The automotive industry is in the process of releasing new vehicle sales results for May and the early signals are very positive. Official results won't be calculated until later today, but currently the seasonally adjusted annual rate, or SAAR, of sales in May are projected to reach 16.5 million or higher.

"The industry is back to the level we expected at the beginning of the year," said Larry Dominique, president of ALG and executive vice president of TrueCar.com, in a press release. "Chrysler, GM and Nissan are all benefiting from increased demand. They are showing higher sales and are able to pull back on incentive spending."

Overall the growth in new vehicle sales in May is a good sign for the automotive industry, as well as for the overall economy, in terms of increased consumer spending. Let's take a closer look at the results from Ford Motor Company (F 0.36%), General Motors (GM +0.62%), and Fiat Chrysler Automobiles (NASDAQOTH: FIATY).

Fiat Chrysler Automobiles

In terms of year-over-year performance, FCA tops the list of these three competitors in May with a sales increase of 17% to 194,421 units. Holding true to the company's trend this year, FCA's sales increase in May was largely driven by its Jeep and Ram Truck brands.

Jeep brand sales were up a whopping 58% in May, which was Jeep's best monthly sales performance ever and the first time sales topped 70,000 units in the U.S. in a month. Diving into individual performances, the Jeep Compass, Wrangler, and Cherokee each posted their best sales month ever. Sales of the Ram full-size pickup truck surged 17% last month in America's most profitable vehicle segment. It was the truck's best May sales performance in nearly a decade.

Looking ahead, FCA is set up well to continue its strong monthly performances throughout 2014. FCA's Jeep and Ram brand's sales are up 49% and 24%, respectively, through May compared to the same time period last year, which has pulled the entire company's sales up 13% for the year.

General Motors

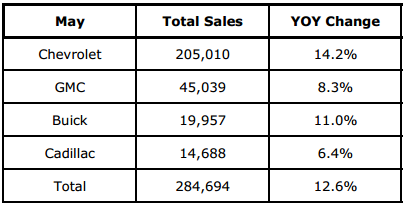

America's largest automaker, GM, posted a year-over-year sales increase of 13% in May to 284,694 vehicles sold in the U.S market. Slicing the data further, GM's retail sales -- those to individual buyers -- were up 10% in May while fleet sales were up 21%. Not all fleet sales are bad, but it's definitely something for investors to keep in mind when judging overall sales increases or decreases. Due to the timing of fleet deliveries, GM's May fleet numbers were slightly inflated and June's fleet sales will be down sharply, which will have some impact on GM's overall sales increase or decrease next month.

General Motors' May sales increase was clearly driven by its mainstay Chevrolet brand. Chevrolet sales were up 14.2% compared to last May and accounted for nearly 75% of GM's 284,694 sales.

Source: General Motors' press release.

Another highlight for GM investors was that its Chevrolet Silverado and GMC Sierra full-size pickups increased sales by 8% and 14%, respectively. This is the third month in a row of sales increases and emphasizes that the company's Truck Month campaign has been working to lure additional customer traffic into dealerships.

Ford's Escape sales surged in May. Source: Ford Motor Company

Ford Motor Company

The folks at the Blue Oval have been trending behind their competitors in terms of year-over-year increases, but part of that is due to their focus on improving retail sales while limiting fleet sales. Ford's retail sales in May were up 6%, while its overall sales only managed a 3% gain, compared to last year.

Despite yet another recall for Ford's Escape, sales continue to surge for the popular crossover SUV. Ford actually posted an all-time monthly record for Escape sales, which reached 31,896 units -- the first time sales of the Escape have topped 30,000 in a month.

Ford also posted an all-time monthly record in May for its other extremely popular vehicle, the Fusion, with sales nearly reaching 34,000 vehicles. Ford's Fusion continues to be a hot option in the western region of the United States, where the Fusion posted a sales increase of 42%.

Ford's luxury Lincoln lineup, which remains in the early stages of a turnaround, posted another strong month: Sales increased 21% in May compared to last year, and reached 8,845 units. One of the biggest announcements was that the MKC has officially begun to arrive at some dealerships, with initial sales reaching 677 vehicles. Expect MKC sales to rival sales of the MKZ, roughly 2,500-3,500 units per month, when ample supply reaches dealerships.

Bottom line

This has been the latest in a handful of months that have reassured automotive investors the slow sales pace to start the year was indeed due to harsh winter weather rather than diminishing demand. Sales are now back on track and look to continue surging higher this year. One thing for investors to keep in mind as we head into June is that May was setup to be a strong month with five weekends on the calendar. That could have a slight negative impact in terms of overall sales volume when automakers report next month.