According to the ITAR-TASS news agency in Moscow, Russian fertilizer producers Uralkali and Belaruskali are talking about possibly returning to operating through their joint venture, the Belarusian Potash Company. There is little doubt that any announcement of reconciliation would send shares higher, at least in the short term. However, the real question is, will any reunion actually raise potash prices?

In my opinion, potash demand is very sensitive to pricing in the current environment. During the first quarter of 2014, Potash Corp (POT +0.00%), Mosaic (MOS +1.98%), and Agrium (NYSE: AGU) all showed year-over-year potash sales volume increases in response to sharp year-over-year price declines, as figure 1 illustrates.

During the company's first quarter conference call, Mosaic said that it expected second quarter shipments to taper off after seeing a sharp increase in the first quarter. The company also expects more potash supply than demand over the next two to three years as the principle potash producers continue to expand production capacity.

Potash Corp., however, expressed more optimism over the near term with regards to potash markets during its first quarter conference call. Unsurprisingly, the perpetually optimistic potash producer is thinking that the current market is supportive of improved prices in the second quarter.

Agrium takes a more middle of the road point of view on potash markets. The company believes the market has stabilized and that this stability will lead to higher demand. In my opinion, the data is supportive of this viewpoint as long as prices don't rise too much. Agrium is also expanding its potash production capacity and expects to bring this new capacity online in 2015.

Another factor putting a damper on fertilizer prices is crop prices. Fertilizer cost is a key input into a crop producer's economic model. As crop prices fall, the producer looks for ways to either support profit margins or cut margin erosion. Over the last year, prices of the major crops such as corn, wheat, and soybeans have declined considerably. As figure 2 illustrates, average year-over-year corn, wheat, and soybean futures prices also slumped during the first quarter of 2014.

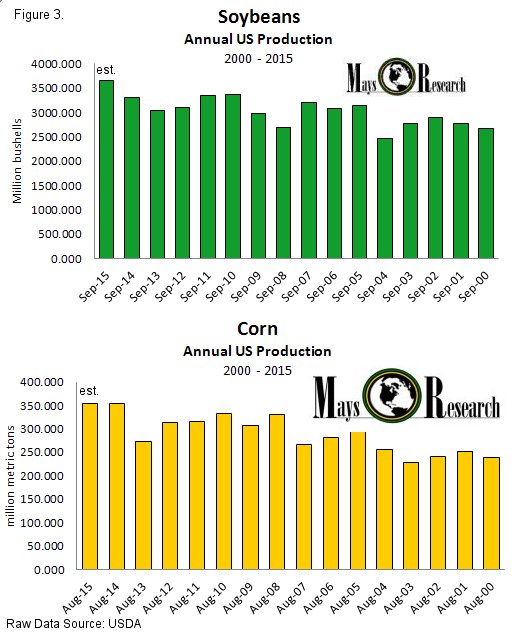

With corn and soybean production for the 2014/15 marketing year estimated at or near all-time records, it is very likely that crop prices will continue to fall with higher global supplies. This will keep varying amounts of pressure on potash as well as phosphate and nitrogen prices. The USDA estimates U.S. soybean production at a record 98.9 million metric tons, while corn production estimates in the U.S. are a hair under 354 million metric tons; this is also a record if fully realized.

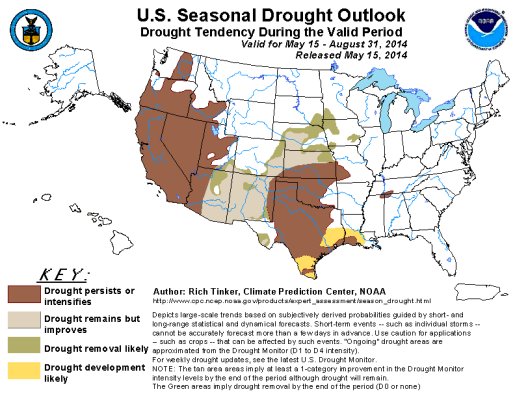

The most recent drought outlook report suggests that the growing season will be ideal through the end of August in the major corn and soybean producing regions. However, continuous monitoring of weather is necessary as persistent dryness during the critical pollination period can cut actual production numbers as harvest season approaches.

In my opinion, higher global supplies of wheat, corn, and soybeans will pressure crop prices. This will in turn pressure producer margins. While I expect potash producers to stay profitable during the trough, they will likely not see much pricing strength in the near future. At some point over the intermediate term, selling prices of crops and potash will align and a new cycle of price expansion will begin.