The Dow Jones Industrial Average (^DJI 0.34%) was trading 19 points lower, or 0.12%, by midafternoon today after closing at another record high on Monday. In positive economic news, new orders for U.S. factory goods rose in April for the third consecutive month. That suggests manufacturing is growing after the harsh winter weather kept things slow at the beginning of the year. Economists believe the manufacturing sector will continue expanding this year.

In another positive sign, the automotive industry is reporting sales numbers that, while not yet official, look quite strong.

"Industry sales in May soared as consumer confidence improved and demand for new vehicles continued to strengthen," said Bill Fay, Toyota division group vice president and general manager, in a press release.

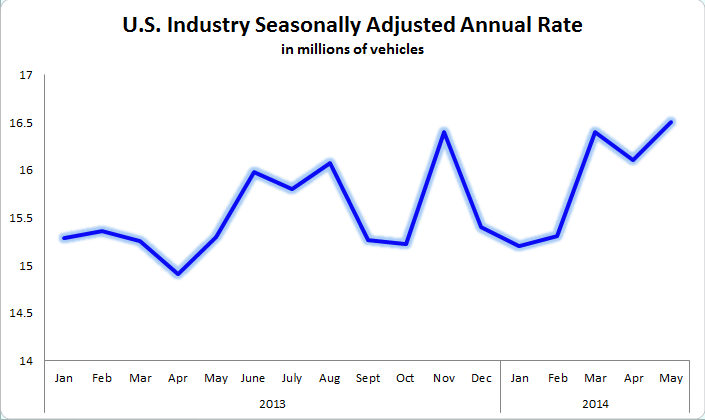

Industry sales in the U.S. are projected to reach a seasonally adjusted annual rate of 16.5 million for May. That would be a large improvement from to the slower pace of sales at the start of the year, as you can see below.

*May 2014 figure is estimated. Source: Automotive News DataCenter.

Winners and losers

While Nissan trails most major automakers in terms of overall sales volume in the U.S., it led the industry in May with its year-over-year sales gain of 19% to 135,934 units. Checking in just behind Nissan, in terms of year-over-year gains, were Fiat Chrysler Automobiles (NASDAQOTH: FIATY) and Toyota (TM 0.13%); each posted 17% gains to 194,421 and 243,236 units, respectively. General Motors (GM +1.54%) still led in terms of overall sales volume in the U.S. with a 13% increase to 284.694 units sold in May.

On the losing end was Volkswagen Group's namesake Volkswagen brand, which slumped 15%. According to Automotive News, the Volkswagen brand's U.S. deliveries have now slipped for 14 consecutive months.

Sales of Ford's Fusion continues to surge. Source: Ford.

Ford (F 0.65%) continued its trend of trailing most major competitors in the U.S. automotive industry, at least in terms of year-over-year sales gains. Despite overall sales only rising 3% from May 2013, retail sales -- those to individual consumers -- rose 6% and its newer vehicles continued to set records.

"Fusion and Escape had their best months ever, which helped us to our strongest May result since May 2004," said John Felice, Ford vice president, U.S. marketing, sales and service, in a press release. "Explorer continued to gain ground in the midsize utility segment with its best monthly sales performance in nearly 10 years, while Lincoln MKZ saw its best May ever."

Sales of Ford's Escape in May topped 30,000 units for the first time ever, reaching nearly 32,000. Ford's Fusion nearly hit 34,000 units and the Explorer topped the 20,000-unit mark for the first time since July 2005.

Investors should keep in mind that May sales were aided by having five weekends on the calendar, as well as the Memorial Day holiday. For those reasons, June's sales figures will likely face a tougher comparison to last year.