If advertising is all about finding eyeballs, then there is an industry in for even more hurt, and an industry still primed for tens of billions of dollars worth in growth. This is because content consumers have been drifting toward new forms of media, and advertising has yet to catch up to the consumers' moves.

While advertisers still spend on print ads, the audience has moved to mobile devices. This lag between ad spend and time spent is obvious, and it presents a gap that has yet to be filled. This trend means two things:

- If you're invested in old media, you better have a contingency plan.

- If you're not invested in new media, it may be worth a deeper investigation.

The defining chart

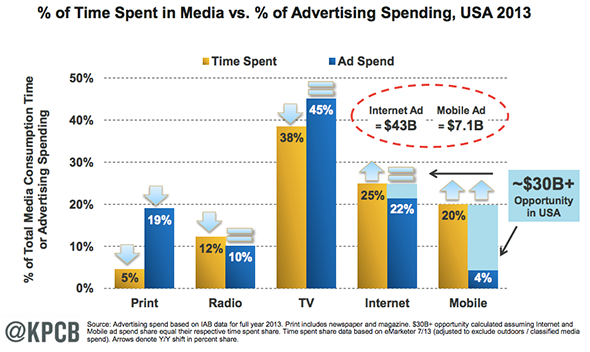

Mary Meeker, one of the first tech analysts, details trends around the Internet each year. In one of the more striking charts, she calculates that if advertising spend caught up with actual time users spent on mobile devices, mobile advertising would increase by $30 billion:

Source: KPCB Internet Trends 2014.

This shows that even though we spend only 5% of time with print media, advertisers spent 19% of their budgets on it. Print has been an established form of marketing when compared with the newer Internet-based media. But Internet and mobile advertising are proving themselves: Global mobile advertising grew 47% from 2012 to 2013.

The evidence can be seen with a simple graph of revenues of older news outlets versus online media:

NYT Revenue (Quarterly) data by YCharts.

The New York Times (NYT 0.34%) and Gannett have both struggled to keep revenue growth positive, while Twitter (TWTR +0.00%), Facebook (FB 0.63%), and Google all have double-digit -- if not triple-digit -- revenue growth. This may not be a surprise, but the possibility of much more pain for print media and still a massive upside for new media means it's not too late to act.

Reactions to the media shift

To survive, newspapers have rolled out different web monetization strategies. The New York Times took in $149 million in its fiscal 2013 from digital subscriptions, up 34% year over year, but it still made up a little less than 10% of its total revenue. Advertising, on the other hand, made up 42% of revenue, but fell 6% year over year, and fell 5% the year prior. In short, digital revenue has a way to go to make up for declining advertising -- especially if advertising revenue keeps falling.

Twitter and Facebook are just starting to monetize their audiences. As they tweak their advertising offerings, advertisers will have to align their spending to where their audiences increasingly spend time: on mobile devices. Both Twitter and Facebook have a little under 80% of monthly active users visiting from mobile devices. Both are also recently experiencing faster average revenue growth per user each quarter, as Meeker calculates:

| Q1 2013 | Q2 2013 | Q3 2013 | Q4 2013 | Q1 2014 | |

| Facebook ARPU | $4.60 | $5.65 | $6.14 | $7.76 | $7.24 |

| Year-over-year growth | 15% | 32% | 39% | 51% | 57% |

| Twitter ARPU | $1.97 | $2.22 | $2.65 | $3.65 | $3.55 |

| Year-over-year growth | 52% | 48% | 61% | 69% | 80% |

Source: KPCB Internet Trends 2014.

Mobile gap takeaway

These mobile-centric media stocks are priced with such growth in mind, both with price-to-sales ratios around 20, but with such a tailwind for their future, it's quite possible such stocks are worth the premium. For older media companies, new strategies will have to keep revenue growing quickly to make up for falling advertising sales.