According to analyst estimates, food equipment company Middleby Corporation (MIDD 0.30%) is on track for low-teens sales growth, with 12% and 22% EPS growth over the next couple of years. Moreover, there are a few reasons why investors can expect upside to those estimates going forward. In addition, industry rivals like Dover Corp. (DOV 0.88%) and Illinois Tool Works (ITW 0.37%) are also reporting good numbers in the food equipment sector -- indicating that Middleby's end markets are good. Is all of it enough to justify its valuation of nearly 26 times forward earnings for 2014?

Middleby middles it

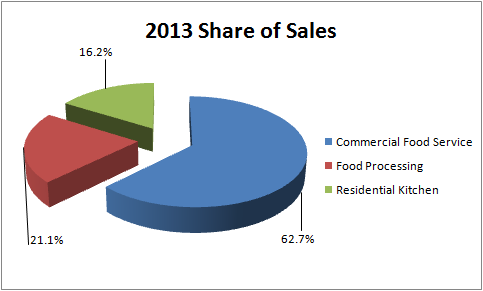

The company operates out of three industry groupings and a quick look at its 2013 revenue split reveals the relative importance of each.

Source: Middleby Corporation Presentations

Middleby's commercial food segment competes with Illinois Tool Works and Dover Corporation, and its rivals are making some positive noises about the marketplace. For example, Illinois Tool Works reported strong growth in its food equipment sales in its most recent quarter. Moreover, in common with Middleby, Dover Corp. sees expansion opportunities in its refrigeration and food segment through products that enhance productivity.

Middleby's growth platform

The excitement around the company centers on the commercial food segment and its residential kitchen segment, known as Viking.

- The anticipated rollout of its so-called "kitchen of the future" (commercial food) to restaurant chains

- Growth from sales of new products at Viking

- Expected productivity and margin improvements at Viking thanks to dealer consolidation

While restaurants are struggling to produce top-line growth in the absence of a strong consumer demand, they can generate earnings growth via improving efficiency in their kitchens. Middleby's "kitchen of the future" brings such efficiencies to restaurants, and according to management on the conference call, represents the biggest growth opportunity for the company going forward. The system is already installed in over 1,500 Chili's locations , and is in field trials with 16 other restaurants at the moment. Management's plans are for the tests to turn into significant rollouts in 2015-2016.

Turning to Viking, Middleby has more than 50 new products coming out and plans are afoot to reduce the number of its dealers from 1,700 to less than 1,000. Moreover, its distribution operations were reorganized during the first quarter -- at the cost of some revenue growth -- and they are expected to bounce back in future quarters.

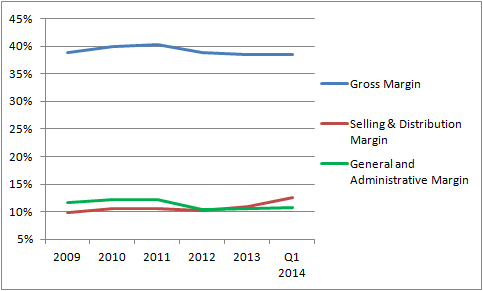

In fact, the reorganization of Viking hit gross margins in the first quarter. Selling and distribution costs increased 30% to $10.8 million. The Viking acquisition caused selling costs at Viking to hit $9.3 million -- its revenue growth was held back by the distribution reorganization -- and selling costs created by other acquisitions to increase by $1.6 million. Otherwise, selling and distribution costs would have been flat. Similarly, there was a non-recurring $2.6 million in general and administrative costs.

Here's a look at the effects on margins these effects had in the first quarter:

Source: Middleby Presentations

However, the good news is that management expects gross margins to improve. CEO Selim Bassoul said on the most recent conference call, "Once this transition of inventory on the channel is complete, we anticipate the gross margin rate will revert to levels higher than in the second half of 2013."

The bottom line

Putting these elements together, it's clear that Middleby investors can look forward to a mix of sales growth and margin improvements in future. Moreover, there is upside potential from its "kitchen of the future". Competitors like Dover Corp and Illinois Tool Works continue to report good numbers in their food segments, suggesting that end-market conditions are favorable.

On a less positive note, it's hard to think that its valuation doesn't reflect a lot of the good news to come. On the other hand, if its "kitchen of the future" testing converts into significant rollouts then analysts will surely upgrade estimates and momentum will take the stock higher. It's not a screaming good value, but well worth monitoring if the current dip persists.