsen Twitter ratings offer a unique spin on how fans engage with their favorite shows, as a vator.tv article from last October noted:

Around 10 million people watched the finale of Breaking Bad; compare that to the The Big Bang Theory, whose highest ratings have nearly doubled the Breaking Bad finale's audience with 20.44 million people. Breaking Bad didn't even make the top 20 in terms of TV viewers, but The Big Bang Theory was nowhere to be found on Twitter. It's like these two shows exist in entirely different universes, despite being shown on the same medium.

Top Twitter TV Audiences

Sept. 23, 2013 – March 10, 2014

| Rank | Show | Date | Twitter Audience |

|---|---|---|---|

| 1 | Academy Awards | 2/2/14 | 13.9 million |

| 2 | Grammy Awards | 1/26/14 | 12.8 million |

| 3 | Golden Globe Awards | 1/12/14 | 10.4 million |

| 4 | American Music Awards | 11/24/13 | 10.2 million |

| 5 | Breaking Bad finale | 9/29/13 | 9.3 million |

| 6 | State of the Union | 1/28/14 | 8.8 million |

Remember Super Bowl XLVII when the lights went out? Oreo sure does:

Power out? No problem. pic.twitter.com/dnQ7pOgC

— Oreo Cookie (@Oreo) February 4, 2013

Who can forget the effect Breaking Bad had on the television world? It practically put AMC Networks on the map, and the final episode generated 1.24 million Tweets, with the conversation maxing out at 22,373 Tweets per minute. The #GoodbyeBreakingBad hashtag was on display throughout the finale and was used nearly 500,000 times as we all bid the diabolical genius Walter White farewell.

Are we sad to see Walter go? You're goddamn right. #GoodbyeBreakingBad pic.twitter.com/RnWMgwBhf1

— Breaking Bad (@BreakingBad_AMC) September 30, 2013

Remember this? Well, 3.4 million Retweets and more than 2 million Favorites later, the Oscar selfie Tweet is still being talked about:

If only Bradley's arm was longer. Best photo ever. #oscars pic.twitter.com/C9U5NOtGap

— Ellen DeGeneres (@TheEllenShow) March 3, 2014

Twitter Amplify

To be sure, the second-screen trend is the impetus behind Twitter Amplify, which was introduced last summer. Amplify promotes live television content in real time by letting media brands and their ad partners disseminate 5- to 10-second clips or photos from the programs they're airing. Amplify has proved to be an effective product, growing to more than 60 partners, including A&E Discovery, MLB.com, NFL Network, PGA Tour, and all four of the major networks.

The 2013 Season in 6 Minutes. Minute 2: Never Stop Working WATCH: http://t.co/Qkwj8NfNem

— NFL (@nfl) March 25, 2014

The Interest Graph

Finally, promoted Tweets, promoted accounts and promoted trends are all products Twitter offers its advertising partners to help promote their brands, products, and services. The information Twitter gathers from its users in the form of users followed, Tweets created, and engagement with Tweets makes up each user's Interest Graph which, when coupled with the real-time dynamic of Twitter's open platform, gives users a unique and personalized real-time experience that no one else can offer — and gives advertisers a window into delivering the most relevant ads.

The Foolish Bottom Line

There's no doubt that Twitter faces short-term challenges with engagement because the service is different and demands a bit more of a learning curve. And if this creates uncertainty in the market, then that's fine, too. But I'll harken back to the initial Rule Breakers recommendation, where Supernova's own David Meier said it perfectly: "Twitter is the global communication platform of the future."

If you can look at Twitter first and foremost as a communication tool, then I believe it will open your eyes to the potential Twitter has as a service and an investment. And three years from now, today's price will look like a steal.

Remember investing is all about the future. There are never any guarantees and you're taking a measure of a leap of faith every single time.

— Jason A. Moser (@TMFJMo) December 2, 2013