CVR Refining (CVRR +0.00%) has been one of the refining sector's best performers this year. As the Brent-WTI spread widened during the first quarter, the partnership's income jumped to $270 million; this was up from the loss of $110 million reported during the fourth quarter of 2013. This growth allowed CVR to hike its quarterly distribution by nearly 120% to $0.98 per unit.

With this stellar performance, CVR's units have notched up an impressive year to date gain of 17.8%, beating the S&P 500 as well as refining sector peers HollyFrontier (HFC +0.00%), Philips 66, and Valero by 12.4%, 24%, 10%, and 11% respectively (excluding distributions.)

Has the partnership run too far too fast, though? Unfortunately, looking at the Brent-WTI spread, it would appear that it has.

The spread is key

During the first quarter of this year, the Brent-WTI differential averaged around $10 per barrel. The second quarter has seen a much tighter spread, closer to $6 per barrel and sometimes dropping under the $4 per barrel level.

CVR's two refineries, Wynnewood and Coffeyville, are located close to the Cushing transhipment point for benchmark WTI, so most of the company's crude throughput is priced at the WTI benchmark. Of the 185,000 barrel per day capacity CVR has, only around 30% of this throughput is priced at a discount to WTI according to the company's presentation.

Unsurprisingly, the crude the CVR uses, which is priced at a discount to WTI, is highly sensitive to Brent-WTI pricing.

Sensitive pricing

During the second half of last year when the WTI-Brent differential traded within a range of $4.50 to $10, the price difference between CVR's discounted crude and WTI fell to around $1. The discount and spread then widened to $2.50 during the first quarter of this year when the Brent-WTI spread widened again.

It is reasonable to assume that with the price of CVR's crude throughput rising, the company's profits are going to decline. Unfortunately, CVR is not able to significantly change the type of crude it refines, unlike HollyFrontier.

The best margins

HollyFrontier has five refineries spaced throughout the country. One is located within the Permian play, two are located near the Mississippi Lime formation,and the final two are located near the Uinta and Niobrara shale formations. This spacing gives HollyFrontier a variety of crudes to choose from and access to Canadian production as well.

Along with WTI, the advantage crudes the company uses are Western Canadian Select, which currently trades at a discount of $20 to Brent, and West Texas Sour, which trades at a discount of around $10.

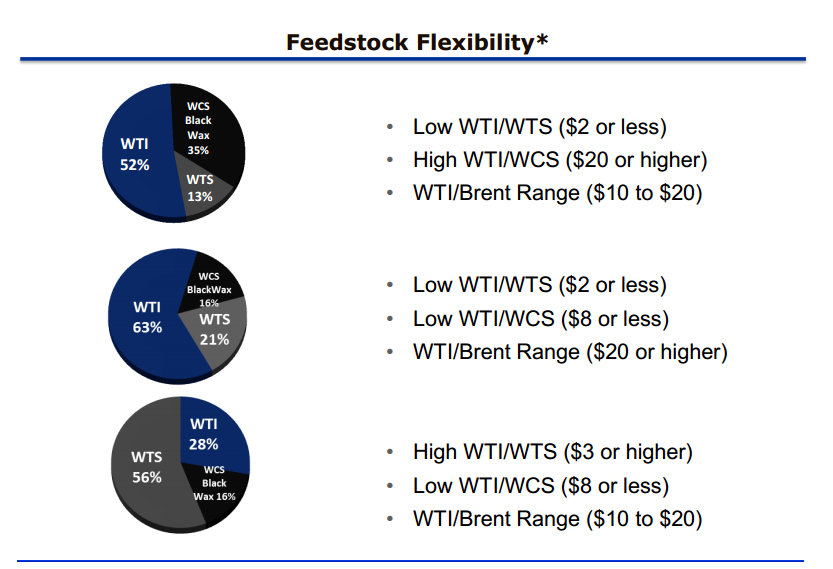

The company is able to change quantities of crude used to achieve the best results, as seen in the slide taken from the company's results below:

Source: HollyFrontier investor presentation.

This ability to switch feedstocks gives HollyFrontier a major advantage over its peers.

Foolish summary

In conclusion, CVR was able to profit from a wide Brent WTI spread during the first quarter of this year. As the spread closes, however, the partnership's income is likely to take a hit.

On the other hand, HollyFrontier has a highly flexible refining capacity. This allows the company to change feedstocks in order to drive the best margins.