Bank of America (BAC +0.30%) gets endless media coverage. But one number may have gone unnoticed from far too many.

The impressive rebound

Over the last few years banks have dealt with their fair share of headaches. Bank of America had all the trouble related to its acquisition of Countrywide. Citigroup (C +0.44%) had questions about its future, and even more recently has had to restate its 2013 results thanks to fraud from its unit in Mexico.

While Wells Fargo (WFC 0.17%) has avoided most of the troubles facing Bank of America and Citigroup, remember it too shelled out more than $8 billion in settlements between 2010 and 2012.

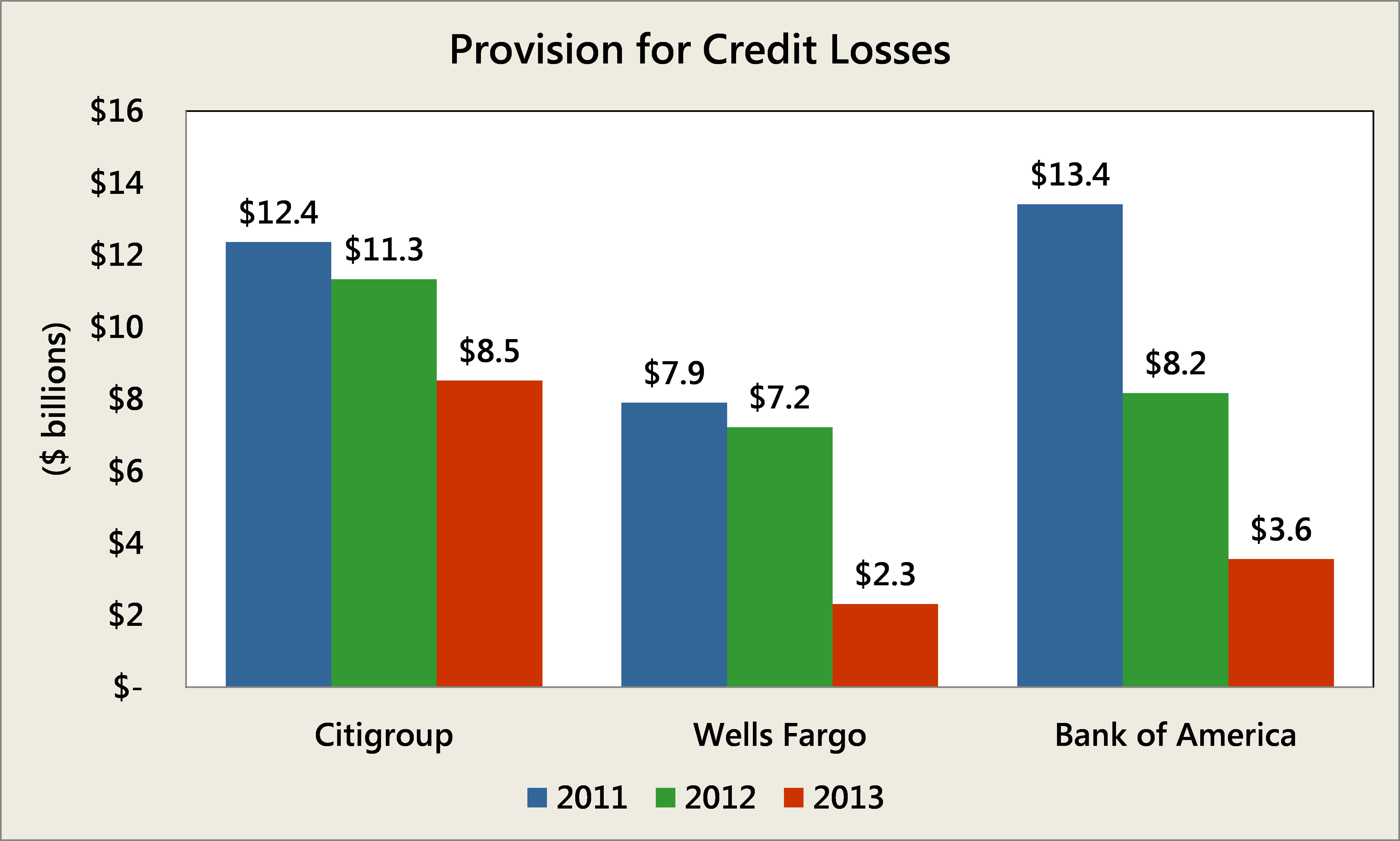

But everyone knows of the legal issues. Yet one of the least discussed realities is the provision for credit losses, which is what a bank expects it will lose from loans it has issued that is written as an expense on its income statement. And the banks have seen a remarkable rebound in these over the last three years:

Source: Company Investor Relations

As you can see, Bank of America -- somewhat astoundingly -- expected to lose nearly $10 billion less from its loans last year than it did in 2011. And it shouldn't come as a surprise Wells Fargo faced the fewest losses, at $17 billion, versus $25 billion for Bank of America and $32 billion for Citigroup.

But it's critical to know this rebound translates straight to the bottom line of the banks. And while the improvement is encouraging and is essential to monitor, it often can obscure the true performance of the underlying businesses.

The bright spot for Bank of America

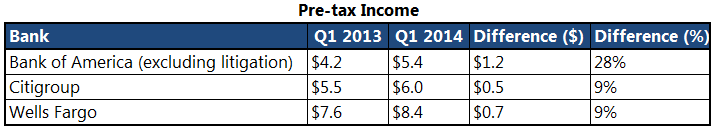

With all that in mind, consider the most recent results from the banks mentioned earlier. A simple glance at the results reveals all three banks had impressive year over year growth:

Source: Company Investor Relations

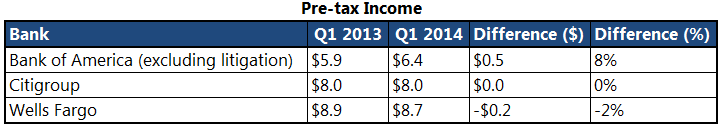

Yet a simple exclusion of the gains from their provision for credit losses tells a much different story:

Source: Company Investor Relations

As you can see, both Citigroup and Wells Fargo only saw improvement because they expected to write off fewer loans, whereas Bank of America managed to actually grow the results from its businesses over the last year. But it must too be noted part of the reason for the dip at Wells Fargo resulted from the fact its mortgage banking income plummeted by $1.3 billion as a result of less mortgage refinancing.

The key takeaway

With this in mind, it's critical to know Bank of America is continuing to execute on its efforts to grow its businesses and also slash unnecessary expenses. While there is still much to be done at the bank, the slow and steady progress is another sign of encouragement.

Improvement in one number relative to peers isn't enough to warrant an investment decision in Bank of America. But this reality is one more thing to add to the long list of reasons why Bank of America presents a compelling investment consideration.