Whenever a major industrial player like Emerson Electric Co. (EMR +3.48%) gives results the market should sit up and take notice. In this instance, the results and the narrative around them suggest an ongoing, but fragile, economic recovery. Emerson's underlying performance was better than the headline numbers suggested, and there was some good news within the report for companies like Rockwell Automation (ROK 1.43%) and Cognex Corporation (CGNX 2.03%). With that said, what should Fools be looking for in the global economy that might benefit Emerson going forward?

Emerson Electric's second-quarter results

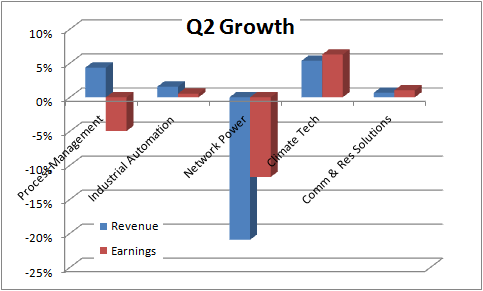

Emerson's headline numbers weren't great with sales falling 2% in the quarter, and earnings before interest and taxes also declining 2%. A quick look at a segmental breakdown of Emerson's revenue and earnings growth reveals the trend in the quarter.

Source: Emerson Electric Presentations

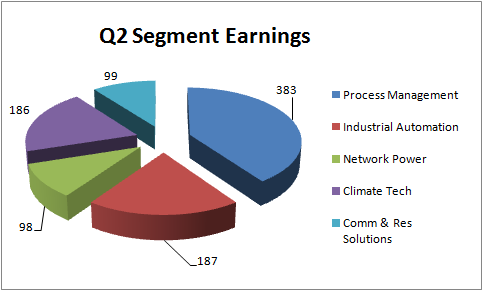

Here is what each segment means to profitability:

Source: Emerson Electric Presentations

As bleak as the headline and segmental numbers look, they don't tell the full story. There are five issues to consider around Emerson's results.

First, Emerson's underlying sales growth (excluding divestitures, acquisitions and foreign exchange effects) was 2% in the quarter, and orders came in with a solid 9% increase -- indicating growth in future quarters.

Second, on the conference call, management outlined that it was seeing more large and increasing complex project orders, which could initiate a longer lag between orders and revenue gains. Moreover, there appeared to be a curious dichotomy emerging between current spending and orders from its process management customers. According to Emerson's investor relations director, Patrick Fitzgerald, on the conference call, this is due to "... a slowdown of the global project execution in the process industry. At the same time, process customers proceeded with plans for future investments helping drive total Emerson orders of 9% in the quarter with strong acceleration in March."

While, this indicates some caution on behalf of its customers, it also suggests that growth could pick up should the economy stay on track, because customers continue to make orders.

Third, the weather obviously had an effect on its performance, particularly on demand from new residential construction.

Fourth, the decline in the network power segment was due to the divestiture of a business in the segment, as underlying sales were up 1% for network power. In addition, Emerson outlined its expectation for modest growth from the segment in 2014.

Fifth, it seems that Emerson's performance differed from its outlook in February due to some caution from its process management customers (as discussed above) and weakness in the North American residential market. These are both issues that can be rectified in due course. Its process management customers actually increased orders by 12% in the quarter, and weather effects would have held back new residential construction activity.

What the results mean to the industry

Emerson's peer, Rockwell Automation, also delivered results that were better than they looked. In fact, Rockwell upgraded its organic sales growth forecasts for the full-year. The only reason why it didn't upgrade its EPS forecast is because foreign exchange effects are expected to be worse than expected and its full-year rate is now forecast to be at the high end of its previous range. Indeed, Rockwell Automation's management highlighted both the oil and gas and the chemical industries as being areas of opportunity for the company in the second half. Both of these sectors are strong areas for Emerson Electric.

There was also some good news in the report for machine vision company Cognex Corporation. Cognex's key growth opportunity comes from its sales to the factory automation market, and the market has worried over its emerging market prospects in recent times. However, Emerson reported that its industrial automation sales increased by 6% in emerging markets in the quarter, with China up 18%. This suggests the spending environment remains favorable for Cognex, and the company can look forward to good growth this year

Where next for Emerson Electric?

All told, Emerson left its full-year outlook unchanged, despite some cautious commentary on the U.S. housing market and geopolitical fears in Europe. Both concerns could turn out to be temporary, and its process management customers are likely to release some pent-up spending given a better macroeconomic environment. Emerson's guidance for 3%-5% in full year underlying sales growth remains the same, as does its EPS target of $3.68-$3.80.

Moreover, for the reasons cited above, Emerson's earnings report was better than it looked. On a forward P/E ratio of 17-18 times earnings the stock looks fairly valued, but Fools should look out for any weakness, because Emerson's prospects look good given a stronger economy in the second half.