With both stocks sporting a dividend yield under 1%, you would be excused for thinking Visa (V 0.82%) and MasterCard (MA 1.13%) neglect their shareholders. However, the exact opposite is the case.

When Visa announced the results for its 2013 fiscal year, its board authorized a new $5 billion repurchase program. And a little more than a month later, MasterCard announced its board of directors had approved $3.5 billion worth of repurchases.

You see, even though MasterCard and Visa shareholders aren't receiving huge quarterly dividend checks, both companies are benefiting shareholders by reducing share count.

The two companies haven't slow to act on the $8.5 billion worth of repurchase authorizations, as MasterCard revealed, through April 24th, it had repurchased 27.5 million shares of its stock for a total cost of $2.0 billion. And Visa noted it had bought back a little more than $1.1 billion worth of its shares through the first three months of 2014.

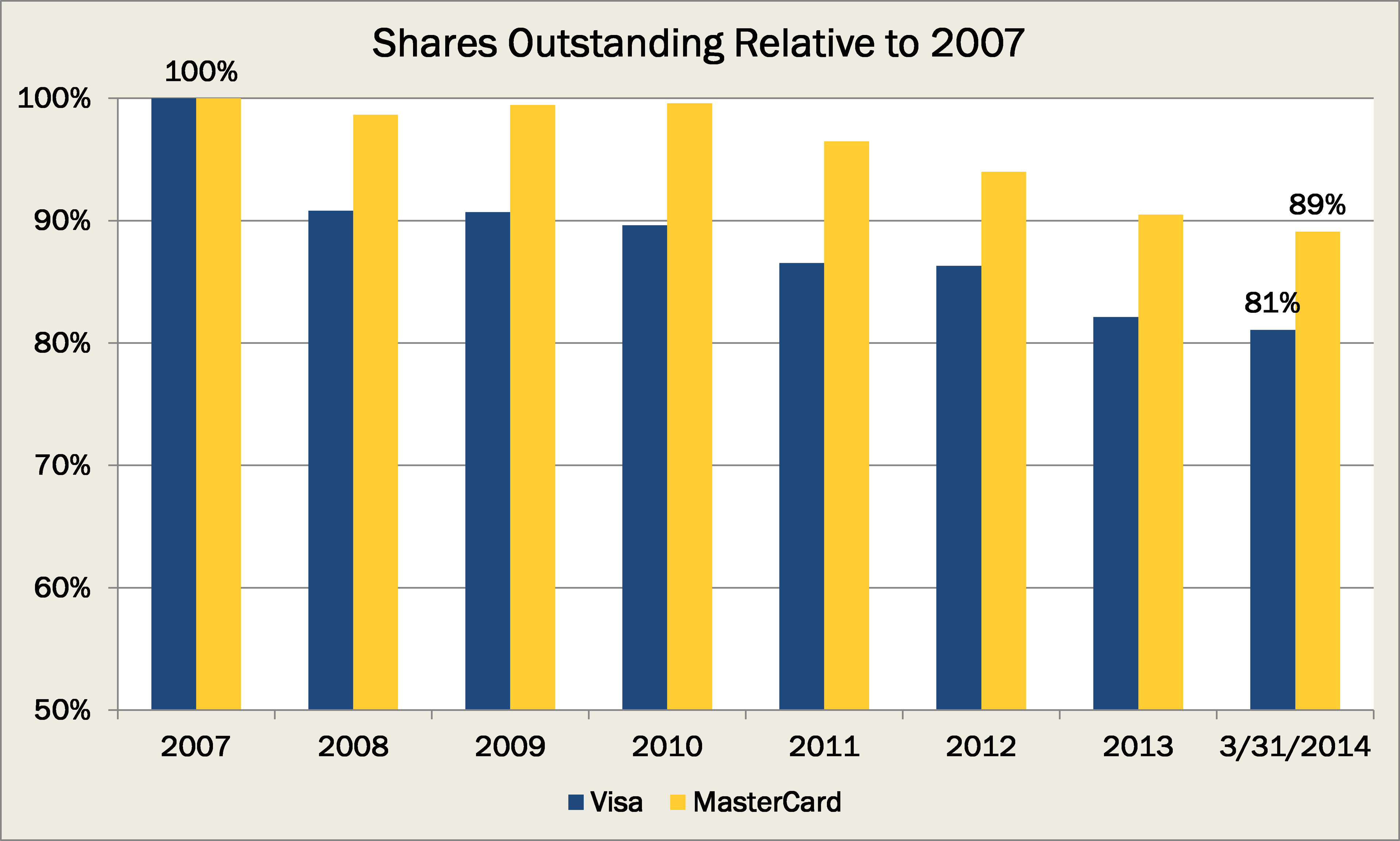

But it wasn't just the first three months of 2014 that marked times when the companies were aggressively buying back their stock. As shown in the chart below, Visa has watched its total common shares outstanding fall by nearly 20% since 2007:

Source: S&P Capital IQ.

This is why Visa's earnings per share (EPS) jumped 31% year over year in the most recent quarter even though its net income rose by 26%. And while a 5% difference as a result of share repurchases doesn't sound like a ton, consider that since 2008, its total net income has risen a little over 400%, but its earnings per share are up 550%, from $0.39 to $2.53.

Over years and years, share repurchases can mean big things to the earnings available to those who own stock of companies.

Why it matters to investors

In its latest annual report, Visa's CEO, Charles Scharf, noted:

We believe in returning the majority of excess cash to shareholders. We have repurchased the equivalent of 151 million shares since our IPO (about 20 percent of our shares outstanding) and returned more than $17 billion of capital to our shareholders in the form of dividend payments and share repurchases.

Although the language about repurchases was absent from his prepared remarks in the annual report, when the $3.5 billion repurchase authorization, and other capital moves were announced -- including a dividend boost and a stock split -- MasterCard's CEO Ajay Banga said, "today's actions reflect our ongoing commitment to deliver shareholder value as well as our confidence in the long-term growth and financial performance of our Company."

While the future of the payment industry draws attention, it is critical for investors to look at the past as well. Some may think these two companies aren't focused on returning capital to their shareholders because of the low dividend yields, but it turns out they just tend to do so in a different way than most.