Slow growth in waste volumes from industrial and construction sectors has been troubling investors of America's largest integrated waste services company, Waste Management (WM 3.66%). Lower commodity pricing for the recycled goods are making matters worse. However, the company was able to soothe investor nerves with a double-digit earnings improvement in the first quarter, and there are three very good reasons to show that this success was not merely a flash in the pan.

Waste Management's 40 yard dumpster. Source: Waste Management.

Maximizing yield

Companies engaged in waste services have been encountering a constant decline in waste volumes with time on account of tight consumer spending, conscious reduction of recyclable materials, check on raw material wastages by manufacturing companies, and economical packaging. According to Environmental Protection Agency, or EPA, only 54% of total municipal solid waste was taken to landfills (garbage dumping ground for decomposing) in 2011, significantly down from 89% in 1980.

But Waste Management is countering this trend with successful pricing strategies and mix optimization that is having a positive impact on its yield (effect on revenue from the pricing activities exclusive of volume changes). In the earnings call EVP and CFO Jim Fish said, "We continue to execute on the trade-off between yield and volume to determine the best mix in order to maximize income from operations, dollars and the margins."

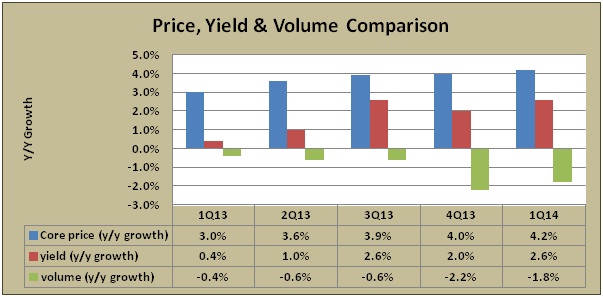

This was visible in the first quarter where lower volumes affected revenue by 1.8%, but a 100 basis point increase in core prices gave the company a necessary boost in the yield, which had a 2.6% positive impact on revenue. Total revenue increased 1.8% to $3.4 billion.

Source: Company press release. Chart made by author.

The company needs an overall average yield in excess of 2% for margin expansion and has been crossing this mark for the last three quarters. In the first quarter, operating income improved more than 13% and there was a 140 basis points increase in operating margin.

Waste Management increased prices in its core collection and disposal business as well as its electricity or Wheelabrator business. Core prices net of rollbacks and excluding fuel surcharge was 4.2%, up from 3.2% in the year-ago quarter. This supported the increase in overall average yield and compensated for the negative yield from its recycling operation. Commodity prices of recycled goods were about 2% lower in the first quarter than the year-ago period.

Average yield in the collection and disposal business was $71 million with a 2.6% revenue impact on related businesses, marking seven straight quarters of yield improvement. And average yield in the electricity business was $27 million with a 37.5% impact on the revenue of related businesses.

With pricing level expected to sustain, the company expects yield to improve further as the second and third quarters are seasonally strong.

Cost control

Waste Management could convert its low-single-digit revenue growth into a nice double-digit earnings improvement mostly due to its cost cutting efforts. Controlling cost is never easy, and there's no doubt that the company had to plan it strategically.

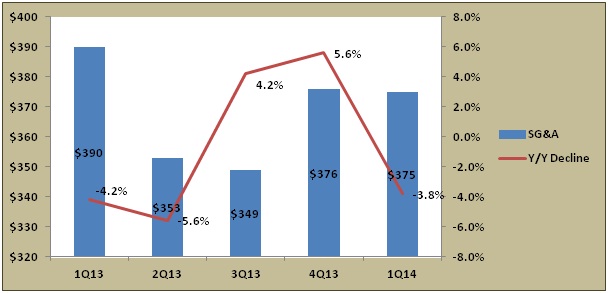

In the past quarter, Waste Management's selling, general and administrative expenses (SG&A) decreased roughly 4% year over year on account of lower incentive compensation, professional fees, advertising, traveling and entertainment costs. Although operating expenses inched up, its percentage on total revenue declined 50 basis points to 65.7%. Higher acquisition costs were partially offset by stricter rebates offered to customers with contaminated loads.

Source: Company press release. Chart made by author.

There is an obvious initiative on the management's part to keep costs in check. Waste Management is gunning for 100 basis points reduction in SG&A costs in 2015 through streamlining back office jobs, and another 100 basis points reduction in operating costs by optimizing its routing and logistic activities. Majority of the company's existing fleet of trucks will now run on compressed natural gas instead of carbon-emitting diesel that will reduce maintenance cost to a good extent.

Investment in technology

The company is investing heavily in technology to find out economical methods for disposing and recycling of wastes. This will facilitate in generating higher yields from its core operations that will help in improving margins.

This February, the company announced plans to make bio-fuels and bio-chemicals from the miscellany in one of its Oklahoma sites using gas-to-liquids technology. To give the idea a proper shape, it's partnering with specialists such as Ventech Engineers International, NRG Energy, and Velocys. This could generate higher yields from its waste-to-energy operations and accelerate revenue and margin growth.

Last words

Waste Management's focus on improving yield through pricing actions, mix optimization, and technology upgrades could lend support to future margin expansion and earnings growth. Its focus on cost control is paying off, providing substantial support to profitability. These strategies could help the company to overcome industry headwinds like weak waste volumes and lower prices of recycled goods.