The Tuscaloosa Marine Shale, according to current CEO of Halcon Resources Corp. (HK +0.00%) and former founder and CEO of Petrohawk Energy Corporation Floyd Wilson, is perhaps "one of the last remaining large footprint oil shale plays in the U.S." Coming from the wildcatter who led Petrohawk to be one of the first companies to identify and develop Eagle Ford's potential, this assessment makes Tuscaloosa deserving of a closer look from companies and investors.

Assessing Tuscaloosa's potential

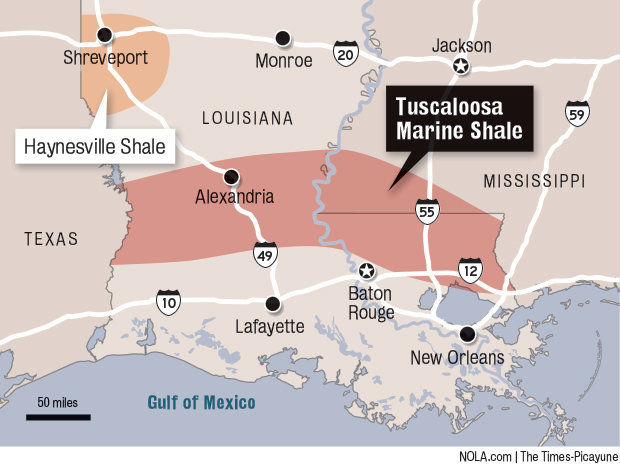

Source: NOLA.com | The Times-Picayune.

The shale play is a sedimentary rock formation that is hundreds of feet thick and about two to three miles below the surface. It covers 6.6 million acres in central and southern Louisiana and southwest Mississippi, and holds as many as 7 billion unproven, unconventional barrels of oil, according to a 1998 report released by the Basin Research Institute at Louisiana State University. Tuscaloosa is an oil play -- most estimates and results suggest an oil cut of at least 92%, so you should not expect prolific natural gas production from the fields.

This isn't the first time companies and investors have looked at Tuscaloosa. In fact, we are in the third period of heightened interest in the area.

The first period was in the 1950s and 1960s, when oil shows from the shale were noted as drillers were targeting the Lower Tuscaloosa deposits. In the 1970s, the second period began as commercial efforts were initiated to extract oil. Four wells were built between 1970 and 1978, but all failed because vertical drilling and the fracturing technology of the day were insufficient to unlock Tuscaloosa's oil. The thickness and depth of this shale presents a challenge, even by today's standards.

For decades, these failures kept interest in drilling in the Tuscaloosa to a minimum. More recently, however, with vastly improved technology and procedures, companies have moved back into the area and resumed operations. This third period of heightened interest in the Tuscaloosa started in 2007.

The players in Tuscaloosa

In 2007 and 2008, Encore Energy Partners LP moved to tap the shale by drilling four horizontal wells. Early production was moderate. Denbury Resources acquired Encore in 2009. Three of Encore's wells encountered serious problems and today produce very little oil, perhaps because of less than state-of-the-art construction. Encore's uncompleted fourth well came under the operation of Encana Corporation (NYSE: ECA).

Source: Sanchez Energy, Oct. 2013 presentation.

Source: Goodrich Petroleum Corp. Tuscaloosa Marine Shale E&P Summit presentation, June 2014.

At the end of 2013, Encana held 302,000 net acres in the play. In December 2013, Halcon Resources entered a deal to pay up to $189.4 million to add 117,870 net acres to its position. The company now holds 314,000 net acres. Halcon announced yesterday that its first operated well in the play yielded an average initial production rate of 1,208 bbl/d of oil over a 24-hour period.

Aside from these two companies, other major players in the area include Goodrich Petroleum (NYSE: GDP) and Sanchez Energy Corporation (NYSE: SN).

Goodrich is betting big on Tuscaloosa; it's one of the company's core properties, alongside Goodrich's Eagle Ford and Haynesville holdings. The company holds 415,000 gross acres in Tuscaloosa, constituting almost 74% of its core properties' gross acreage. Sanchez acquired about 40,000 net undeveloped acres last year for $78 million.

Tuscaloosa is a major shale play... right?

While production has been promising, and many companies have moved into the area, a small but notable contingent of dissenters has developed. These dissenters and the evidence pointing away from Tuscaloosa being a major shale play will be elaborated upon in a follow-up article in the coming days, so stay tuned!