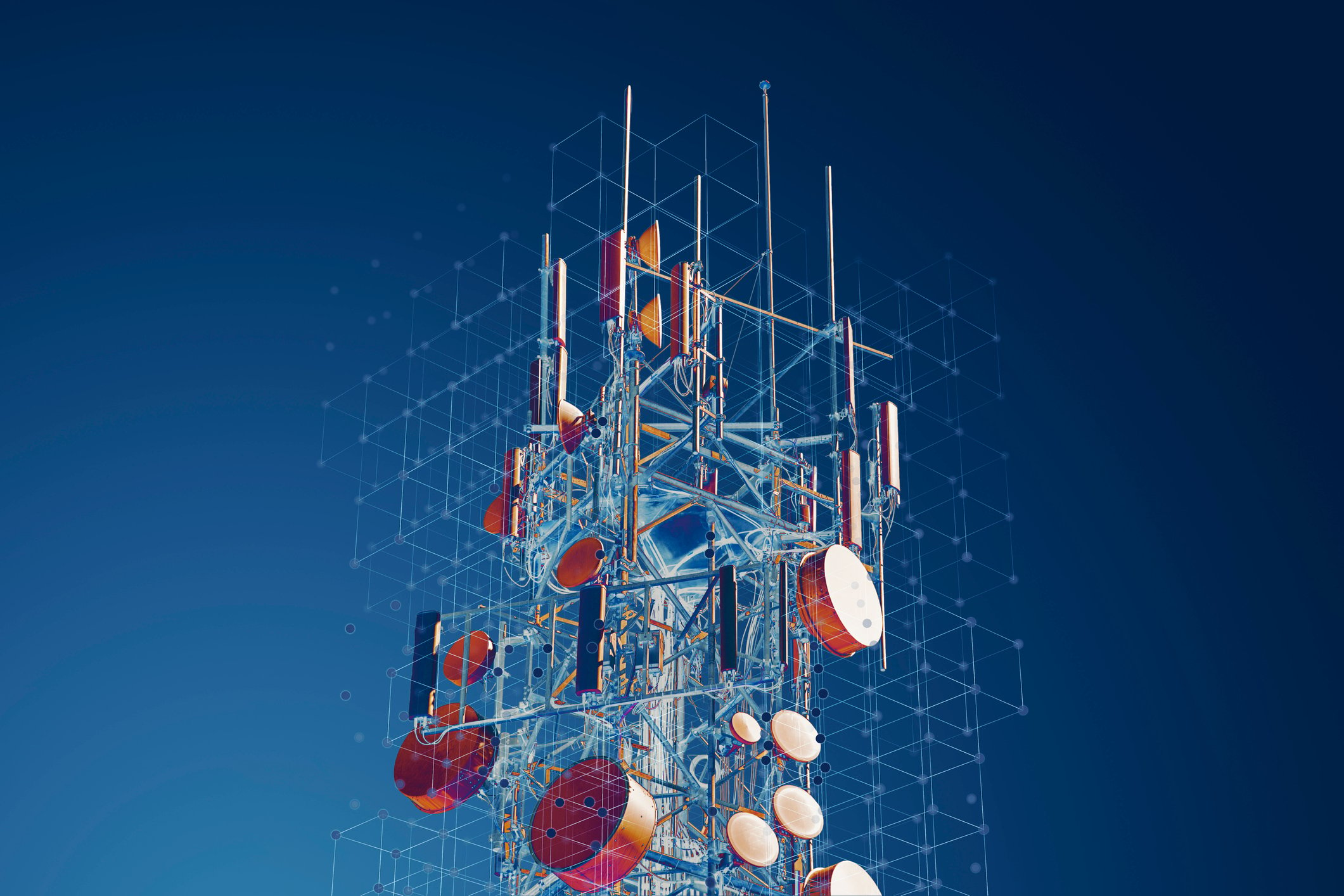

American Tower just made another $1 billion move to expand in Brazil, Credit: American Tower

If you thought American Tower Corporation (AMT +1.18%) was done expanding its presence in Brazil, think again.

On Sunday, the wireless and broadcast real estate specialist announced an agreement to acquire all outstanding equity of BR Towers for approximately 2.18 billion Brazilian Reais, or $978 million based on current exchange rates. Previously an American Tower competitor, BR Towers is expected to own roughly 2,530 towers and exclusive use rights to another 2,110 towers by the time the transaction closes in the fourth quarter of this year.

When that happens, American Tower anticipates its newest towers will generate roughly $131 million in annual run rate revenue, and around $81 million in annual gross margin. Better yet, the purchase should also be immediately accretive to American Tower's adjusted funds from operations -- a metric which effectively measures a real estate investment trust's cash flow from operations.

This isn't American Tower's first rodeo

The deal also comes less than a year after American Tower announced it would acquire up to 2,790 towers in Brazil, and 1,666 towers in Mexico from NII Holdings (NASDAQ: NIHD) for around $424 million and $382 million, respectively. NII Holdings, for its part, immediately leased back those towers from American Tower for a minimum of 12 years. That may seem strange at first, but NII Holdings was more than happy to have the additional liquidity to continue investing in next-gen network deployments for its Nextel subsidiaries in the two countries.

Also in the third quarter of last year, American Tower agreed to buy up to 236 additional communication sites in Brazil for an aggregate price of roughly $127.1 million. All told, that brough American Tower's portfolio in Brazil to an impressive 6,746 towers by the end of 2013.

How do you say "growth" in Portuguese?

So why the big push into Brazil? Look no further than the country's massive potential for wireless and broadcast infrastructure growth.

According to BR Towers' CEO Mauricio Giusti, Brazil currently has just 70,000 cell phone towers, which amounts to around 4,000 users per tower. By comparison, the United States only has around 1,000 users per tower. As a result -- and as the current infrastructure feels the weight of its burgeoning wireless market -- Giusti expects Brazil to boast between 150,000 and 200,000 towers a mere four to five years from now.

If one thing seems sure in the end, it's that American Tower most certainly isn't finished growing its presence in Brazil. In fact, all things considered, it looks like American Tower is just getting started. For that, I think its shareholders should be more than happy.