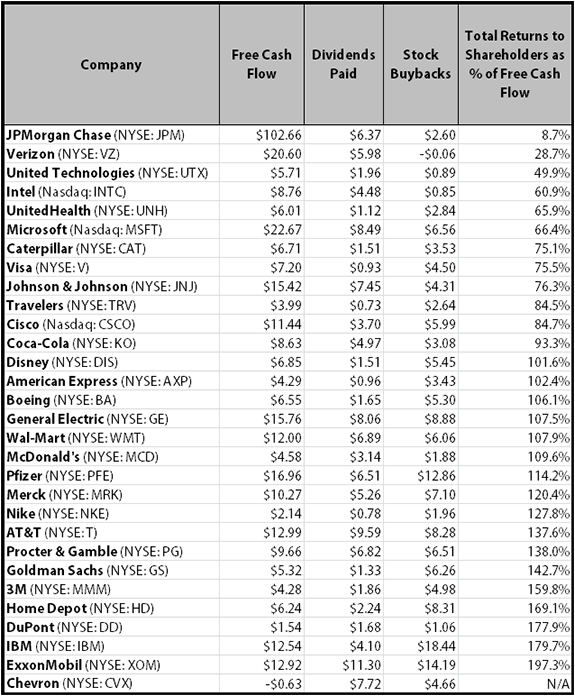

Investors have for centuries flocked to large-cap stocks with histories of returning profits to shareholders. Many of America's largest publicly traded companies continue to reward loyal shareholders with billions of dollars of dividends and stock buybacks each year. Many of these shareholder favorites are part of the Dow Jones Industrial Average (^DJI 1.20%), which tracks a number of of America's largest and most profitable public companies. All told, the Dow's 30 components have returned $292 billion to shareholders, in the form of dividends and buybacks, over the past four quarters. That's nearly enough to give every man, woman, and child in the United States $1,000 -- but those rewards flowed only to the investors savvy enough to own shares in these blue-chip companies.

Some Dow components have been savvier than others about managing their shareholder returns: only 13 of the Dow's 30 components paid out less than 100% of their free cash flow as distributions or buybacks over the past year. Even then, few kept much in reserve -- Verizon (VZ +0.30%), which paid out the least in relation to its free cash flow, is the only non-bank Dow component to return significantly less than half of its free cash flow to shareholders. Second best was United Technologies (UTX 0.39%), while Intel (NASDAQ: INTC) was the last of the three non-bank Dow stocks to return less than two-thirds of its free cash flow to shareholders over the past year.

Why does this matter? When a company pays out more than its total free cash flow to shareholders, it's essentially saying "we don't need this money, and we can make more when we need it." As the financial crisis of 2008 demonstrated, the line between easy money and dire straits is thinner than many companies would like to admit. Keeping at least some free cash flow in reserve can help companies -- even those as durable as the Dow's 30 -- survive troubles without depleting hard-earned reserves.

Let's look at the three non-bank Dow stocks that have the best control over their cash flow today. At the end of this article, you'll find a table ranking all 30 Dow components by the percentage of free cash flow they've paid out to shareholders over the past year.

Third-best free cash flow control: Intel (paid out 61%)

Intel began making quarterly payouts way back in 1992, when most tech companies were busy hoarding cash. Intel has never cut its payouts, and the company has become steadily more committed to dividends over the past decade -- payouts have risen from barely 10% of free cash flow to over 50% today. An ongoing commitment to stock buybacks has funneled billions more to shareholders in recent years; as a result of these dual commitments, Intel's total cash on hand (including short-term investments) has been declining for several years:

INTC Stock Buybacks (TTM) data by YCharts.

Intel has the resources to sustain (or even increase) its campaign, but in the current tech climate, its investors may be better served by a deeper commitment to developing and deploying new mobile chips than they would be by a larger buyback. Intel hasn't pushed its free cash flow higher in a decade, but after tripling its dividend payouts in that time frame, it may soon reach the limits of its ability to grow shareholder returns without a major source of new sales:

INTC Total Dividends Paid (TTM) data by YCharts.

Second-best free cash flow control: United Technologies (paid out 50%)

Defense contractor, people mover, and air-conditioning giant United Technologies hasn't cut its dividend in decades and has been committed to quarterly payouts for over 40 years. United Technologies has seen payouts spike as a percentage of free cash flow recently, but by all indications this is a short-term aberration -- the company has been quite good at keeping dividend payouts at roughly 25% of free cash flow for the past decade:

UTX Total Dividends Paid (TTM) data by YCharts.

Investors shouldn't worry about United Tech losing control of its finances, as the diversified manufacturer has managed its buybacks quite well in recent years. The company's cash on hand has grown faster than its free cash flow over the past decade, and while buybacks have been rather erratic, they've settled at a level in line with the company's underlying financial health:

UTX Stock Buybacks (TTM) data by YCharts.

Best free cash flow control on the Dow: Verizon (paid out 29%)

The surprise of our list is telecom giant Verizon, which has bucked the industry trend of sky-high payouts and supersized stock buybacks to consistently reduce both its free cash flow payout ratio and its total buybacks -- a negative number on the buyback side indicates Verizon actually sold a small number of shares on the market over the past year:

VZ Total Dividends Paid (TTM) data by YCharts.

Throughout this process, Verizon has been steadily building up its trailing 12-month free cash flow, which has more than doubled over the past decade. The big difference between Verizon and fellow Dow telecom component AT&T isn't cash on hand -- despite earning nearly $8 billion more in free cash flow, Verizon has roughly the same cash reserves -- it's buybacks. While AT&T has committed billions to buybacks over the past decade, Verizon has held the line, and as a result has maintained a much more sustainable level of shareholder returns:

VZ Stock Buybacks (TTM) data by YCharts.

Source: YCharts. Dollar results in billions, on a trailing 12-month basis.