With a lot of space for growth in the Chinese Internet industry due to low penetration levels, search service providers like Baidu (BIDU 0.67%) and Qihoo (QIHU +0.00%) are poised to grow in the coming years. Baidu is better-positioned than its competitors due to its leading market share, strong financial position, and differentiated search and mobile products, thanks to its integrated location-based services. Moreover, potential R&D efforts lead by Google's former artificial Intelligence chief, Andrew Ng, make future prospects seem even brighter.

Baidu is famous for its web search services in China, and is often compared to Google (GOOG 0.73%) (GOOGL 0.73%). The company generates nearly all of its revenue through an advertisement-based model. In addition to search, the company also owns a third-party Android app store, which gives it access to the app ecosystem. Baidu also owns e-commerce website Nuomi Holdings to seek growth from e-commerce platforms. The company has been showing impressive financial performance in recent quarters and is expected to continue doing so.

Industry and competition dynamics

The Internet penetration level in China is around 42%. This is expected to increase in the next few years, as the country's Internet user base is set to grow to 800 million by 2015, translating to approximately 60% penetration. Baidu's market share was around 63.5% as of December 2013, compared to a 71% market share back in 2012.

Source: Tech in Asia

Qihoo recently launched its search service and achieved a 22.5% market share. The company's target of a 35% market share may be difficult to achieve, and even if it was able to do so, it would be tough to maintain. Baidu invests a lot in R&D, and this factor comes into play in the long run. Moreover, Baidu's integrated location-based services and hiring of Google's former AI chief further threatens Qihoo's chances of expanding its market share.

Source: Tech in Asia

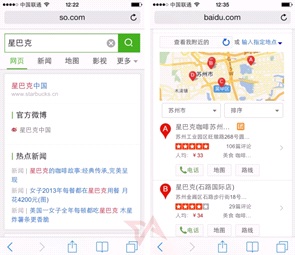

For instance, when searching for "Starbucks," Qihoo simply returns a list of links, while Baidu provides the nearest location, plus reviews and ratings from users, similar to Google's search results. The quality and depth of search results are paramount, especially in the mobile space, where location-based search is preferred.

Financial highlights

Baidu posted revenue of $1.53 billion in the first quarter of 2014, which equates 59.1% growth on a year-over-year basis. The main revenue drivers include an 8.8% increase in active online marketing customers, along with a 44% increase in revenue per customer. These results reflect the implementation of a strong monetization policy.

Net income was $407.8 million, an increase of 24% over last year. Earnings grew relatively slower than revenue, mainly because of increased sales and marketing, R&D, and content costs. The company is investing in personnel and R&D, a rational approach given the growth rate of the industry. Margins will remain under pressure for now, but this policy is in the long-term best interest of the company.

Baidu is trading cheaply, as far as investment value is concerned. The forward P/E of the company is around 22.60, compared to 23.25 for Qihoo.

|

|

|

Qihoo |

Baidu | |

|---|---|---|---|---|

|

Forward P/E |

17.92 |

34.59 |

23.25 |

22.60 |

Understand that Google and Facebook are ranked first and second, respectively, in terms of Internet traffic, while Baidu is fifth.

Facebook's P/E is higher than Baidu's because Facebook has a global reach and more room to grow. However, a higher P/E also increases downside risks and thus Baidu, with a lower P/E, is a less risky investment.

Key advantage and the bottom line

Baidu recently appointed Andrew Ng to head its labs in Beijing and Silicon Valley. He was a faculty member in computer sciences at Stanford University, and contributed to artificial neural networks during his stay at Google. Strong AI leads to better search services, and leveraging Mr. Ng's AI capabilities, along with his experience at Google, will help Baidu improve future offerings.

The company is turning out to be the Google of China. Regulatory intervention did not allow Google to dominate the search market in China, and Baidu's knowledge of the language and culture puts it ahead of Google in its local market. The bottom line is that Baidu is focusing on improving its capabilities, and already holds the lion's share of the market. It has the balance sheet strength and other resources to consistently lead China's Internet space. Add the recent focus on AI and R&D to the mix, and it's clear that other local search players will find it difficult to compete with Baidu.