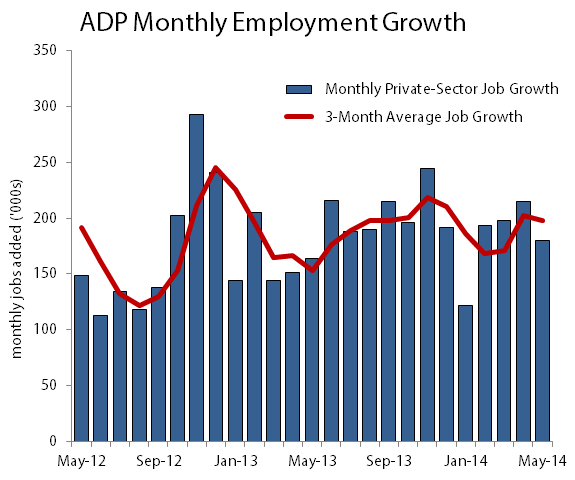

The monthly Automatic Data Processing (ADP 0.22%) jobs report has been updated with May's data, dashing the hopes of optimistic investors and analysts that the United States' first-quarter GDP decline was merely a speed bump on the road to a stronger economy. ADP's update showed that private businesses added 179,000 new jobs last month. This result isn't terrible -- there have been 10 months in the past two years alone in which ADP found fewer new jobs -- but it's nonetheless disappointing to economists and analysts who had reached a consensus estimate of 210,000 new jobs for the month. ADP also revised its April estimate lower by 5,000 jobs, which compounds today's disappointment.

Source: Automatic Data Processing.

In what has become a running theme, however, Wall Street met the underwhelming news with a shrug. Following the release on Wednesday, the Dow Jones Industrial Average (DJINDICES: ^DJI) finished the day slightly in the green, with only one component stock moving more than 1% in either direction.

ADP's report has become somewhat marginalized this year; Barclays analyst Cooper Howes told Business Insider that "the methodology and frequent revisions of the ADP employment report limit its usefulness for forecasting the BLS private employment series on a month-to-month basis," and Pantheon Macroeconomics' Ian Shepherdson tweeted, "If you aren't professional[ly] obliged to be interested in the ADP employment number, [it's] probably best not to bother with it." ADP's results do tend to diverge from the official Bureau of Labor Statistics numbers, although by varying degrees -- there were 73,000 more jobs in the BLS' April update than were found by ADP's survey that month, but in March the ADP's result was only 5,000 jobs under the government's.

It's still worth highlighting two aspects of ADP's monthly updates: the sector breakdowns (which are also covered in BLS data) and the business-size breakdowns, a unique feature of the ADP report. May's weakness seems to stem from slower growth in the professional (read as white-collar jobs) sector, and in construction, as both sectors saw a month-over-month slowdown in growth rates. Other major sectors tracked in the ADP report were either flat or grew at a slightly faster rate:

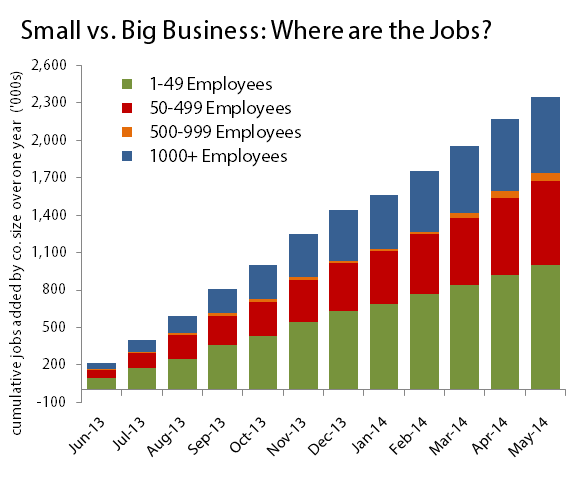

Job growth continues to be driven by smaller companies: Of the 179,000 jobs added in May, 82,000 were added by private companies with fewer than 50 employees. On the other hand, midsized to large companies that reported between 500 and 999 employees actually cut ranks by 3,000 employees last month. Over the past year, companies of this size have added only 59,000 new jobs, compared to the 1 million new jobs added by companies with fewer than 50 employees:

Source: Automatic Data Processing.

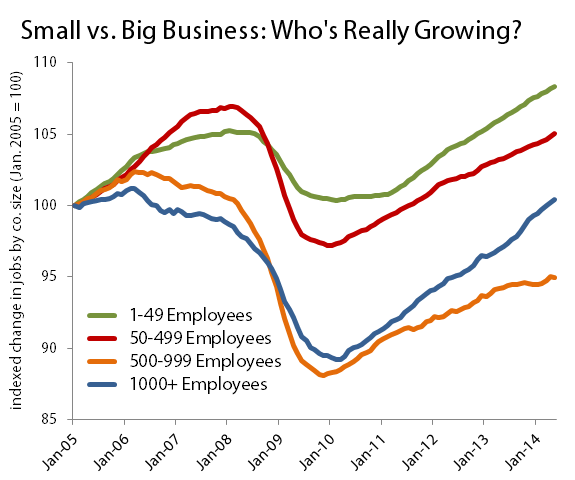

This part of the private sector (500- to 999-employee companies) accounts for a mere 6.8% of all private jobs, which is well below its weight of 7.5% in private jobs a decade ago. Large companies with over 1,000 employees are also a weaker source of employment than they were in 2005, with their slice of the pie dropping from 16.5% to 15.8% of all private-sector jobs today. The only real source of employment growth over the past year has been in smaller companies with fewer than 50 employees, which have added roughly 3.8 million new jobs since the start of 2005. You can see why these smaller companies are so important on the graph below:

Source: Automatic Data Processing.

In fact, you could argue that these small businesses could be producing more growth and that a lack of new small-business creation is what's really keeping the U.S. economy from reaching escape velocity. A Brookings Institution report released last month said the U.S. economy has become less entrepreneurial over time; the number of business failures exceeded the number of new businesses created for the first time during the financial crisis, and this trend persisted at least through 2011, which was the latest year for which Brookings had data. America needs to create small businesses, and it hasn't. That goes a long way toward explaining not only the persistent weakness in employment growth, but also the ongoing weakness of the economic recovery, which barely seems like a recovery at all for millions of people across the country.