In my last article on Linn Energy, I explained why I believe that Linn Co (NASDAQ: LNCO) and its MLP counterpart Linn Energy (LINE +0.00%) are excellent long-term, high-yield income investments. One of my main arguments supporting this stance was that Linn Energy was looking to trade its Midland Basin assets (which would have been a steep cost to drill) for assets that are already producing. This would increase production while lowering costs, greatly increase distributable cash flow (DCF), and secure Linn Energy's generous 10+% yield. On May 21 Linn Energy indeed announced such a deal with oil giant ExxonMobil (XOM +2.02%) and after careful study of specifics of the arrangement, I believe that the long-term investment thesis for all three is substantially stronger.

Why this deal is so great for both companies

In exchange for 25,000 net acres of its Midland Basin properties from Linn Energy, which are producing 2,000 barrels/day, ExxonMobil is giving up 500,000 net acres of its Hugoton field in Kansas (gas reserves of 700 billion cubic feet of gas, currently producing 85 million cubic feet/day, MMcf/d, of natural gas).

For Linn Energy the deal is advantageous for several reasons:

- Total company reserves up 9.4%

- Total gas production up 18%

- Decline rate of 6%

- $30 million-$40 million in additional DCF/year

- Distribution coverage ratio increases to 1.01-1.27

In addition to securing the current distribution and likely setting it up for strong growth ahead, the deal netted Linn Energy the East Goldsmith field (24 million barrels of reserves), an enhanced oil recovery (EOR) project that uses CO2 injection to increase well pressure and results in super low decline, high-margin oil production.

Linn Energy also receives the Jayhawk gas plant, a 450 MMcf/d processing facility located in the heart of the Hugoton basin and already processing Linn Energy's gas from the field. Jayhawk is 44% utilized and with its new production Linn Energy should be able to achieve much higher utilization rates, synergistic cost savings, and higher margins on this gas production.

What is most exciting for Linn Energy investors is that it retains 30,000 net acres of the Midland Basin, producing 15,000 barrels/day.

Why are these Midland assets so valuable? Because they sit over the Wolfcamp and Spraberry shale formations, which Pioneer Natural Resources believes to be the largest recoverable oil deposits on earth, with an estimated 75 billion barrels of remaining oil in the ground, an estimate that is up 50% since 2013.

This is the real reason that ExxonMobil was willing to trade land at a 20:1 ratio. The Hugoton gas formation, though low decline, is 80% natural gas and 20% natural gas liquids.

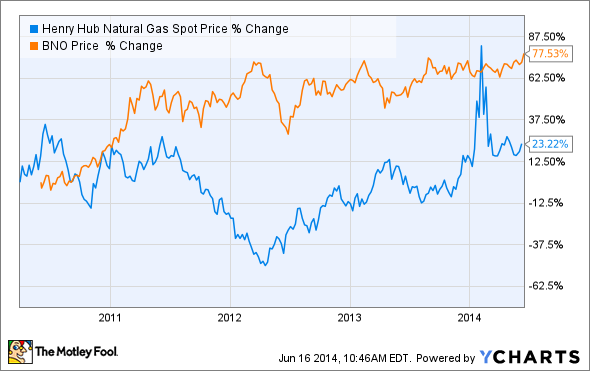

Due to America's recent shale gas explosion and current lack of export capabilities, natural gas prices fluctuate much more than oil prices as the below graphs shows (BNO is Brent Oil, considered world standard price).

Henry Hub Natural Gas Spot Price data by YCharts

Thus we see the benefit of this deal to both companies. Linn Energy, whose recent Berry Petroleum acquisition ran into massive cost overruns that left the company strapped for cash (and holding valuable but expensive-to-drill land), traded less than half of its assets to ExxonMobil, a company with a bank vault-safe balance sheet and plenty of cash necessary to exploit the new, oil-rich land. This greatly increases both ExxonMobil's reserves and future production potential. In the meantime Linn Energy gains a substantial increase in low-cost, low-decline gas production that will generate large and steady cash flows to not only secure its generous yield, but grow it in the future.

Meanwhile, ExxonMobil shareholders should be excited at the prospect of management's stellar execution for its long-term plan to lower costs while increasing production. With this deal, plus Exxon's downspacing efforts in its 570,000 net acres of Bakken Shale and the company's declining exploration and production capital spending, ExxonMobil is setting itself up for continued double-digit dividend growth through 2016.

With a track record of 31-years of consecutive dividend growth (7.54% CAGR dividend growth since 1970) and one of America's three remaining AAA credit ratings (better than the U.S. government...), long-term dividend growth investors should look at a potential for double-digit dividend growth through 2016 as further reason to buy ExxonMobil shares.

Foolish takeaway

The specifics of this deal are not only massively beneficial to both Linn Energy and ExxonMobil but illustrate why these are two of the premier names in the energy sector. Linn Energy's generous yield is now safe and set to grow, and the company has preserved its access to the world's largest oil reserve. Meanwhile ExxonMobil gains access to high-quality oil reserves that will allow it to grow production at sufficiently low cost to continue its superb dividend growth record.